2023 IHA Occasions Report: Housewares Joins The Celebration

The exclusive HomePage News Report on the 2023 International Housewares Association (IHA) Occasions Survey offers an in-depth look into how consumers are currently celebrating life moments and what that means for home and housewares purchasing in 2023.

The 2023 International Housewares Association (IHA) Occasions Report provides insight into how consumers are once again embracing key life moments and plan to in the year ahead and beyond.

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands. Results of the Survey throw light on opportunities available to the home and housewares industry to serve upcoming personal, family and friend celebrations. They also reveal how consumers will approach their next life stages and how retailers and suppliers can forge lasting customer relationships by engaging them and following them through key life moments.

The proliferation of housewares product purchases for these stand-alone occasions suggests that housewares retailers and suppliers should continually consider their role as gift providers for not only major life events but for annual occasions including birthdays and anniversaries, and also for “anytime moments” when a person wants to turn just another day into a time to celebrate.

The COVID-19 pandemic and its economic aftermath have scrambled long-established occasion traditions, and year-over-year results in the Survey chronicle how consumers have both rescheduled and reimagined life events that were delayed by coronavirus-related fears and restrictions. Weddings, for example, were postponed. According to the Survey, the proportion of respondents who plan to attend a family or friend wedding during the next 12 months or so declined.

The proliferation of housewares product purchases for these stand-alone occasions suggests that housewares retailers and suppliers should continually consider their role as gift providers for not only major life events but for annual occasions including birthdays and anniversaries, and also for “anytime moments” when a person wants to turn just another day into a time to celebrate.

However, that has occurred during a year that, according to market research by The Wedding Report, has seen a major rebound from a depressed number of nuptials in pandemic-stricken 2020 and also beyond what was typical in the years prior to the COVID-19 outbreak. The Wedding Report anticipates another slight bump next year before the numbers slip back toward what would normally be expected. So, the rush to wed after marriages were deferred by the pandemic may be declining, but the occasion will still offer significant opportunities for home and housewares going forward.

Deferral isn’t the only change in weddings wrought by COVID-19. Time, place and format are all in flux. Many weddings being conducted and planned today are “second” weddings for couples who have already married in small ceremonies that included only a small circle of attendees, but who now, as the pandemic becomes a lesser consideration, are determined to have their larger reception and celebration. The pandemic also gave new impetus to destination weddings, already popular but surging as the world opens up again. The pandemic allowed engaged couples to “nest” in their homes before the actual wedding event, and many of them began to bring products into their homes that might normally have waited until registry fulfillment.

The thinking can even extend to non-traditional events conducted to more closely reflect the tastes and personalities of the frequently older and better-established couples. Other factors that encourage consideration of the non-traditional include the difficulty of even finding a traditional venue, many of which have been thoroughly booked up and can be incredibly expensive. Indeed, The Wedding Report reported that the average wedding in the United States cost just over $27,000 in 2021. How might these consumers rely on housewares product to pull off their less elaborate ceremony and reception plan?

In the 2023 IHA Occasions Survey, just under a quarter of respondents were looking at attending a friend or family wedding in the next 12 months versus 29% in the year-prior survey. Those expecting to be involved in a family and friends engagement event in 2023 totaled 21% (6% very likely and 15% somewhat likely) versus 25% (9% very likely, 16% somewhat likely) a year earlier.

In the 2023 IHA Occasions Survey, just under a quarter of respondents were looking at attending a friend or family wedding in the next 12 months versus 29% in the year-prior survey.

The bridal shower occasion slipped slightly at 19% of respondents likely (7% very likely and 12% somewhat likely) to be involved in such a family and friends event in 2023 versus 2022, at 23% (9% very likely and 14% somewhat likely). A slight year-over-year difference held for baby showers at 25% (11% very likely and 14% somewhat likely) versus 16% (11% very likely and 15% somewhat likely) in the 2022 survey.

