As the population evolves in the United States, it is important from a consumer product business standpoint to recognize the Hispanic community, a significant demographic already at a quarter of the population, is critical and growing.

However, it’s also important to know the Hispanic population is internally diverse. As such, Hispanics have tremendous buying power and unique consumption and lifestyle characteristics that, if not understood, could be a barrier to successful engagement with the group.

“U.S. Hispanics are an economic powerhouse,” said Roberto Ruiz, executive vice president, research, insights and analytics for TelevisaUnivision, a Spanish-language media enterprise. “With growing households and spending power that continues to increase at a rate faster than non-Hispanics, this audience is one that, simply put, needs to buy more to manage their homes and day-to-day lives.”

Ruiz said Hispanic consumers contribute $3.2 trillion to the American gross domestic product. The figure, if it were the GDP of a country, would fit the Hispanic market firmly in the top 10 among the world’s largest economies and ahead of countries such as France and Russia.

Moreover, he said, the economic generation of the Hispanic population is growing faster than that of the non-Hispanic GDP.

“This population presents a significant opportunity for houseware sales for several compelling reasons,” Ruiz said. “Hispanics, with a median age of 33 versus 43 for non-Hispanic, are in their prime spending years. Often residing in multigenerational homes, these households include everyone from parents to children to grandparents, creating diverse consumer needs. With 44% of Hispanic homes having children under 18, evolving needs and demands arise as these families grow older, emphasizing the need for a wide range of household products to effectively manage their homes and daily lives,” Ruiz said.

Ruiz will appear as a keynote speaker at The Inspired Home Show on March 17 at 1 p.m. in a session entitled “Future-Proofing Your Brand with America’s Growth Engine: The Hispanic Marketing Imperative.”

In a report published last year, the Pew Research Center relayed that the Hispanic population in the United States reached 63.6 million in 2022, up from 50.5 million in 2010. The 26% increase in the Hispanic population was faster than the national 8% growth rate and only slower than that of the smaller Asian population, which gained at a 34% clip. In 2022, Hispanics comprised almost one in five U.S. residents, up from 5% in 1970 to 16% in 2010.

Roberto Ruiz, Executive Vice President, Research, Insights and Analytics for TelevisaUnivision

More people live in Hispanic households, at 3.2, versus 2.4 in non-Hispanic households, and, in many cases, Hispanics live in multigenerational households with parents, kids and grandparents all living under the same roof or at least the same community. Kids are particularly prevalent, as 44% of Hispanic homes have children under 18 living in them versus just 27% of non-Hispanic homes. As they age, their needs change with them.

The numbers underscore the point Ruiz emphasizes that Hispanic households need more of everything to conduct their everyday lives.

Although the growth of the Hispanic population is widely understood and their economic contributions recognized, not everyone understands the full economic weight of the community.

“Hispanic households earning an annual salary of $100,000 plus have more than quintupled since 2000,” Ruiz said. “Dispelling the notion that Hispanics resist trying new products, they are among the first to embrace innovations that cater to their needs. Before making purchases, they rely on recommendations from family, friends and trusted social media platforms and creators. While there may be a perception of needing an entirely different product line for Hispanic consumers, the truth is that they share similar needs with non-Hispanics.

Lastly, language is not a barrier when it comes to transactions. Hispanics transact in English and are comfortable buying and shopping on English-language websites. However, brands can and should work to find ways for an in-language approach when reaching this consumer base.”

Ruiz said quality is important for Hispanic consumers in housewares purchases, with a focus on the price/value relationship that cuts across income and even generational lines. Durability is an important element in the price/value equation for Hispanic consumers in general.

“Since many Hispanics live in larger, multigenerational households, consider that products will be used across generations: Products ‘built to last’ receive special consideration and are recommended to friends, an important means of gaining trust for brands,” Ruiz said.

Noting U.S. Hispanics are more likely to live in multigenerational households, Sudipti Kumar, director of multicultural insights at market researcher the Collage Group, said, “Appealing to a Hispanic household means recognizing the many generations all live together or near one another. The value of family transcends each generation’s specific lifestyle nuances, and appealing to this love of the extended family is important when serving the Hispanic market.”

