Directional Data and Insights on Consumer Home and Housewares Purchase Intent

Directional Data and Insights on Consumer Home and Housewares Purchase Intent

The second part of the 2025 International Housewares Association (IHA) State of the Industry — MarketOutlook — examines consumer purchase intent across a full range of home and housewares categories.

At a time when a fast- and ever-evolving retail marketplace is marked by uncertainty, MarketOutlook provides a comprehensive directional resource to help inform home and housewares suppliers and retailers seeking more clarity and confidence in their near- and far-term product development, marketing and merchandising strategies.

The exclusive MarketOutlook survey of more than 2,000 likely home and housewares purchasers in each of 15 core home and housewares categories was conducted for IHA by Morning Consult. The MarketOutlook report offers detailed insight into which home and housewares products consumers expect to purchase in 2025, key factors influencing planned purchase decisions and the retail channels from which consumers are most likely to make purchases. Also, amid concerns about potential price increases, the survey results reveal the extent to which inflation would affect how much more consumers would pay for products.

The MarketOutlook survey results are supported by in-depth analysis by the editors of HomePage News, the official media partner of the 2025 IHA State of the Industry.

Methodology: The 2025 MarketOutlook survey was conducted for the International Housewares Association by Morning Consult among a sample of 2200 adults. The interviews were conducted online, and the results are weighted to approximate a target sample of adults based on age, gender, race, educational attainment, region, gender by age, and race by educational attainment. Results from the full survey have a margin of error of plus or minus two percentage points.

Hover over charts and click to enlarge.

Purchase Intent Stays Strong Across Housewares Categories

When looking at consumer purchase intent by category in the coming months, most categories tracked in the survey indicate a combined “very likely/somewhat likely” to-purchase score at or above 50%. This underscores home and housewares as a key general merchandise producer at retail, one that has historically been resistant to economic lulls and uncertainty.

Notably, the only categories with “very likely” purchase intent ratings above 30% in this year’s survey are personal care, cleaning tools and home health care, perhaps underscoring the elevated role of wellness as a lifestyle priority driving purchase intent of myriad personal and household products.

Purchase Intent Stays Strong Across Housewares Categories

When looking at consumer purchase intent by category in the coming months, most categories tracked in the survey indicate a combined “very likely/somewhat likely” to-purchase score at or above 50%. This underscores home and housewares as a key general merchandise producer at retail, one that has historically been resistant to economic lulls and uncertainty.

Notably, the only categories with “very likely” purchase intent ratings above 30% in this year’s survey are personal care, cleaning tools and home health care, perhaps underscoring the elevated role of wellness as a lifestyle priority driving purchase intent of myriad personal and household products.

Replacement Still Leads, but Innovation and Aesthetics Gain Ground

When it comes to purchase motivation, replacement remains the leading driver across nearly all categories, most ranging from 30% to 50%. Categories like kitchen electrics and home environment also show strong upgrade interest (24%), pointing to innovation as a key purchase trigger. Tabletop categories, along with cookware, outdoor living, and home storage and organization, show elevated aesthetic appeal, with 11–13% of shoppers motivated by home design.

Shoppers Put More Trust in Reviews and Peers

Online product reviews remain the dominant influence across nearly all housewares categories, with kitchen electrics (27%) and home environment (26%) leading consumers’ reliance on digital feedback. Consumer ratings sources also play a significant role, particularly in home health care, floor care electrics and home environment (at 16%), while friends and family recommendations continue to rank as a trusted input across categories, at 15-19%. Manufacturer websites and retailer inserts show less impact overall. Packaging tends to play a modest yet consistent role, peaking at 12% in dinnerware and drinkware. This pattern reflects consumer preference for friends and family recommendations and performance insights over advertising when navigating purchase decisions.