At a time when the home market is in flux, the housewarming occasion possibility for family and friends slipped year-over-year at 28% (10% very likely and 18% somewhat likely) versus 32% (12% very likely and 20% somewhat likely) a year before. The decline is no surprise, but the continued elevation vs. pre-pandemic levels is important.

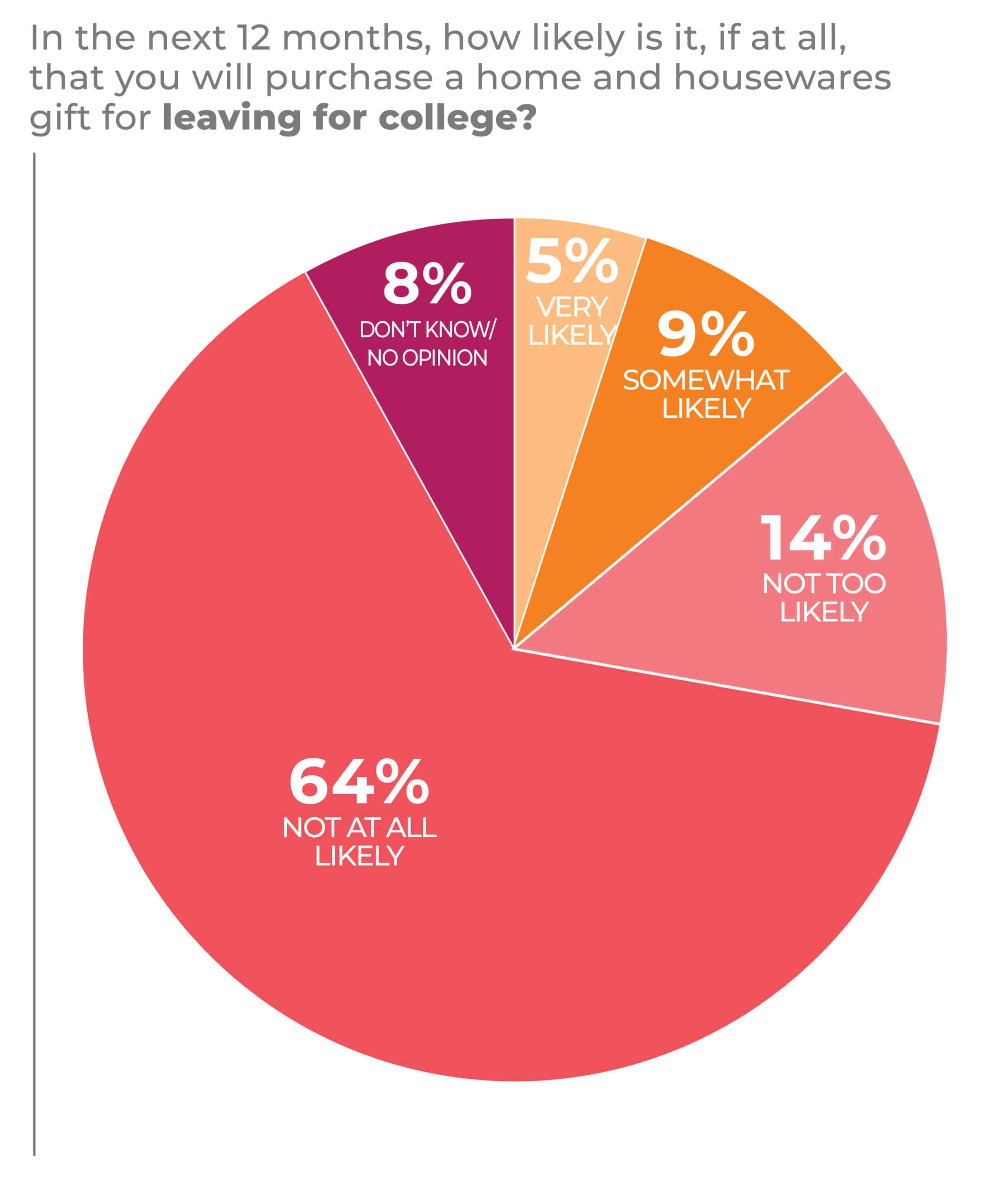

Fewer 2023 IHA Occasions Survey respondents expected to be involved in the family and friends leaving for college occasion in the coming year, at 15% (7% very likely and 8% somewhat likely) than was the case in the 2022 survey, at 17% (9% very likely, 8% somewhat likely.) However, what may be more revealing about the data is how the occasion seems to be made up of multiple events that stretch over several months as friends and family interact with the college-bound from the period leading up to high school graduation and the time the newly located collegians are using gift cards to finish fitting out their dorms and apartments. In addition, the pandemic created an influx of online secondary education opportunities which are both experienced in the home as opposed to away, and that are often experienced by slightly older consumers than you would expect in a traditional “off to college” demographic.

Taking place beyond a singular time and place for a given occasion, new pet ownership is similar in that it may consist of multiple events as people pay visits to the household with a new pet.

Still, as a gift-giving occasion, it amounts to pretty much the same thing, and, in the aggregate, new pet occasions are up slightly in the 2023 study to 33% from 32%, although the certainty is a bit less at 10% very likely and 23% somewhat likely in the 2023 survey versus 12% very likely and 20% somewhat likely in the 2022 Survey.

Taking place beyond a singular time and place for a given occasion, new pet ownership is similar in that it may consist of multiple events as people pay visits to the household with a new pet.

As for retirement, fewer respondents in the 2023 Survey said they anticipate a family and friend occasion, at 20% with 8% very likely and 12% somewhat likely, as compared to 22%, with 10% very likely and 12%, somewhat likely, in last year’s Survey. The depressed stock market and inflation are among the factors that could be convincing seniors to work a bit longer. In the nationally projectable Survey of 2,200 adults across the United States, 20% represents more than 66 million potential customers.