In considering Hispanic communities, research shows younger Hispanics in Gen Z and younger Millennials embrace their culture and heritage to the extent that they are more likely than their non-Hispanic counterparts to look up to their parents and grandparents. They may be U.S.-born and raised and often grew up strongly influenced by their older relatives. The influence shows in their shopping and other consumer behaviors.

Marsha Everton, principal and founder at the Aimsights Group, said, “One of the most important umbrella concepts in reaching the (Hispanic) market is to understand the rich fabric of their lives.”

Compared to non-Hispanic white consumers, U.S. Hispanics tend to embrace home life, products, information, shopping and culture as a more intricate interrelationship. In this sense, Everton said, Hispanics can be characterized as “super consumers” shopping in a more culturally complex mode than many other consumer groups. For one thing, Hispanics often shop as families. For another, they tend to enjoy mixing cultural elements, which leads to complexity. In a sense, Hispanic consumers juggle choices and priorities as they shop, whether looking for merchandise emerging from their traditions or perusing more mainstream American goods or products from other ethnic groups.

“They like to cook foods that are part of the family’s cultural heritage, and they like to experiment with foods from many cultures,” Everton said. “Food from the family’s cultural heritage helps them feel connected to the family. This sentiment is expressed at roughly twice the response of other ethnic backgrounds. Special occasions like Thanksgiving are a time to serve traditional American menu items and dishes that reflect their cultural heritage.”

Everton pointed out Hispanics are as much a part of the American cultural environment, shopping accordingly.

The balance is worth considering as it suggests serving the community shouldn’t be too narrow in execution. Ruiz said Hispanic consumers are willing to try new things and are always paying attention to new technologies and trends. As in the society at large, some of that is a consequence of age. So, according to market research, 83% of Hispanic Gen Z consumers are drawn to new technology products, Ruiz said.

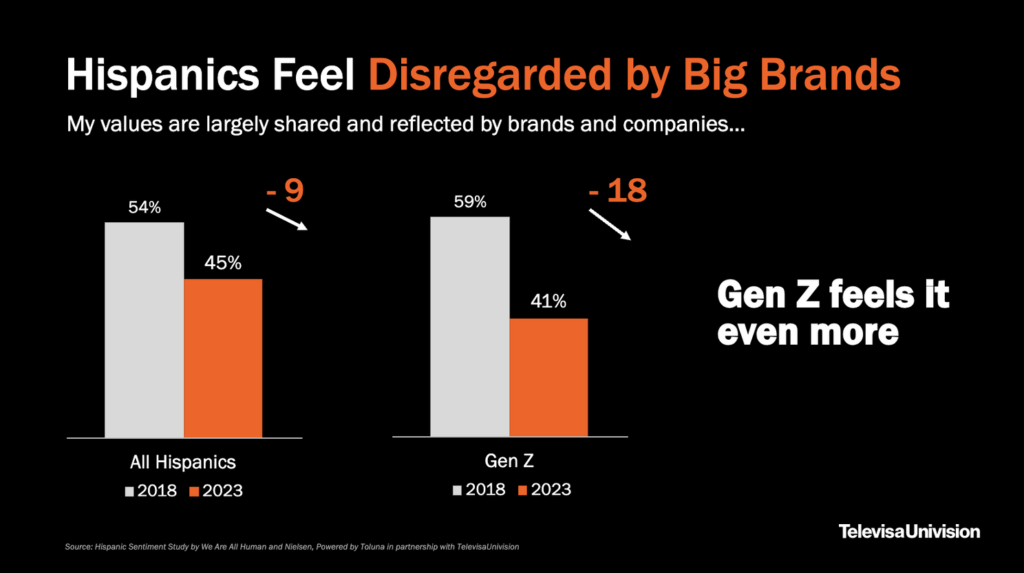

Given that, it shouldn’t be surprising media that addresses the community and priorities is important to the Hispanic community.

“TelevisaUnivision’s differentiator in the marketplace starts with our audience, which continues to grow in size and economic relevance,” Ruiz said. “There is an understanding of how best to serve our Spanish-speaking audience, which starts with trust and authenticity. TelevisaUnivision is the expert as it relates to reaching U.S. Hispanics, and we’re here to help businesses in building those connections through an in-language, in-culture approach.”

Content is important in traditional as well as social media, he said.

