Sizing Up the Home + Housewares Business

Sizing Up the Home + Housewares Business

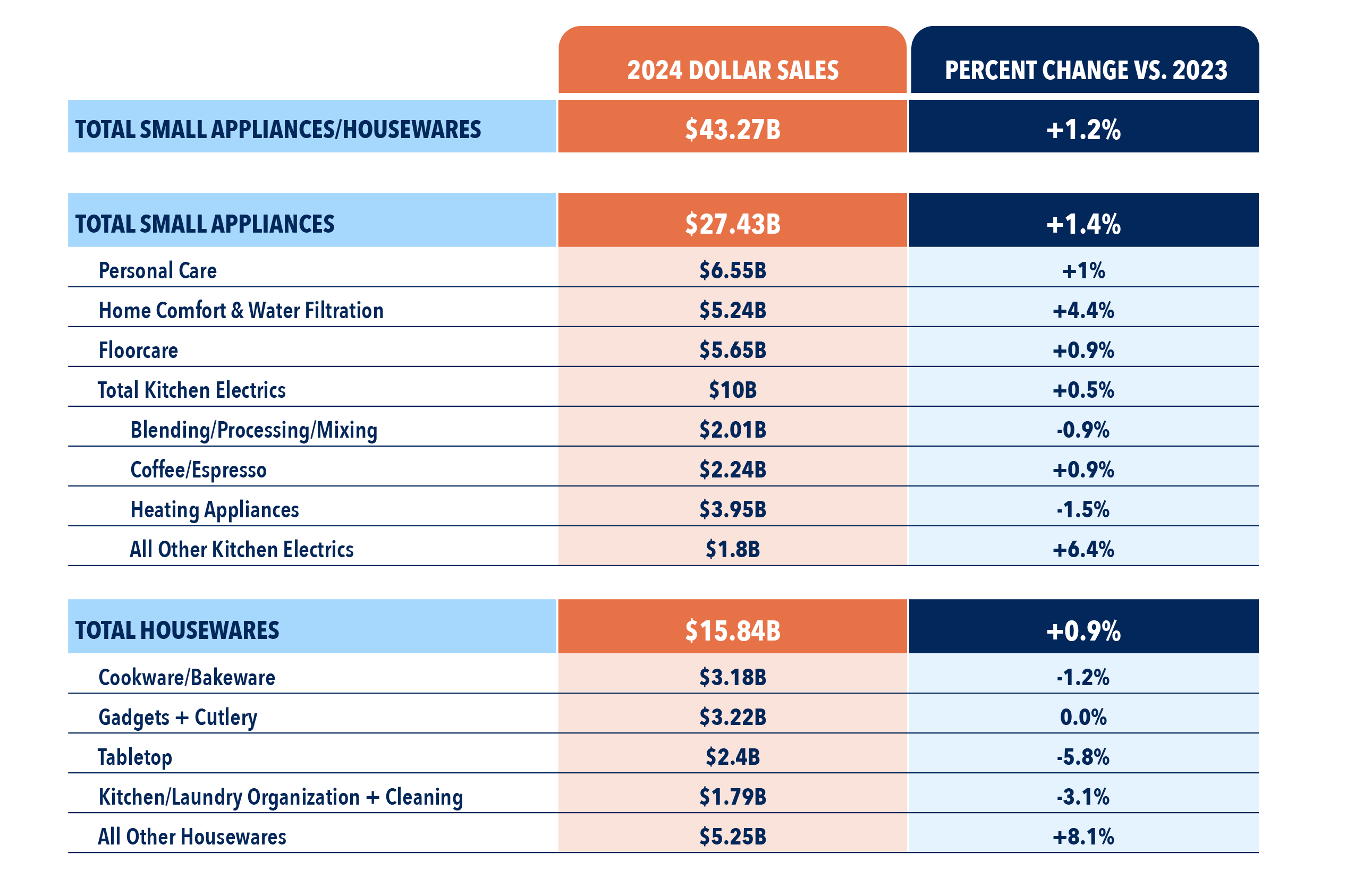

This first installment of the 2025 IHA State of the Industry provides a look into the size of the U.S. retail housewares business, with data on market and primary category size and exclusive insights provided by leading industry market research analytics company Circana.