Shoppers Put More Trust in Reviews and Peers

Online product reviews remain the dominant influence across nearly all housewares categories, with kitchen electrics (27%) and home environment (26%) leading consumers’ reliance on digital feedback. Consumer ratings sources also play a significant role, particularly in home health care, floor care electrics and home environment (at 16%), while friends and family recommendations continue to rank as a trusted input across categories, at 15-19%. Manufacturer websites and retailer inserts show less impact overall. Packaging tends to play a modest yet consistent role, peaking at 12% in dinnerware and drinkware. This pattern reflects consumer preference for friends and family recommendations and performance insights over advertising when navigating purchase decisions.

High-Tech Housewares Spur Online Research and Purchase

Online research and purchase behavior vary by category, reflecting differences in product complexity and consumer confidence. Categories like kitchen electrics, floor care electrics and home environment show the strongest digital engagement, with high rates of both online research and willingness to buy from traditional or online-only websites. In contrast, more tactile or style-driven categories such as flatware, drinkware and cleaning tools see higher shares of consumers who skip online research altogether.

Mass Merchants Dominate Online and In-Store as Off-Price Remains In-Person Favorite

With many traditional channels coming in with the same channel-preference percentages for in-person and online shopping, this year’s survey confirms the normalization of omnichannel retailing when it comes to how consumers define their shopping outlet choices. For example, mass merchants, by far and probably to the surprise of few, lead the preference rankings with 37% of respondents picking that channel for in-store purchases and 40% picking it for online purchases (the slightly higher online percentage likely comes from consumers including Amazon among the mass merchant options). It is also notable that the department store channel, whose challenges may be as mainstream as ever, was selected by just 6% of consumers for in-person purchases and 5% for online purchases.

The relatively low, 7% in-store and online purchase likelihood results for home specialty stores might reveal a consumer base responding to the absence of Bed Bath & Beyond stores over the past couple of years and, as of yet, unaware of plans for the return of stores under that label. Off-price stores, meanwhile, show slightly higher purchase likelihood for in-person purchasing compared to online purchasing, confirming a channel whose value to consumers continues to be driven by the in-store“treasure hunt” experience.

Charts above reflect average values across all product categories. View category-specific details.

Bakeware

The home baking renaissance has continued with a lift from the at-home entertaining revival. With that, shoppers tend to approach bakeware purchases with clear intent.

As the replacement cycle heats up across housewares, 42% of consumers surveyed plan to buy bakeware to replace worn-out items.

Meanwhile, 11% cite new recipes or home projects as a purchase motivator, more than most other categories. This reflects bakeware’s reinforced ties to seasonal use, hobbies and special occasions. Impulse purchasing is slightly below average at 8%, and trust in manufacturer websites is also lower (9%), suggesting consumers lean more on third-party sources and peer recommendations. Purchase intent drops significantly among adults 65+, reinforcing the category’s stronger appeal to younger and family-focused households.

While aluminum bakeware continues as the top choice in bakeware materials (selected by 34%), growing awareness of the versatility of other materials is reflected in the similar preference for glass, ceramic and cast iron.

Cookware

Cookware maintains steady interest across demographic groups and income levels, with a strong functional appeal.

While replacement remains a key reason for purchase, 19% of consumers cite updated features, such as nonstick technology or induction compatibility, as a leading motivator. It’s notable that with longstanding PTFE nonstick coatings made with PFAS chemicals facing increasing regulatory scrutiny, ceramic nonstick is preferred by consumers surveyed by a factor of almost two to one.

Trust in manufacturer websites, selected by 11%, reflects the need for detailed product information, particularly around specifications and materials. The cookware category also demonstrates more balanced gender interest than most others, reinforcing its role as a core, household-wide item rather than a niche or specialty purchase.

Kitchen Tools

Kitchen tools are among the top five in overall purchase intent, with 61% of consumers indicating plans to buy across a diverse range of basic and specialty items within the next year.

The category appeals broadly across age and income groups and is driven equally by practical replacement (42%) and feature upgrades (19%), reflecting growing consumer interest in ergonomic or sustainable improvements even in lower-cost products.

Take note of the high preference for stainless steel, chosen by more than half of respondents as the material of choice in kitchen tools, in a reflection of how important durability and easy cleaning are in food prep tasks. That bamboo and wood came in ahead of nylon underscores growing interest in natural materials.