“U.S. Hispanics are passionate about social content, and what they see on social posts resonates with them,” Ruiz continued. “Our posts show higher emotional engagement than other entertainment channels, particularly as it relates to pride. “It’s crucial for any brand looking to win with Gen Z to take an authentic approach, as 90% of Hispanic teens say their cultural background is important in their personal lives, and want brands to acknowledge their background and represent their experience, he said. “Authenticity and in-culture content extends beyond creator activations and touches all of our social initiatives.”

Brian Pomeranc, vice president at Bene Casa, which specializes in Hispanic housewares and related products, said social media works well with Hispanic consumers, and authenticity and respect are important. So, Bene Casa’s social media spokespeople include individuals from Mexico, Cuba and Venezuela, each of whom can speak to a community in familiar terms.

“All three of them born and raised in their countries, fluent in Spanish but all living in the U.S.A.,” Pomeranc said. He added traditional Spanish-language media is important. Telenovelas and such traditional programming remain popular among Hispanic households in the U.S.”

Bene Casa Aluminum Nonstick 8″ Fry Pan

Collage Group’s Kumar said the involvement with media is multifold and must be considered whenever a company wants to approach Hispanic communities.

“Hispanics are very active with media, whether that be streaming video content at high rates, listening to music for more hours a day than other racial and ethnic groups, or spending more time on social media,” Kumar said. “Expect Hispanics to be the first to try a new platform or streaming service and be the leaders in tech adoption. Their intuitive understanding of media means that they should be a key part of any media strategy, whether that be considering bilingual/Spanish ads, partnering with Hispanic influencers and thoughtful representation of the community. The segment is active on social media sites like WhatsApp at high rates and displays opportunities for businesses to connect with the segment beyond just Facebook or Instagram.”

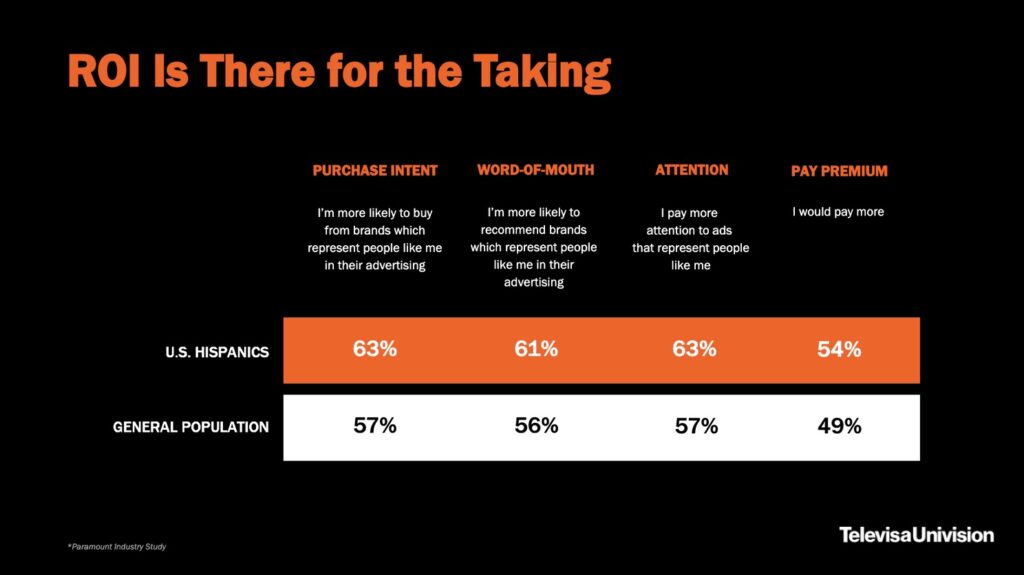

The popularity of social media with U.S. Hispanic consumers means outreach through such platforms is more likely to generate a return than it is with most other ethnic groups.

“The Hispanic market is one that prioritizes social media,” Kumar said. “However, when partnering with an influencer on social media, the segment will recognize inauthenticity. They value businesses that do their due diligence on the types of partnerships they seek out. We’ve also seen the importance that music plays in content, social media or otherwise. Music can convey nuanced elements of culture, point to trusted influencers and creators, and speak volumes about the culture within the beat. Brands who thoughtfully use music on social media, in ads, and across content have a unique advantage towards connecting with Hispanic consumers.”

