Retirement

Retirement is not only a significant life event but a significant opportunity as well, given that it often includes downsizing or future-proofing homes to ensure that aging seniors can continue living where they want for as long as they want. Friends and family often want to help out with that need.

In the 2024 Occasions Survey, 25% of participants expected retirement events for family or friends over the year, while 16% expected one of their own. In the 2023 study, 20% of participants said they expected a retirement event among family and friends in the ensuing year, and 12% said they expected one of their own.

For the retirement occasion, 18% of consumers said they would purchase a home or housewares gift over the upcoming 12 months for such an event, while 15% said the same in 2023. The biggest period for giving a retirement home or housewares gift is October-December, when 27% believe they may do so.

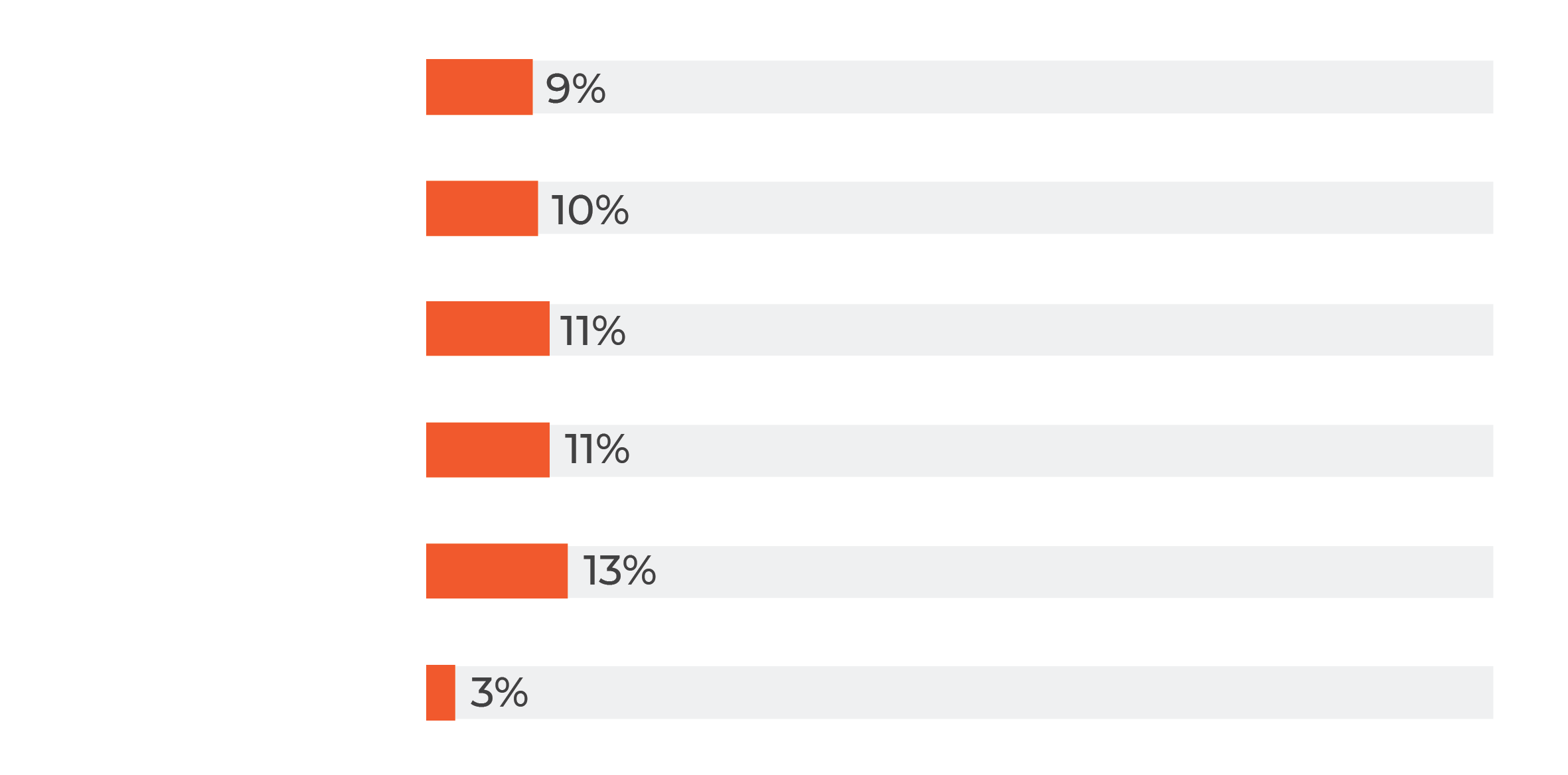

In terms of gift categories, organization or home décor is the top pick at 10%, followed by cleaning or home environment at 7%, bathroom or personal care products at 6%, kitchen products at 5%, and bedroom products at 4%. Given the occasion, 47% of consumers would give a gift card in the retirement case and 43% a specific product.