The report specifies the 2024 sales of the total housewares market, measured by various Circana tracking methodologies. It also breaks down small appliances, including sales broken out by kitchen, personal care and home environment electrics, and non-electric housewares, including sales by cookware/bakeware, kitchen tools and gadgets, tabletop and home organization/cleaning. A listing of specific categories tracked under each classification is also presented.

The report also indicates year-over-year percent sales gains or declines for each of the classifications tracked. Joe Derochowski, the Circana vice president and senior home analyst who provides insights on the metrics present in this report, said such percent gain/decline data points could be the most compelling research findings for industry and retail executives across the home and housewares business landscape.

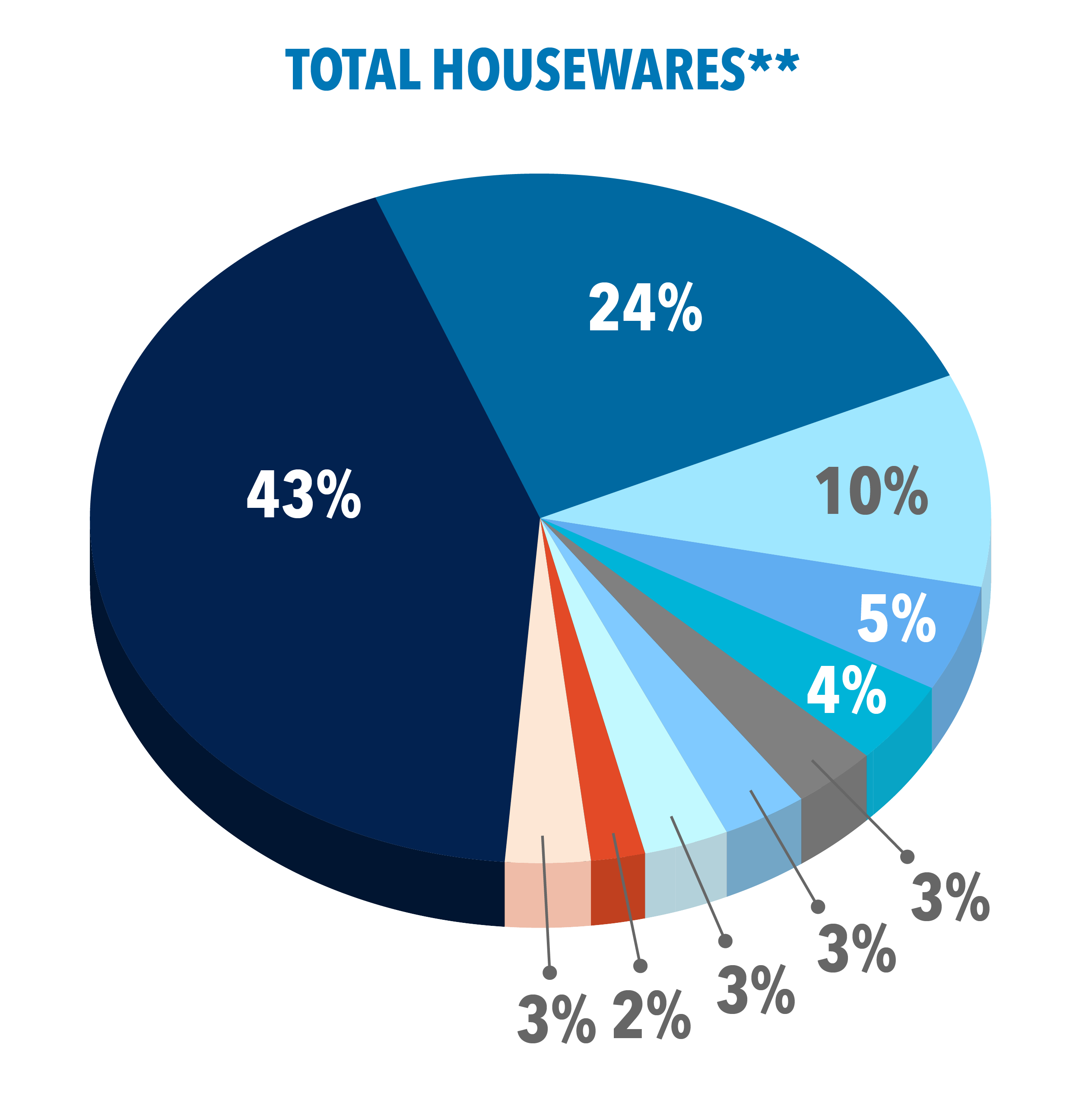

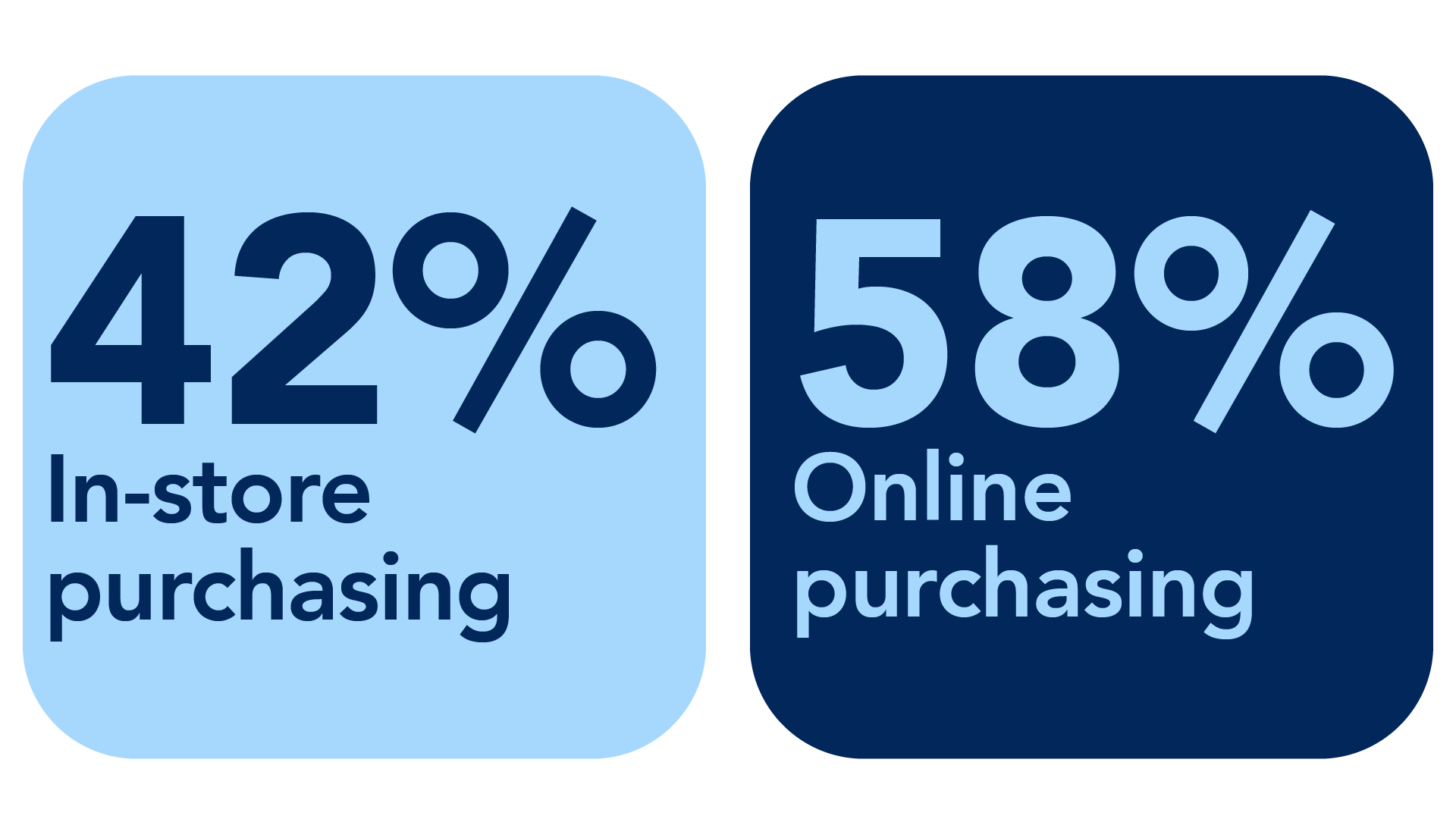

In addition, this report presents data on the share of 2023 housewares retail sales by retail channel, including a breakdown of the overall business by online and physical store sales.