All that being said, the Hispanic community isn’t, nor should it be considered, monolithic. Countries with Spanish-speaking populations range from Europe to North and South America to the Caribbean. They have different histories and sometimes profoundly different outlooks.

“(Hispanic) is a big umbrella with a lot of segments,” Everton said, “and a lot of inter-racial components. And the long-term U.S. citizens are often very different than recent immigrants. A fourth-generation Puerto Rican in New York City is very different than a recent Mexican or Venezuelan immigrant in the southwest or a long-time Cuban-heritage resident of Miami.”

According to the Pew research, Mexicans were the largest ethnicity within the U.S., representing 58.9% of the total, followed by Puerto Ricans at 9.3%, Salvadoran at 3.9%, Cuban and Dominican tied at 3.8%, Guatemalan at 3% and Columbian at 2.3%. Mexicans are by far the largest ethnicity among U.S. Hispanic residents, but they aren’t necessarily the dominant group as a percent of Hispanic population in all part of the country. In the New York Metropolitan area, for example, Puerto Rican and Dominican populations are larger, according to Pew. In metro Philadelphia, Puerto Ricans are by far the largest Hispanic ethnic group, while Dominicans are the largest Hispanic group in the Boston area. As might be expected, Cubans are the most populous Hispanic ethnicity in the Miami/South Florida market.

In Los Angeles, where 75% of the Hispanic population is from a Mexican background, 8% of the Latino population is Dominican, and 6% is Guatemalan. In such major markets, the smaller Hispanic groups still have representation.

Ruiz said getting to know the communities you want to serve is always important and especially so when it comes to Hispanics, given their several national and even regional cultures. Still, getting started in reaching Hispanic consumers doesn’t require crafting messages for each group.

“It’s always better to know your audience,” Ruiz said. “If you’re targeting a specific market, find out what the dominant heritage country is. It may be useful at the hour of choosing influencers, developing creative and planning promotions.”

“However, you don’t need to know all the details about all the different subsegments to reach these consumers,” he continued. “Food, beauty, home and family are all great ways to effectively reach these audiences authentically, regardless of their specific origins. Tap into what we call ‘passion points’ and you will be able to effectively start to engage them.”

Music, food and sports are among the passion points that can serve as an “in” to engage with Hispanic consumers, Ruiz said.

Kumar added, “It is important to understand the distinctions between countries of origin within the Hispanic community. We stress that the segment is not a monolith and unique country of origin experiences and pride are very relevant and important to the segment.

“For example, Nike releasing a sneaker with the Puerto Rican flag in recent years resonated with the Puerto Rican community in America due to the pride the segment has in their heritage,” Kumar continued. “Nike’s work here, which included several missteps that they recovered from through persistence, also benefits from halo effects, as other Hispanic communities recognize the deep dive the brand has taken to elevate one community within the larger Latino diaspora.”

Kumar added companies that want to serve Hispanic consumers should consider such consumers are “very proud of both their heritage/country of origin while also being very proud of their achievements in the United States. This is contrary to the misconception that the Hispanic community is more connected to one or the other. In fact, we see a cultural duality within many in the segment where they are proud to be both, and they reward businesses who understand their cultural fluency. This duality is increasingly important with bicultural Hispanics not only exercising cultural stewardship of their heritage but of the culture they help create in the U.S.”

In conducting research on the Hispanic market, Everton said it becomes apparent that one factor— family— underlies everything else, and it’s the one factor that should be revisited constantly.

“Family is everything,” Everton said, adding Hispanics not only shop as a family; they also “shop to satisfy other family members, not just themselves. The collective framework supports the sharing of space with a less rigid sense of privacy. This leads to being more interactive with store employees and more retail engagement in general.”

The fundamental shopping behaviors embraced by Hispanics should be top of mind with anyone selling into the Hispanic market, Everton said. “With such emphasis on home and tight family connection, companies that sell products such as housewares should consider both the opportunity and the imperatives involved in addressing Latino communities,” she said. “Understanding the emphasis on family and the home is the first consideration. Then, recognizing that the centrality of family isn’t something that makes Hispanics insular. Rather, it’s a basis for broader interaction with the other cultural influences around them. Hispanic consumers like choice and, at times, might make selections based on their own cultural traditions. They may also look for something new and trendy to bring home. So when it comes to making purchases, Hispanic consumers are looking for a choice of products that have a unique resonance for them.”