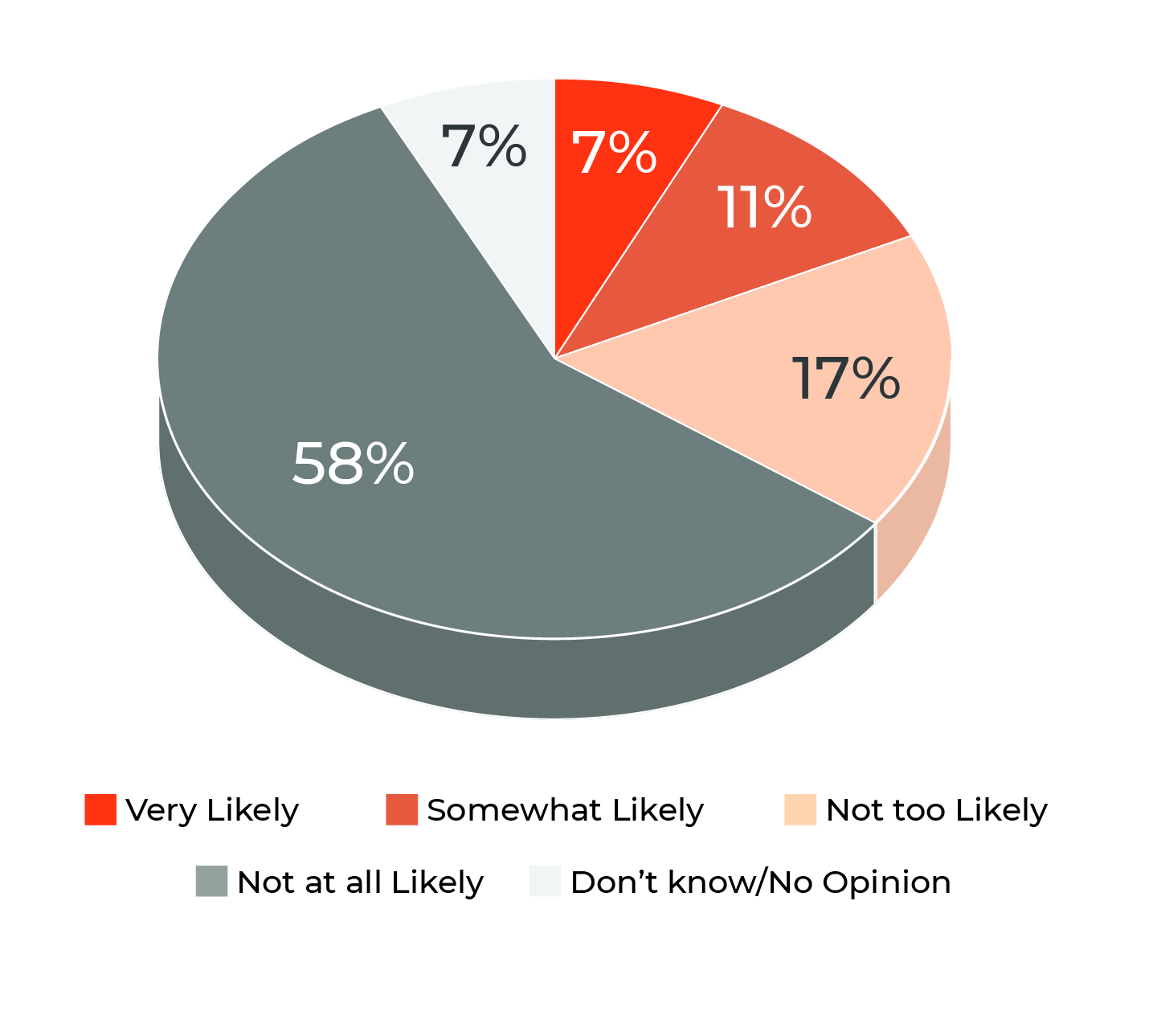

Men, at 28%, are six points ahead of women in regard to friends and family retirement events upcoming in the year, although they are only four points higher, at 18%, in their own retirement occasion.