The Survey also identifies the attitudes toward occasions gifting among 18-34-year-olds. The age bracket is worth calling out because it mixes younger Millennials and older Gen Z members. Many market observers consider this group to be important, as members often have more in common with each other than with their designated cohorts. While the oldest Gen Zers are in college or beyond, as they’re as old as 25, the youngest members are 11, and in a very different life stage. Then, the youngest Millennials are 26 while the oldest are reaching their 40s and are more likely to be settled down than the younger members of the group.

By calling out 18-34-year-olds, the Survey coverage zeroes in on younger people who are emerging as consumers and likely relatively enthusiastic housewares purchasers. It’s noteworthy that in almost all housewares purchase categories covered, 18-34-year-olds are at or near the top in terms of their purchase intent across key occasions. This makes sense, as many key life occasions—leaving for college, engagement, bridal showers, weddings and baby showers—tend to take place within this age range. This age group is generally the most active in terms of changes in their lives that tend to require home + housewares product acquisition.

“We talk about retirement as an occasion, but after the occasion has passed, this is a different consumer. A retired consumer. What do they need moving forward?”

— Leana Salamah, VP Marketing, IHA

The Survey identifies opportunities in terms of market parameters and dynamics. Another important factor to consider, though, is the survey’s delineation of life events. Leana Salamah, vice president, marketing, IHA, said the opportunity isn’t necessarily confined to a given occasion, but it often extends well beyond as consumers re-equip for their next life stage. After an event and its related occasion occur, a consumer’s lifestyle and needs evolve.

“These are inflection points,” Salamah said. “They fundamentally change something about the consumer. We talk about retirement as an occasion, but after the occasion has passed, this is a different consumer. A retired consumer. What do they need moving forward?”

Occasions have another effect, particularly now, as they are not only celebrations but also important points that allow people to connect and reconnect.

The need to celebrate and restore personal relationships has been particularly important over the last several months, Joe Derochowski, home industry advisor for The NPD Group, said. The habits developed during the pandemic period of relative isolation haven’t been easy for everyone to shake off, especially because the COVID-19 virus has rebounded in variants in such a way as no clean break with the pandemic occurred. Occasions are helping consumers get back into the swing of personally socializing with family and friends.