“Hispanic shoppers look for products and brands that offer an emotional connection, often by their concern about the well-being of the world as well as personal and family health,” Everton said. In the kitchen, gender-neutral products might have an advantage because men cook too, she added.

In addition to family, marketers and retailers should pay attention to internal demographic factors as they play out within the framework of the Hispanic market.

Kumar said, “Another consideration is the segment’s relative youth. They are younger than all other major racial and ethnic segments, on average. This contributes to their tech-savviness overall and their high rates of use of social media.

“Lastly, it is important to recognize the segment’s overall positivity but not to view it as unbridled optimism, Kumar added. “This positivity is rooted in the very real challenges the Hispanic community has faced in the U.S., including immigration to this country and ongoing discrimination. Despite this, the segment leads with warmth and optimism, focusing on helping one another on their path to success.”

Because of its open attitude toward the social environment in which Hispanic and non-Hispanic communities interact, cultural crossovers are inevitable. A Hispanic family living in New Orleans might be just as fond of Cajun cuisine as they are of food from their heritage. Although from a heritage more closely associated with baseball, a Puerto Rican living in New York might be a big hockey fan. As such, it’s important to reach out to specific heritage while remaining aware that Hispanic consumers are likely to want a broad range of choices as they express their concerns and preferences. It also means that U.S. Hispanic consumers, even those who are primarily Spanish-speaking, share interests within the broader social environment.

“Our research shows that Hispanics have a trailblazing mindset and tend to exude cosmopolitan behaviors,” said Victor Paredes, executive director of cultural strategy at Collage Group. “As such they are very willing to try new things and new flavors. So in addition to retail meeting their needs for their daily grind and cultural staples, the environments need to facilitate exploration. The segment values both in-person and online relationships at high rates.

“Their positivity means they enjoy the in-person shopping experience across business categories, and many appreciate the interaction with sales staff who help them feel at home,” Paredes continued. “There are also many in the segment who speak Spanish primarily and reaching them through the Spanish language is critical. Hispanics are also highly engaged, and they are on the lookout for what businesses are doing on issues they care about. One issue that matters to many is the environment/climate change. Addressing this issue can speak directly to a cause that really matters.”

The importance of taking a balanced view of the U.S. Hispanic consumer should apply all the way back to product conception.

“Consider the importance of eco-friendly products to appeal to Hispanics, as well as the importance culture/heritage is to the segment when developing products,” Paredes said. “Appealing to nostalgia that connects with this heritage, as the brand Fabuloso has done so well, is a critical way to connect. The scents of Fabuloso are familiar for many Hispanics, and as such, they are a smart brand to partner with, which we saw Hefty do recently with Fabuloso scented trash bags.

“Making connections through country of origin will appeal to a subset of Hispanics but will also hold broader appeal to Hispanics in aggregate, too,” Paredes added. “In addition, it’s important to celebrate and enable the intersectional interests and passions of Hispanics. Brands like Dove and Ulta Beauty are doing interesting work in driving relevance, trust, and advocacy from Hispanic women who have a wide variety of skin and hair colors and textures.”

As was mentioned, Gen Z Hispanics embrace their family traditions, as well as trends that interest other young people across demographic groups. With all the other factors to consider, the age of the consumers is vital and should be an equal part of any effort to reach the Hispanic community. Moreover, with the growth of the Hispanic population in the United States, its representation among younger consumers is proportionately higher than the general population.

“Gen Z Hispanics make up a huge proportion of Gen Z in general,” Kumar said. “They are growing up in a digital-first world and are dealing with the real stressors of being a young person in America right now. Their desire to be online more, engage with brands that offer a dynamic experience, and for support in the area of mental health are higher than older Hispanics.”

Another thing to keep in mind is the effect the Hispanic community has had on the general culture in the United States. So, as Hispanic consumers are open to the larger popular culture, so is that popular culture drawing more from Hispanic traditions.