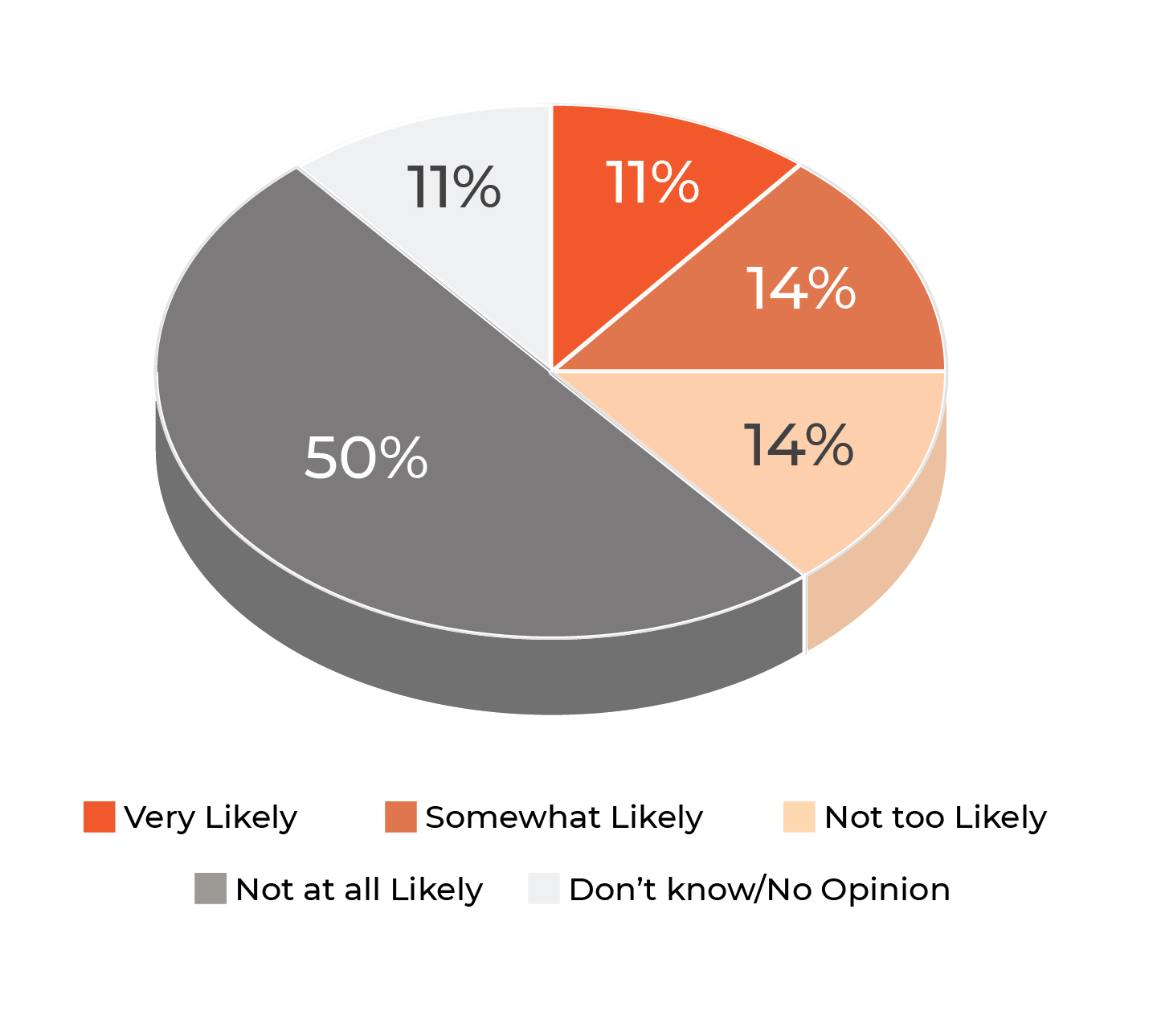

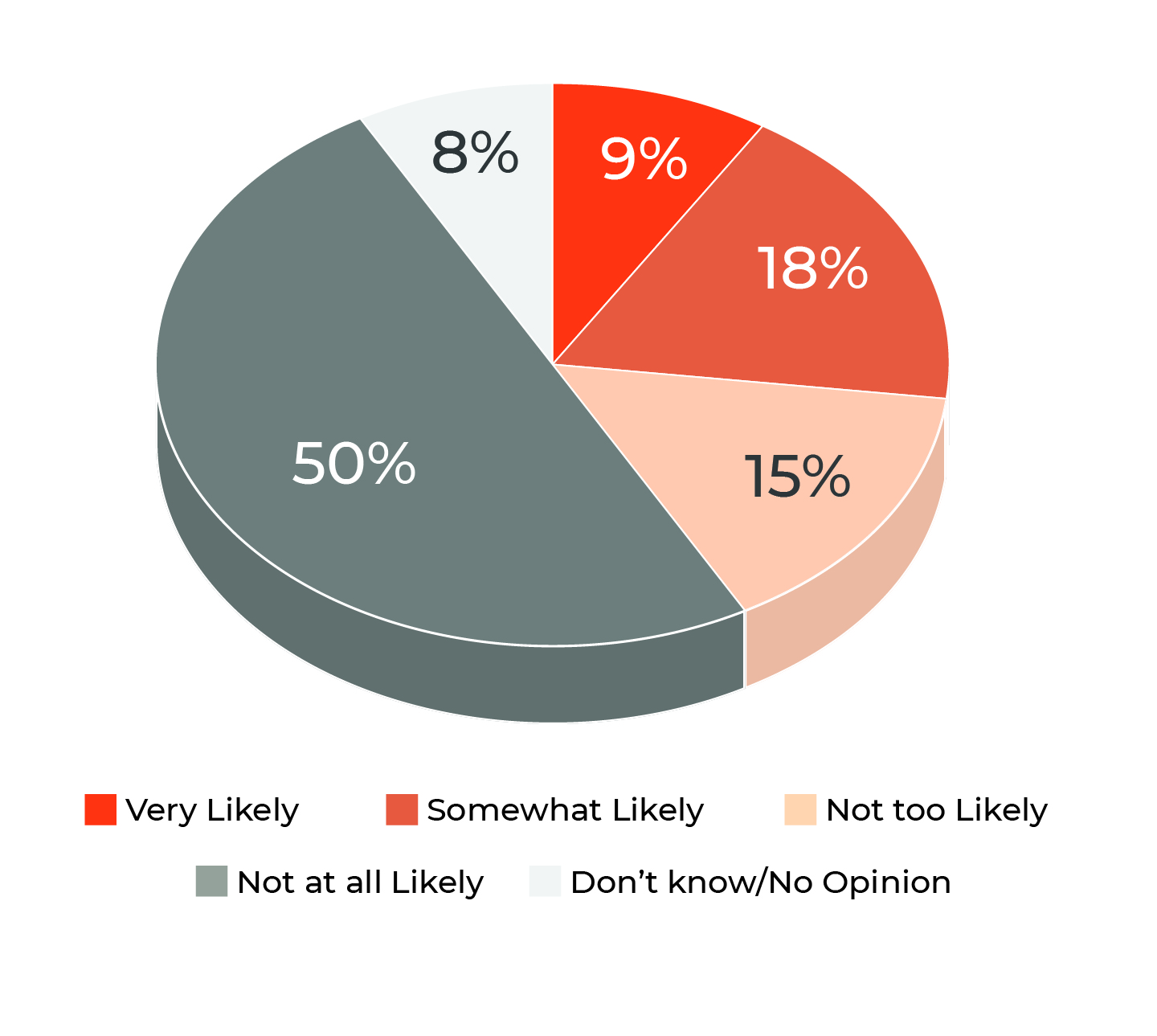

For your friends and family, how likely is it, if at all, that a retirement occasion will take place at least once over the next 12 months?