Kitchen tools also stand out for their heavy reliance on online reviews (24%), while retailer advertising (10%) and product packaging (10%) play a significant role as well. This signals a well-balanced path to purchase that blends digital research with in-store influence.

Drinkware

Drinkware is an impulse-driven category, with 12% of consumers making unplanned purchases.

Aesthetics, trend appeal and emotional factors play a significant role in purchase decisions. Friends and family (18%) and product packaging (12%) are top-trusted sources, highlighting the social and visual nature of drinkware shopping. Younger consumers, particularly Gen Z and Millennials, have more interest and are often influenced by hydration trends and brand collaborations.

Design motivation is strong (11%), and replacement ranks lower than in more functional categories, pointing to a “refresh” mindset among buyers. Solid, fairly even demand for specialized wine and cocktail glassware reinforces a continuation of the home bar culture that has strengthened in recent years. However, coffee and tea glassware by far is the most preferred choice by consumers surveyed, indicating a still-percolating home coffee and tea boom that has cemented a reliable, new growth path for the retail glassware business.

Dinnerware

Dinnerware, another category that has benefited from an increase in at-home entertaining, stands out for its aesthetic appeal, with 13% of consumers citing a desire to match home design, the highest rate across all categories.

However, purchase intent is relatively low, with many consumers surveyed replacing dinnerware infrequently. The category shows influence from visual cues such as product packaging (12%) and manufacturer websites (11%), underscoring the importance of presentation and branding.

Demographically, dinnerware sees heightened interest among younger adults and families with children, while older consumers show sharp declines in intent, likely due to established ownership and lifestyle shifts. Such generational differences also support the entrenchment of casual dining lifestyles at the expense of traditional formal dining occasions in the home. More such evidence: Melamine/plastic was selected by 9% of consumers surveyed as the preferred dinnerware material, while bone china was selected by 5%.

Flatware

Flatware shares similarities with dinnerware in terms of low purchase frequency, while it shows emerging sensitivity to design.

Eleven percent of consumers cite matching home decor as a motivator, equal to drinkware and higher than kitchen tools. Online reviews (21%) and input from friends and family (18%) are trusted more than manufacturer content, and impulse purchases remain low at 8%.

Like bakeware and dinnerware, purchase intent among older adults drops significantly, suggesting that long product life cycles and established ownership limit turnover in the category. That also might explain why classic/traditional styles, often perceived to be more enduring and versatile, are preferred by 42% of survey respondents, compared to modern/contemporary styles at 24%.

Kitchen Electrics

Kitchen electrics continue to stand out as a high-consideration, research-intensive category driven by both planned replacement cycles and evolving consumer expectations.

Air fryers lead the pack, with 38% of consumers planning a purchase, signaling that this pandemic-era favorite may be entering a robust replacement phase. Toaster ovens and toasters also show strong replacement potential, boosted by multi-functionality and persistent at-home breakfast routines.

Across the category, updated features remain the top purchase motivator for 24% of consumers, while functionality, performance and energy efficiency increasingly justify premium pricing. Shoppers rely heavily on online reviews (27%), consumer rating sites (15%) and manufacturer websites (11%), reflecting an electronics-style approach to purchasing, where brand trust, technical specs and value-added benefits like U.S. manufacturing and extended warranties heavily influence decisions.

Home Storage & Organization

Household organization has become a compelling consumer lifestyle priority in a period when people are spending more time at home, which now might also serve as offices, entertainment centers, workshops and more.

So it’s no surprise that closet organizers, totes, laundry storage accessories, kitchen/pantry organizers and garage storage products rank among the categories with the highest purchase intent, after food storage, in the home storage and organization segment.

That desk organizers and file/drawer storage show solid purchase intent reinforces how hybrid home-and-away work arrangements remain commonplace, driving the growth potential for related home organization products. Demand for general and specialized food storage solutions gets an added lift during times when cost-conscious consumers are cooking at home more often, thereby looking to optimize leftovers, extend food preservation and facilitate on-the-go meals.