“All ethnicities in the U.S. report eating Mexican cuisine as a top choice,” Everton said. “For the non-Hispanic white segment, Mexican and Italian cuisine preferences are roughly equal. Chinese cuisine is third. For Hispanics, Italian cuisine is not equal in appeal. It’s a strong second choice. Multi-cultural works for all segments.”

Joe Derochowski, home industry advisor at market research firm Circana, said that addressing Hispanic consumers is something of an art. The growth of the Hispanic population alone compels businesses, especially those that deliver goods into the U.S. marketplace, to develop ways to satisfy such consumers.

For home goods retailers and producers, recognition of the differing eating habits and their evolution through generations living in the United States is an important beginning. The recognition that consumers maintain their traditions even as they become more immersed in U.S. society is also vital. Even with the close family relationships and the continuity of tradition, by the fourth or fifth generation after arriving in the United States, consumer purchasing patterns are closer to those of the general population. As such, beyond general tendencies and national background, companies should consider the development of Hispanic communities and whether they are heavily populated by immigrants and first- and second-generation U.S. residents. Or are they more mixed and include a large proportion of people who are several generations past the initial arrival?

Derochowski mentioned a particular factor that underlies and distinguishes the housewares buying habits of first- and second-generation Hispanic consumers.

“With first and second-generation consumers, there is very much a difference,” Derochowski said. “They are much more into fresh foods. They’re actually, to a degree, healthier consumers because of that. “On top of that, their meals tend to be a bit more involved,” he continued. “Those things identify that, yes, there is a clear opportunity for housewares and kitchen electrics to develop products to help them meet the needs to make that meal and make it great. Is there a way to continue these behaviors for future generations as they become more like a typical U.S. consumer? The underlying force is convenience, which means we need innovation.”

Companies that can provide products that make it easier to cook traditional dishes more conveniently could find a receptive audience among Hispanic consumers now and over time.

Kitchen appliances, gadgets, storage, tableware and other housewares items can be marketed to suit Hispanic lifestyles. The marketing consideration is such, Derochowski said, that home goods sellers might want to review the advances the food industry has made in addressing the Hispanic market. The time is now to evaluate and advance initiatives to connect with Hispanic consumers through product development and marketing communications, he said.

Marketing isn’t the only factor that needs tailoring if companies want to engage U.S. Hispanic consumers. Building a business with Hispanic communities requires developing internal processes regarding factors such as product development and design.

That means looking at the market broadly, just as a company might look at the entire U.S. as an entity. It also means drilling down to who constitutes that market and their preferences and priorities, Derochowski said. Where Hispanics are, the national distribution of U.S. Latino populations is, as previously illustrated, far from uniform. Even in terms of language, in marketing to specific national groups, getting the dialect right can be essential to the success and failure of marketing outreach.

One way to think about addressing the Hispanic market, according to Bene Casa’s Pomeranc, is to think about selling home products to people from the United States, Australia and the United Kingdom, each of which varies in how it approaches even foods emerging from British traditions and, to a significant extent, in what kind of cookware, serveware and tabletop products are used by each group.

Pomeranc said Hispanic consumers have a lot in common and that can be a starting point for producing and selling certain classes of product. Espresso is something that’s shared widely in Hispanic culture, indicating espresso makers are likely to get a good reception, as will milk warmers, Pomeranc said. Drip coffee makers aren’t common in Hispanic households, he noted, as there is no tradition involving that brewing method. Hispanic consumers generally don’t prefer paninis; they traditionally prefer flatbreads, and they’ll purchase a press that works with their preference.

The Hispanic consumer shops frequently in the relative sense and, on average, spends more while shopping compared to other ethnic groups, according to Pomeranc. Yet, to really make gains within Hispanic communities, marketers and merchants need to consistently refine their approach.

“You’re going to get more foot traffic and more dollars from the Hispanic consumer than you will the national consumer,” Pomeranc said. “The misconception is if you think you’re going to have a catchall that is going to work for all of them, you’re in error. You really have to understand your customer base and what they prefer.”

Marketers need to look at how Hispanics shop across a wide range of consumer products to gain a sufficient understanding of the marketing opportunity for housewares products.