Indeed, new celebrations are getting more emphasis as they encourage get-togethers. One, still informal but increasingly more clearly defined occasion is the baby gender reveal, an extra new child-related occasion. Not everyone has embraced the event, at least not yet, but the same can be said of other accepted festivities. Celebrations around new pets, it’s worth noting, have become more prevalent.

“It’s not just the occasions that drive you in giving a gift, but you’re also living that occasion.”

— Joe Derochowski, VP, Industry Advisor, Home & Home Improvement, The NPD Group

Appreciation of an occasion is important because it leads to the recognition that housewares products are more than tools purchased by consumers based on need, Derochowski said. “It’s not just the occasions that drive you in giving a gift, but you’re also living that occasion,” he continued.

A thoughtful gift reinforces the bond and helps outfit a recipient for the next life phase. Given their wide range of purposes, housewares can be those thoughtful gifts from single-cup coffee makers for the college bound to vacuums designed to capture pet hair more effectively to cooking tools that work efficiently for people who may be losing some strength with age. A corollary effect can be the development of an emotional relationship with brands.

Tom Mirabile, founder of Springboard Futures and IHA’s consumer trend forecaster, said the opportunities that occasions provide should be explored and appreciated, but he takes it a step further. To boost sales, housewares should be developed and sold not only for their inherent qualities but also as gifts that suit a wide variety of occasions. He emphasizes that every day is a potential occasion, and housewares can be positioned to encourage consumer purchases for life stages and everyday celebrations. Mirabile even recommends having staff dedicated to monitoring social media so they can get in early on the next big thing. Other considerations shouldn’t distract from an important constant, Mirabile said. “Housewares is a gift business.”

The 2023 IHA Occasions Survey was conducted by Morning Consult in September 2022. More than 2,200 interviews were conducted online, and the data is weighted to approximate a target sample of adults based on gender, educational attainment, age, race and region. Results from the full survey have a margin of error of plus or minus 2 percentage points.

The 2023 Occasions Report Analysis was written by Mike Duff, Contributing Editor.

Engagements

Engagement circumstances have changed, with many proposals occurring between people already living together. In that way, engagement gifts may be becoming less about immediate celebration and tradition and more about the lifestyle and preferences of a couple.

In The Knot’s 2021 Jewelry & Engagement Study, outdoor proposals increased to 73% compared to 40% in 2020, with a third of engagements occurring on a trip versus the year before when the COVID-19 pandemic kept people close to home. Hiring photographers and other vendors to help with the proposal gained as well, at 19% compared to 12% in 2019.

As is happening with other life events, younger consumers particularly are looking to put their personal imprints on the events.

In the 2023 IHA Occasions Survey, just about 21% of consumers—6% at very likely, 15% at somewhat likely—believed they might be involved with a family or friend’s engagement occasion, a lower proportion than with nuptials, which may reflect the COVID-19 pandemic-related marriage gains seen the past several months.