Home + Housewares Ripe for Growth

The home industry, Circana’s Derochowski said, was one of the few industries across general merchandise that saw growth in 2024 driven by (1) consumers eating more at home, (2) consumers entertaining more at home, (3) high-frequency use products hitting the replacement phase, (4) changes in weather patterns, (5) and innovation.

The total small appliance and total housewares segments each saw year-over-year growth in dollars, according to Circana.

Small Appliances

Personal care grew by 1%, led by oral care, women’s styling, men’s grooming, and garment care, as consumers continued to focus on health, convenience-oriented innovations and continued experiential travel.

Home Comfort + Water Filtration grew by 4% as changes in weather patterns created a greater need for products to help us stay cool (fans and room ACs) and warm (heaters). Consumers also sought to consume more water to help save money.

Floorcare grew by 1%, led by stick vacuums, deep carpet cleaners and workshop vacuums, as consumers looked to replace some of these products, seek help with weather-related events and leverage innovations.

Total Kitchen Electrics grew as consumers ate and entertained more at home. Espresso makers, ice cream/yogurt makers, slow cookers and rice cookers led growth.

Housewares

Cookware/Bakeware saw a decline of 1%, but metal bakeware was flat and fry pans/skillets saw growth as consumers ate and entertained more at home.

Gadgets/Cutlery was flat, but growth occurred among cooking and serving gadgets because of the increased frequency of home dining and entertaining.

Tabletop saw a decline in dollars. However, casual flatware saw a slight growth in unit sales.

Kitchen/Laundry Organization and Cleaning saw a decline of 3%. However, similar to major appliances, laundry care was a growth segment. Growth was driven by hampers, baskets, sorters and clothes drying racks as consumers focused more on this part of the house.

All Other Housewares grew by 8%, led by Portable Beverageware as consumers continue to consume more beverages at different occasions.