“Hispanics, in general, shop more often, spend cash for fresh ingredients, use local traditions and recipes that have been passed down, and prefer brands that connect with their heritage,” Pomeranc said. “So you’re going to be able to capture a large portion of a Hispanic audience without trying to be so perfectly specific. In other words, the rice, beans, corn, espresso: all Hispanics are going to use those. Cubans will use it one way; Puerto Ricans and Dominicans will use it another way; Central Americans will use it another way; Mexicans will use it another way. But that’s pretty much the basis. The key consideration of companies serving the Latino community is that there is no one definition of a Latino. There are some generalities about Latinos. But the most common misconceptions would be thinking that Latino defines a people.”

Latino culture has a foundation in Europe and covers most of South America and continues through Central America, the Caribbean and Mexico to the U.S. border and, in reality, beyond it, so it’s not surprising that Hispanic consumers have commonalities and distinctions.

“If you think you’re going to capture the Hispanic community by putting a tamale steamer in your store, I can tell you there are many Latinos who are not going to use tamales,” Pomeranc said.

When it comes to products that most Hispanics would prefer but that differ from what other U.S. consumers, in general, would favor, Pomeranc referred to fry pans. In the typical case, a U.S. consumer will buy a frying pan with a flat bottom and flat sides for cooking foods such as pancakes that can be cooked with a small coating of butter. Hispanic consumers are more likely to favor a frying pan with curved sides because they’ll be using it for cooking food in a depth of oil, as is the case with plantains.

Then comes the deeper demographic analysis necessary to maximize sales in Latino communities. Bene Casa does this by working with its customers and tracking the movement of the consumers shopping in their stores. In Miami, Pomeranc said, stores that once served a Cuban population, and before that, a high concentration of Haitian consumers, might now have a primary base of shoppers from a Venezuelan background. Hispanics who are just entering the country, in particular, tend to move from one community to another relatively quickly as they seek opportunities and surroundings with which they are comfortable.

In serving the Hispanic community, therefore, any business needs to stay current with what’s going on population and trend-wise, then tailor its approach to the current reality.

“If you look at how important it is to understand the various national subcultures of the community, you better know who your customer is and you better watch it closely because it will change,” Pomeranc said. “How important is it for them to understand the particular preference, whether it is material, design, visual impact? It is extremely important. Cubans are extremely visual in design, while Mexicans are not.”

The distinctions can be starker than that. Take the example of a comal, a smooth, flat, heavy griddle pan used in Mexico, Central America and parts of South America to cook tortillas and arepas, toast spices and nuts and sear meat. Mexican consumers generally express their preferences in terms of materials used to make the comal. A Cuban consumer wouldn’t have much use for one at all, as comals aren’t central to their cooking traditions, Pomeranc said.

“You really have to know the Latino who is shopping your stores,” Pomeranc said. “Or if you are a manufacturer, and you’re trying to make product for the Latino, who exactly are you making it for and what features and functions are you adding? What materials are you using? What designs, what visual impacts, and what price are you going out there at?”

In some cases, Hispanic consumers use the same type of product, such as a mortero or mortar. However, they don’t always prefer one made of the same material.

“(You need to) understand that Dominicans are going to need wooden bowls and morteros, Puerto Ricans are going use a stainless steel mortero, and the Mexicans and Central Americans are going to use a granite or volcanic mortero — all for different purposes but all the same items,” Pomeranc said. “Different material, different shapes, different food and outcomes, but basically the same item.”

In addressing what he called another misconception, Pomeranc emphasized marketers need to keep in mind many Hispanics are wealthy. The range of incomes found in Latino communities and neighborhoods can vary. Across the income range, Pomeranc said, Hispanics generally avoid low-cost items that don’t live up to high-quality standards.

“They’re not going to buy a poor quality item just because it’s cheap,” Pomeranc said. “That’s a huge misconception. It better be a great value, or they’re not going to buy it.”

Hispanic consumers, especially new arrivals to the U.S. or first-generation Americans in the lower or lower-middle-income range, often live in somewhat cramped spaces, especially in multigenerational households. For them, Pomeranc said, scale can be as important as quality.

“You have to have products that are good for the efficiencies and the smaller homes,” he said. “That’s going to be tabletop burners and indoor products that work on tabletop burners.”

Many Hispanics often shop in mainline supermarkets, mass-market and related stores specifically because they understand the price/quality relation they can expect in each case. However, such consumers also know they might not find the more specialized products they need.