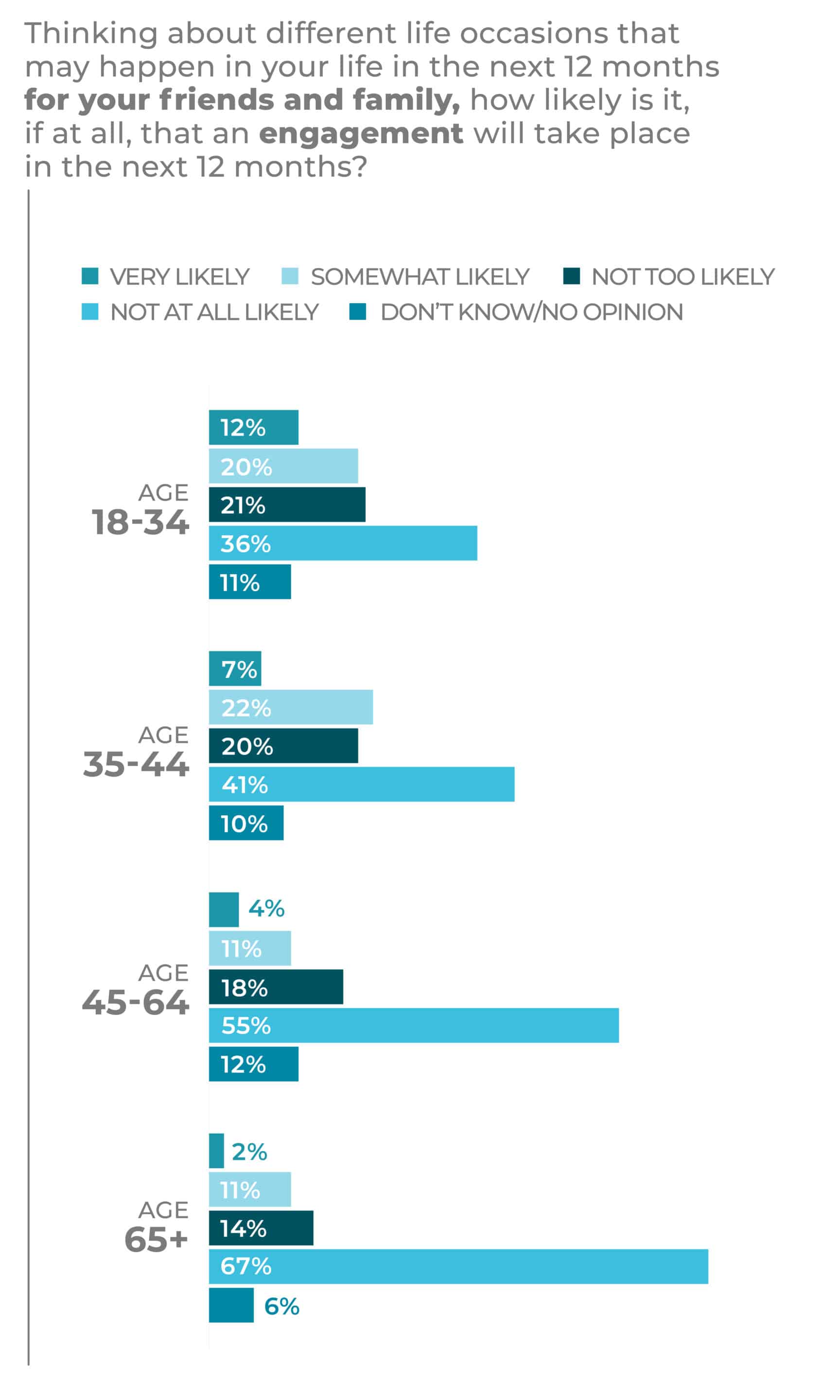

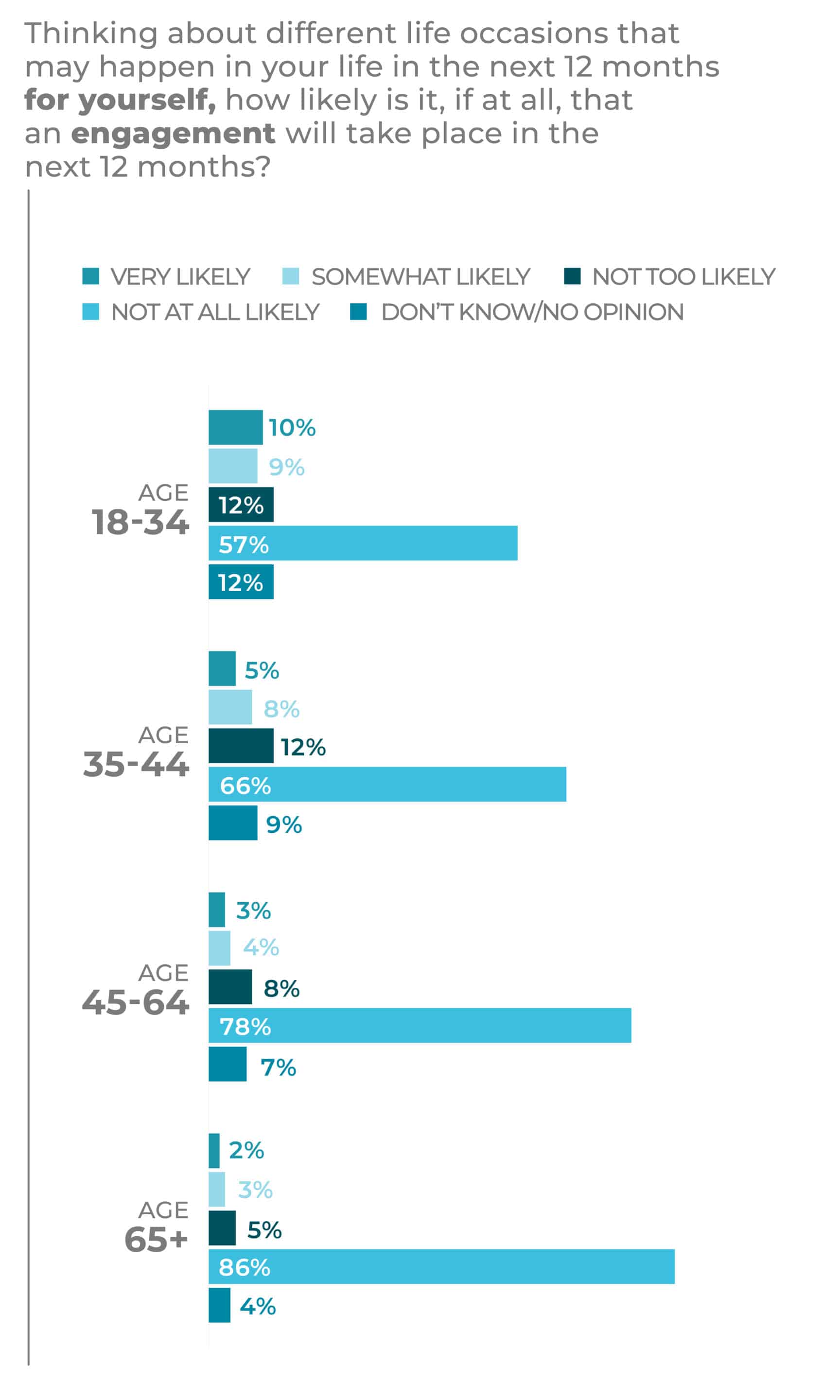

Perhaps unsurprisingly, the proportion of 18-34-year-olds who feel they are very likely to be involved in a friend or family engagement, at 12%, is twice the average percentage. Many Survey respondents were less certain about being involved with an engagement themselves, with 4% saying they likely would and 7% saying they somewhat likely would. Among men, 5% said they would very likely and 10% said they would somewhat likely be part of an engagement. Among women, the numbers were 4% and 5%, respectively.

As for age brackets, 18-34-year-olds were most inclined to be part of an engagement at 10% very likely and 9% somewhat likely, followed by 35-44-year-olds, down to 5% very likely and 8% somewhat likely. Engagements among family and friends garner a 67% likelihood for a single event in the study, with 28% of respondents having two to four such occasions in sight and 5% having five or more on the horizon. Men trailed women in the single engagement category, 63% to 71%, but men led in the two to four category, at 31% to 25% for women. People 65 and older were leaders in the single-event category at 84%, while 18-34-year-olds were most likely to have five engagements coming in the next year at 7%.