Personal Care

A wide range of hair care, beauty and grooming appliances are in this year’s purchase plans, as consumers continue to embrace the convenience and economy of at-home personal care, bolstered in recent years by performance advances for improved ease of use, versatility and customization.

The men’s grooming category is one to pay attention to, especially among the post-Boomer generations, with the marketing increase around bald styles, the wide range of popular beard styles and lengths, and the resurgence of classic mustache styles. Consistently high demand for women’s hair removal products continues to reward innovation that makes the process easier, safer and pain-free.

Home Environment

Air purifiers remain by far the most in-demand products among home environment appliances, confirming the elevated position of everyday wellness as a home and family lifestyle priority.

Wellness also factors into strong water filter demand, but the category continues to be boosted by environmental concerns related to single-use bottles and from a growing range of on-the-go hydration bottles with filtration. The rise in demand for portable air conditioners has been fueled by updated performance and convenience.

Another factor is the economy of cooling a single room compared to operating central AC, especially in work-at-home spaces. Energy efficiency, easy maintenance and safety are the most important attributes for home environment appliances, many of which typically operate for long periods.

Cleaning Tools

With the age-old task of keeping the home clean elevated to a zealous lifestyle priority in recent years, consumers have embraced introductions of general-use and specialty cleaning tools promising easier use and increased performance.

It’s notable that as eco-friendliness and the use of natural materials have moved up as purchase drivers in the category, convenience still often prevails, as indicated by the continuing strong preference for cleaning tools that use disposable cloths or pads.

The category’s long-standing commodity positioning might explain why nearly half of the consumers surveyed say they wouldn’t pay more for such products, despite constant, helpful innovation. That said, the strong demand for spin-mops, for example, reveals that consumers can be stepped up to products that facilitate household cleaning.

Floor Care Electrics

Fairly even purchase expectations across types of vacuum cleaners and other floor care appliances suggest this is another segment entering what could be a productive replacement cycle.

Moreover, it underscores the opportunity to sell consumers multiple types of cleaning electrics for different household surfaces and needs. Steam cleaners, positioned as fast, natural cleaning alternatives, are on the upswing again and were the most in-demand cleaning appliances in this survey.

While robotic vacs have significantly increased household penetration in recent years and remain at the epicenter of technological progress in cleaning, they come in with about the same demand as other floor care electric segments. Gains in pet ownership in recent years have supported an expanding assortment of upright and canister vacs, hard floor cleaners and carpet shampooers developed to tackle pet hair and other pet messes.