Traffic tracker Placer.ai, in a study that looked at the grocery sector, determined that in the focus period between May 2022 and April 2023, monthly visits to specific Hispanic-oriented grocery chains, El Super, Vallarta Supermarket, Cardenas Market, Fiesta Mart, Northgate Gonzalez Markets, and El Rancho Supermercado, consistently exceeded the previous year’s monthly visit levels. During the period, year-over-year visits to the wider grocery category remained negative almost every month. The study suggests that as the Hispanic population grows and integrates, such consumers will continue shopping where they can find products authentic to their traditions.

Hispanic consumers might shop mainline retailers for some products, Pomeranc said. However, to purchase a caldero, a cooking pot that’s traditional in many Latin American countries, Hispanic shoppers are likely to visit retailers specializing in Hispanic products. That holds true even if the mainline supermarket offers some Hispanic items, Pomeranc noted.

Family shopping reemphasizes the desire for a product consistent with a particular tradition, he said, especially when elders are part of the shopping process.

For retailers who want to build their businesses with Hispanic consumers, in-store merchandising programs should be abundant.

“Pack it out wide and big and deep and create value,” Pomeranc advised. “The perception of value is when you have two dozen of the same items out versus two inline on the shelf. So pack it out to create the perception of value, create a promotion, have the products from the right origin, have the quality because this consumer is going to touch it, view it, talk about and decide to buy it or not. It’s not an impulse. So they’re going to buy it. They’re going to be proud to own it. They’re going to use it and they’re going to expect it to last a long time, and that’s why they’re so brand loyal.”

Loyalty emerges from value and authenticity, as well as the fact that Hispanics often cook together. Cooking is often a family affair, with multiple generations in the kitchen together. As such, cookware and other housewares involved in food prep and consumption must satisfy the priorities of everyone present, including the grandparents and other older adults who might be immigrants or first-generation Americans.

“You have to have an item that has the features and the functions that they’re looking for and not the ones they’re not looking for, so they’re not overpaying,” Pomeranc said. “It has to be able to last a long time, handed down to the next generation and something they’re proud to have on their counter or in their cupboard, and enjoy using and talking about using and having people over saying look how great it is. That’s what makes the brand loyalty. It really resonates. It’s the performance of the brand.”

Even with that, Hispanic consumers often evolve with opportunity and time. So, in one initiative, Bene Casa encouraged and succeeded in moving many Hispanic consumers from enamel to better-quality aluminum cookware. The company has used community knowledge to build business in areas where otherwise it might fail with more mainstream items.

Hispanic consumers traditionally use pressure cookers. Bene Casa took a Cuban multicooker as an inspiration and developed its own product made specifically for the Hispanic market and programmed to prepare items such as arroz con pollo and ropa vieja. Pomeranc said while Hispanic consumers might be slow to follow cooking developments in the larger culture, they are more likely to adopt variations on what’s in the mainstream that appeal to their specific cultural sensibilities. Even as later generations develop habits more consistent with mainstream consumers, such as embracing methods and products for cooking convenience, they still will want the dishes they prepare to have the authentic flavor they favor.

“The next generation is going to say, ‘Wow, look at this innovation,’ and that inspiration to use something new is still there,” Pomeranc said. “You just have to do it the right way, or it’s a complete failure.”

Anyone selling to the Hispanic community should also realize that such consumers are going to be involved in a lot of parties and other festive occasions, Pomeranc said.

The 2024 International Houseware Associations Occasions Report, recently published exclusively by HomePage News, backs up that assertion. In almost every case, Hispanic respondents to the underlying survey were more likely to anticipate attending major occasions related to life events, whether their own or those of their family and friends, than consumers on average. For example, 30% of consumers in general expected to be involved in the celebration of a family and friend wedding this year, but 36% of Hispanic consumers anticipated attending such an event. When it comes to engagements, which aren’t always subject to celebratory occasions in the wider society, 34% of Hispanic respondents expected to be involved in festivities around such an event versus 25% of consumers on average. The biggest differential occurred in celebrating new pet ownership. In that case, 34% of respondents expected to be involved in a pet-related celebration, but that proportion jumped to 47% with Hispanic consumers.