E-Commerce, Mass Merchants Lead the Way

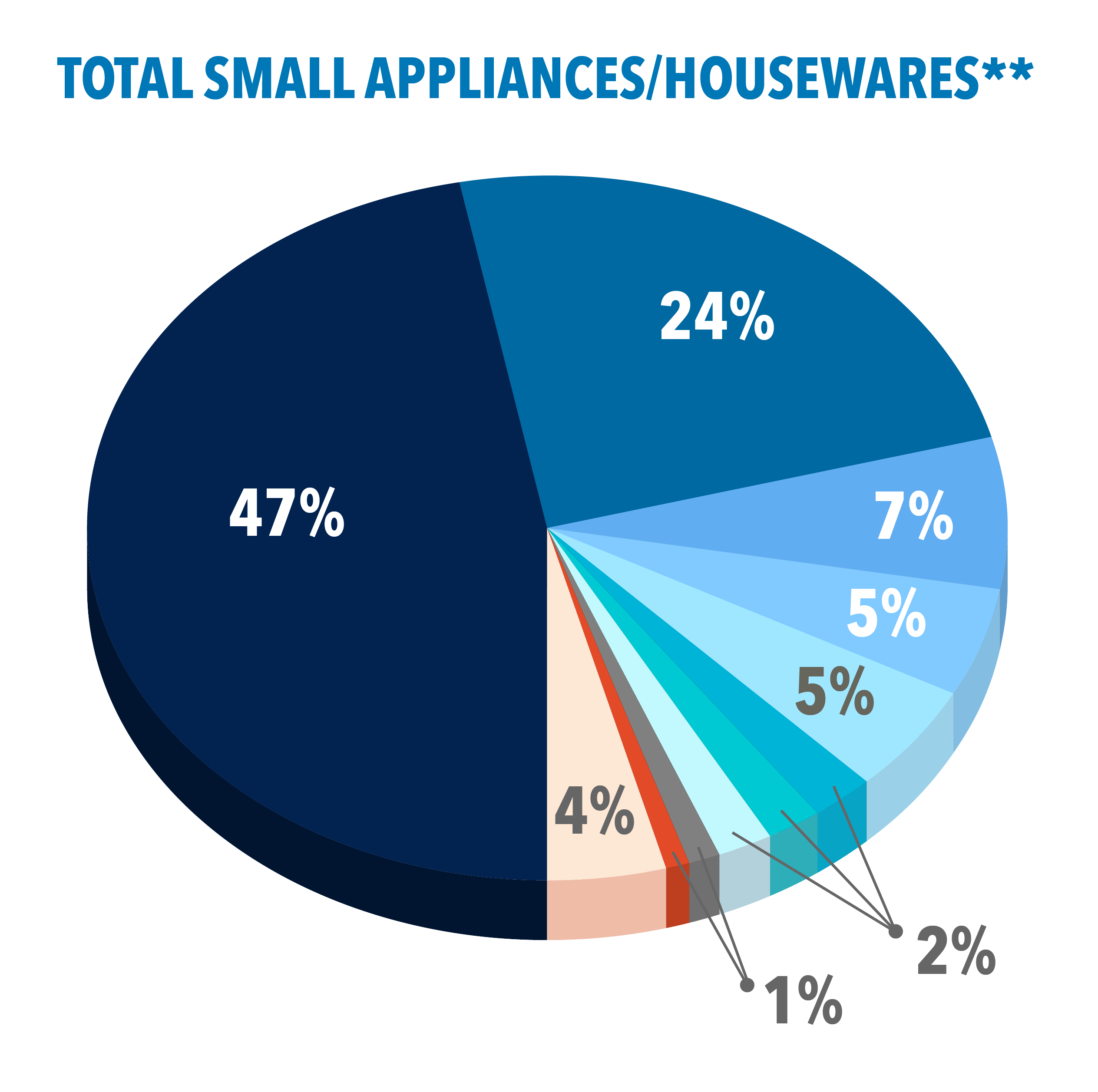

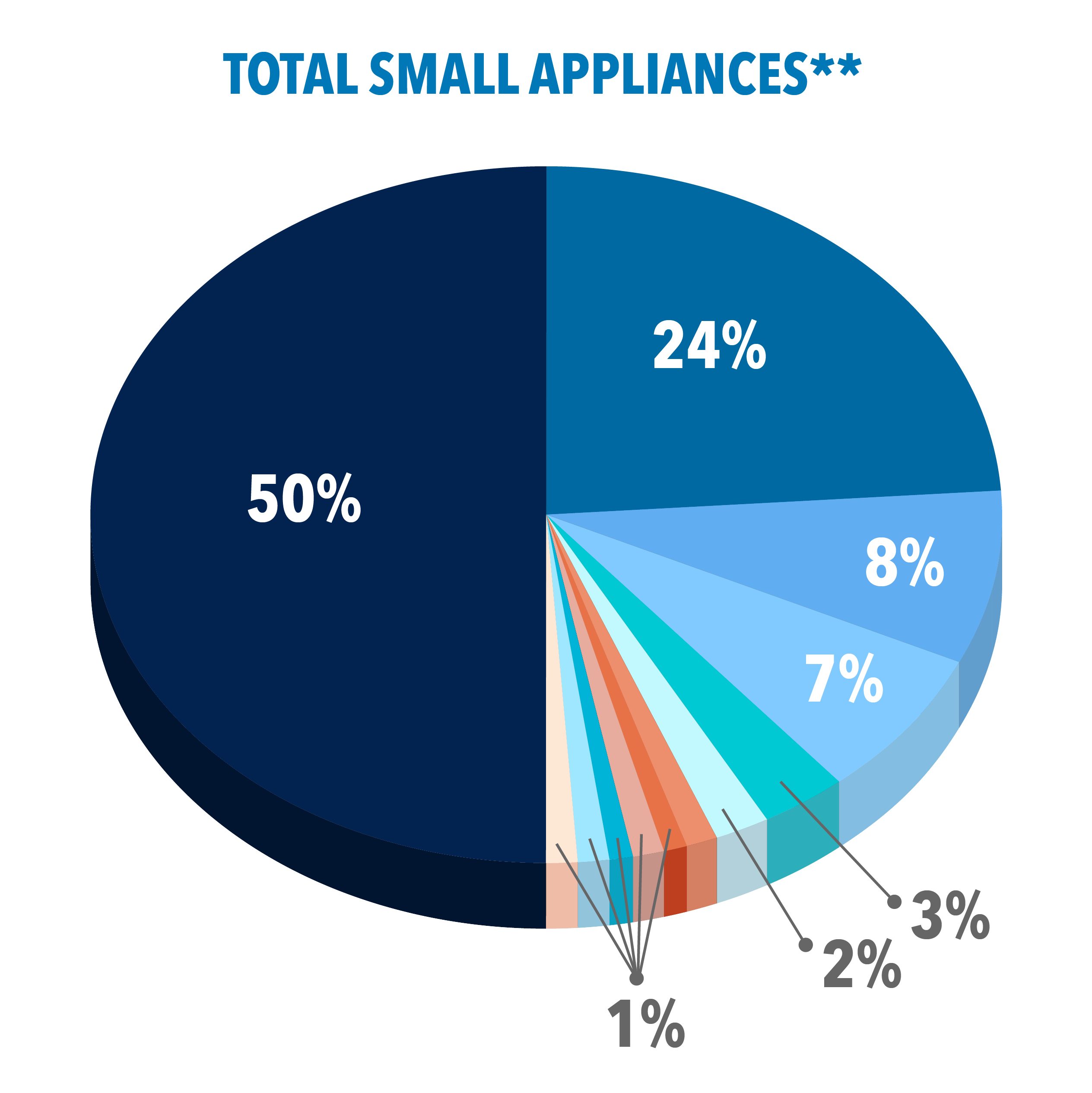

Channel profiles for housewares and small appliances are similar at the top, led by E-Commerce and Mass Merchants, but after that, the profile changes, Circana’s Derochowski said.

Housewares has Off-Price and Dollar Stores among the top five channels, while for Small Appliances, these channels are on the fringe of the top 10. Small Appliances have Home Hardware Stores and Electronic Stores among the top five channels.

As such, Derochowski said this data raises the consideration that Home Hardware and Electronic stores could present a growth opportunity for housewares, while Off-Price and Dollar Stores could present a greater opportunity for Small Appliances. Rounding out the top five channels are Warehouse Clubs, which are number three for Small Appliances and number four for Housewares.