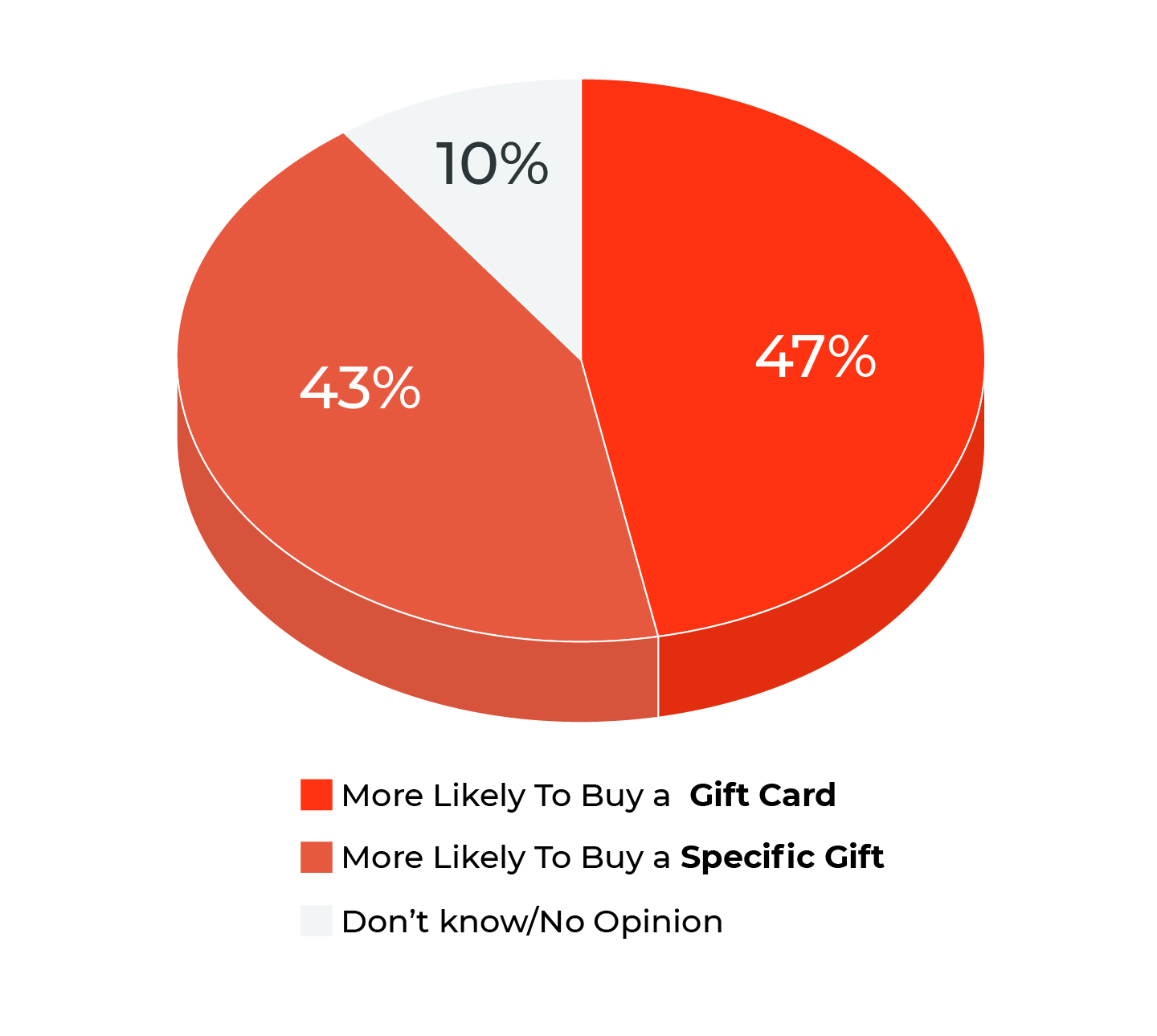

For retirement, are you more likely to buy a gift card or a specific gift?

Women, at 53%, are 11 points more likely to purchase a gift card for a retirement present than are men.

Affluent consumers are also the most likely among income brackets to purchase a home and housewares retirement gift at 24%.

What general product categories of home and housewares gifts would you be likely to purchase for retirement? (Select all that apply)

At 27%, the youngest consumers, aged 18 to 34, are most likely to purchase a home and housewares gift for a retirement occasion, nine points ahead of 35- to 44-year-olds.

Although the youngest consumers, aged 18 to 34, are most likely to anticipate a friends and family retirement, at 31%, all three other age groups designated in the Occasions study come in bunched together, with 45- to 64-year-olds at 23% and both the 35- to 44-year-olds and 65+ at 22%.

For yourself, how likely is it, if at all, that a retirement occasion will take place at least once over the next 12 months?

In the next 12 months, how likely is it, if at all, that you will purchase a home and housewares gift for retirement?

Consumers from households making $100,000 or more are most likely to be looking at an upcoming retirement occasion, by several points, for themselves and for family and friends.

Final Thoughts

Retirement is a big occasion in any life, and Baby Boomers who tended to extend their working lives, sometimes into their 70s, are now winding down their careers. Although the Social Security Baby Boomer retirement age for full benefits increased from 66 to 67 for the cohort’s older contingent, most statistical analysis looks at 65, the age of Medicare eligibility, as a retirement threshold. According to the United States Census Bureau, 10,000 Baby Boomers a month have been turning 65 since 2010. By 2030, all Baby Boomers will be over 65. That’s a lot of retirements forthcoming by the decade’s end. Put another way, the Population Reference Bureau noted that by 2025, 20.8 million people in the United States will be between 60 and 65. In the year 2000, the number was 10.8 million. The 60-year-old in that statistic is a Gen Xer.