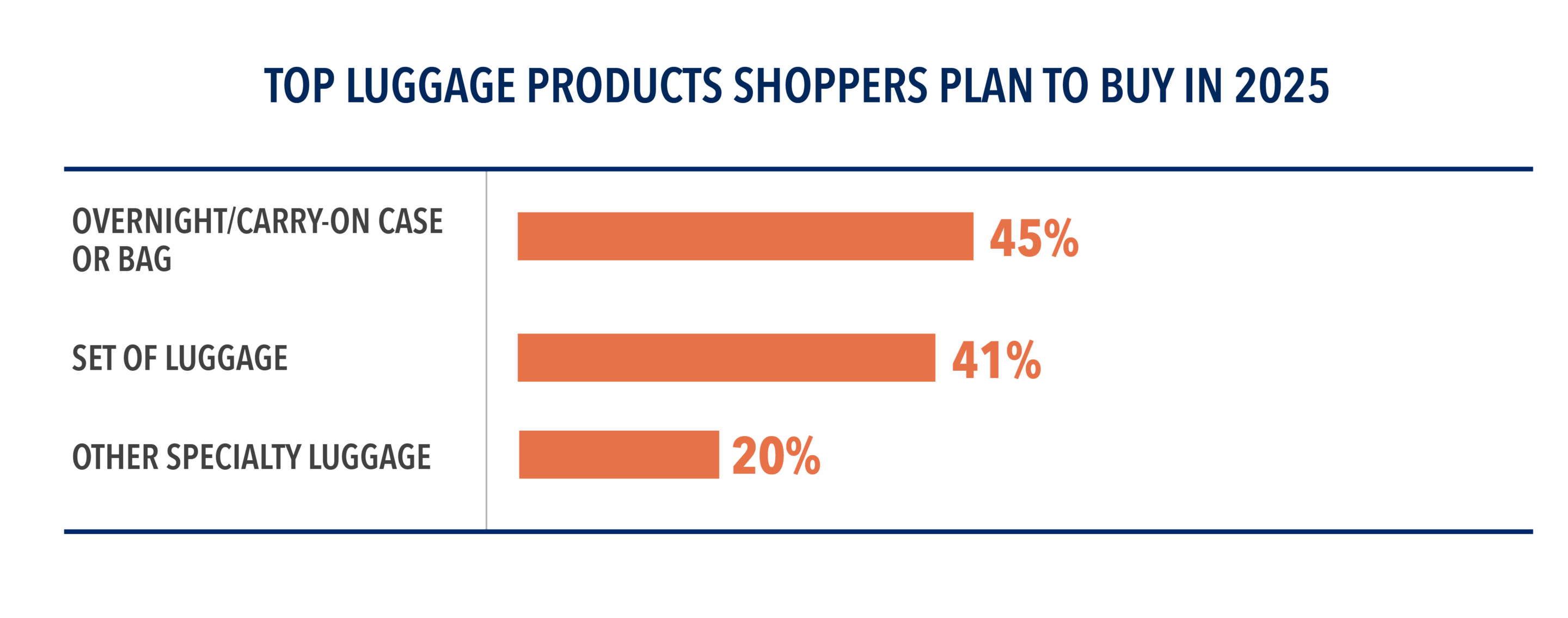

Luggage & Travel Goods

While inflation and economic uncertainty might have tempered soaring post-pandemic travel and tourism growth, the demand for new travel goods remains strong.

The high demand for overnight/carry-on luggage in this survey underscores an opportunity for new, versatile short-trip solutions. Meanwhile, consumers continue to seek accessories that make the packing of clothing, shoes and personal items more organized, space-efficient and accessible. Look for more luggage designed so consumers can access items easily while traveling without unpacking.

Outdoor Living

Backyard recreation, entertaining, cooking and dining have become more routine among consumers surveyed.

This is firing up demand for myriad outdoor living accessories. As outdoor grilling continues to boom, full-size grills remain a top preference of consumers in the market this year. Within such strong demand for full-size grills is the continuing popularity of kamado-style cookers and a fast-rising interest in griddle-style models that tout the versatility of their large, flat cooking surfaces. Smokers are also sustaining solid levels of consumer demand.

The popularity of different, sometimes specialized outdoor grill types has fueled multiple-unit ownership, as many users have increased their outdoor grilling frequency and skills. This, as the survey indicates, has propelled solid, fairly even demand for specialized grilling tools, cookware and thermometers (notably a growing range of Wi-Fi-enabled digital models). Consumers are in the market for a wide range of outdoor living accessories. This is indicated by the relatively even purchase expectations for a range of products — including tableware, candles, storage products and portable comfort electrics — designed to bring added function and style to more frequently used outdoor spaces.

Home Health Care

Home health care appliance development and marketing have evolved in recent years to project a more holistic wellness orientation for all generations compared to what previously had been a more clinical purpose and tone.

Such positioning has raised awareness of and demand for a wide range of products, promoting the opportunity for consumers to take more control of their physical and emotional wellbeing, sometimes at a considerable cost saving.

Comparable purchase intent for body fat scales, blood pressure monitors, fitness trackers and massagers in part reflects an aging population intent on being more active and fit. The strong intent to buy electric plaque removers and facial/skin care appliances, which can also be attributed somewhat to an aging population, showcases how health and beauty benefits can combine into a powerful purchase elixir.