2024 Retail Housewares Sales by Channel

**Notes: Department Store includes National Chain; E-Commerce = Pureplay Retail and DTC Brands

Source: Circana/Checkout/12 months ending 12/24 vs. prior year

*Product Types Tracked

Personal Care

Segment Categories

- Curling Irons/Stylers

- Hair Removal Replacement Parts

- Garment Care

- Hairdryers

- Hairsetters

- Heating Pads

- Home Hair Clippers

- IPL

- Lighted Mirrors

- Massaging Appliances

- Men’s Electric Shavers

- Men’s Trimmers

- Oral Care Appliances

- Oral Care Replacement Parts

- Scales

- Women’s Grooming

Home Comfort

Segment categories

- Air Purifiers

- Air Purifier Filters

- Air Purifier Pre-Filters

- Dehumidifiers

- Electric Diffusers

- Fans

- Heaters

- Humidifiers

- Room Air Conditioners

- Vaporizers

- Water Filtration Devices

- Water Filtration Replacement Filters

Total Kitchen Electrics

Segment Categories

Blending/Processing/Mixing

- Combo Hand/Stand Mixers

- Hand Blenders

- Hand Mixers

- Kitchen Systems

- Other Blending & Processing

- Single-Serve Blending & Processing

- Specialty Drink Makers

- Stand Mixers

- Stand Mixer Attachments

- Traditional Blenders

- Traditional Choppers

- Traditional Food Processors

Coffee/Espresso

- Coffee Grinders

- Coffee Percolators

- Coffeemakers

- Cold Brewers

- Espresso Makers

- Frothers

- Moka Pots

- Non-Electric Coffee Presses

- Non-Electric Pour Overs

- Single-Serve Brewing Systems

Heating Appliances

- Air Fryers

- Countertop Microwave Ovens

- Electric Griddles

- Electric Grills

- Electric Pressure Cookers

- Electric Skillets/Woks

- Food Steamers

- Fryers

- Multi-Cookers

- Other Cookers

- Other Electric Grills/Griddles

- Other Waffle/Sandwich/Treat Makers

- Rice Cookers

- Roaster Ovens

- Sandwich Makers

- Slow Cookers

- Sous Vides

- Toasters

- Toaster Ovens

- Waffle Iron

All Other Kitchen Electrics

- Beer & Cocktail Makers

- Bottles/Carafes

- Breadmakers

- Carbonators

- Chocolate Fountains

- Citrus Juicers

- Compact Refrigerators

- Kitchen Composters

- Electric Can Openers

- Electric Kettles

- Electric Knives

- Electric Pasta Makers

- Fondue Sets

- Food Dehydrators

- Food Vacuum Sealer Bags & Rolls

- Hot Plates

- Ice Cream/Yogurt Makers

- Ice Shavers/Snow Cone Makers

- Jar Openers

- Juice Extractors

- Meat Grinders/Mincers

- Mixes/Syrups

- Specialty Ovens

- Popcorn Makers

- Soda Machines

- Tea Makers

- Vacuum Sealers

Floorcare

Segment Categories

- Bare Floor Cleaners

- Canister Vacuums

- Deep Carpet Cleaners

- Electric Carpet Sweepers

- Handheld Specialty Cleaning

- Hand Vacuums

- Non-Electric Carpet Sweepers

- Robotic Vacuums

- Stick Vacuums

- Upright Vacuums

- Workshop Vacuums

Cookware/Bakeware

Segment categories

- Cookware

- Non-Metal Bakeware

- Metal Bakeware

Gadgets/Cutlery

Segment categories

- Cutlery

- Cooking Gadgets

- Entertaining Gadgets

- Preparation Gadgets

- Serving Gadgets

- Specialty Gadgets

Tabletop

Segment categories

- Beverageware

- Dinnerware

- Flatware

- Serveware

All Other Housewares

Segment categories

- Crystal Giftware

- Food Preservation

- Food Storage

- Kettles

- Portable Beverageware