Fourth-quarter results signal gains ahead for Target, despite lower-than-expected sales for the period, Target Chairman and CEO Brian Cornell told participants in the company’s annual investment community event.

Net earnings for the 14-week fourth quarter were $1.38 billion, or $2.98 per diluted share, versus $876 million, or $1.89 per diluted share, in the year-previous period.

An analyst consensus estimate published by Yahoo Finance called for earnings per diluted share of $2.22 and revenues of $29.33 billion.

Fourth-quarter comparable sales slipped 4.4%, with stores down 5.4% and a comp digital sales decline of 0.7%, Target stated. Number of transactions declined 1.7% and average transaction decreased 2.8%. Sales were $31.47 billion and total revenues were $31.92 billion versus $30.98 billion and $31.4 billion, respectively, in the in the year-prior period. Operating income was $1.87 billion versus $1.16 billion in the year-before period, the company maintained.

Full-year net earnings were $4.14 billion, or $8.94 per diluted share, versus $2.78 billion, or $5.98 per diluted share, in the year previous. The 2022 fiscal year results included an adjustment to earnings per diluted share that put the figure at $6.02.

Sales were $105.8 billion and total revenues were $107.41 billion versus $107.59 billion and $109.12 billion, respectively, in the previous year. Operating income was $5.71 billion versus $3.85 billion in the year before, the company reported.

The extra week in the fiscal year contributed $1.72 billion to sales in the fourth quarter and the full year of 2023, according to Target.

In opening up the Target’s 2024 Financial Community Meeting, held after the company released its fourth-quarter results, Cornell (pictured above) said the company made progress from the second to fourth quarter by improving in store traffic trends and operational elements. However, he noted the company was “not satisfied” with top-line results. Even so, he said, Target was now better positioned for growth going forward.

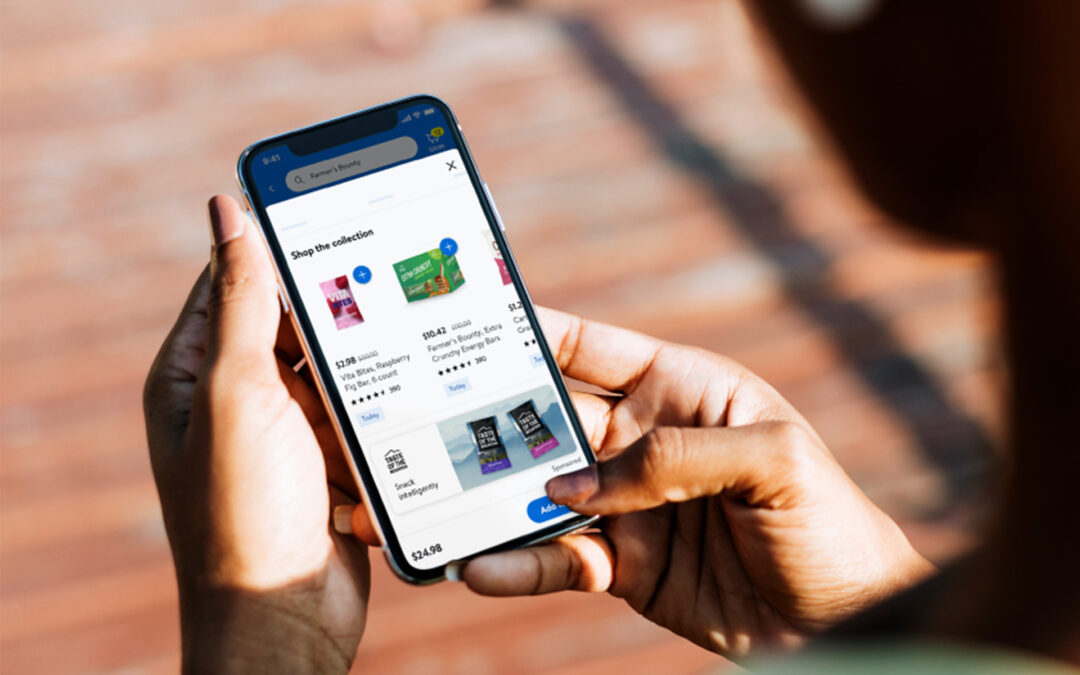

Cornell said the company wasn’t waiting for a turnaround in consumer discretionary spending as it has evolved in the current economy. He said the retailer would push critical initiatives, including updating its Target Circle membership program with new features in areas such as delivery. The company also would continue to build on key fundamentals, such as affordability and in-stock availability, Cornell added.

Target is poised to regain momentum in top line growth, traffic gains and market-share expansion, Cornell said. As it advances, Target will build its omnichannel capabilities by adding 300 stores in the next decade, supported by ten additional supply chain distribution facilities. The company will back up investments in stores and supply chain with more dollars going to technology, including the application of machine learning and artificial intelligence, and labor as Target continues to emphasize the front-line employee role in its operations and future. The company also will continue to press its private-label program, and Cornell pointed to recent additions, such as the Figmint brand, as evidence that Target intends to leverage private label as a differentiator and growth opportunity.

Cornell discussed continued investment in online and related operations, such as providing faster delivery and broader outreach including through social media. He also made reference to Target’s in-store media network as an ongoing opportunity and increasing contributor to revenue.

In announcing Target’s fourth-quarter earnings, Cornell said, “Our team’s efforts changed the momentum of our business, further improving our sales and traffic trends in the fourth quarter while driving profitability well ahead of expectations. Throughout the season, guests responded to newness, value and the inspiration and ease of our in-store and digital shopping experience. Looking ahead, we’ll continue to invest in the strengths and differentiators that have delivered strong financial performance over time. We’ll also roll out fresh innovations, including our new Target Circle membership program, as part of our roadmap for growth aimed at meeting consumers where they are, reigniting sales, traffic and market share gains, and positioning Target for profitable growth in 2024 and beyond.”