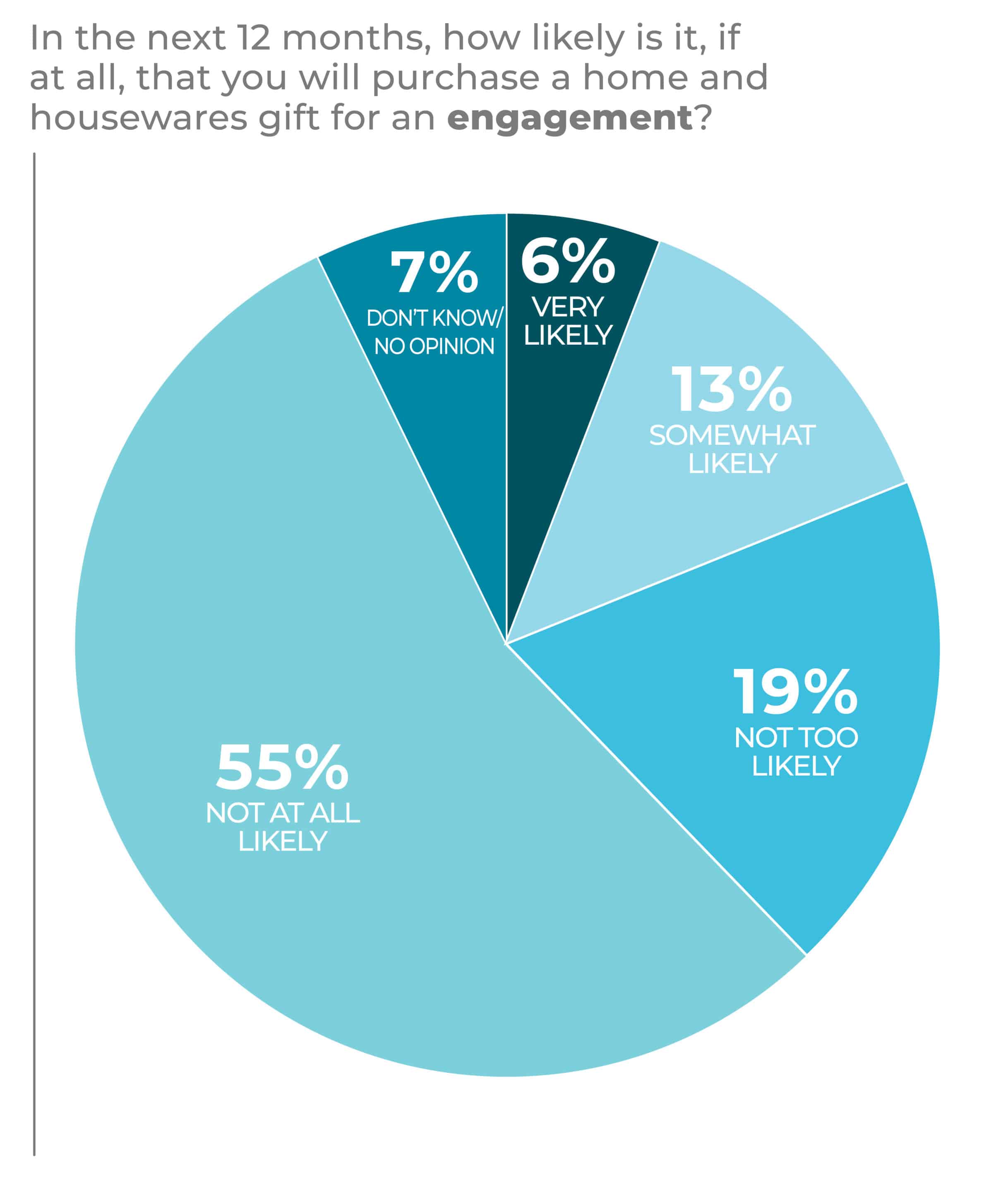

As for housewares gifts for the occasion, 6% of survey respondents said they were very likely and 13% were somewhat likely to purchase such products, with men and women about equal in their results. Respondents in the youngest echelon, 18-34-year-olds, led in looking at housewares engagement gifts, with 9% very likely and 18% somewhat likely to buy.

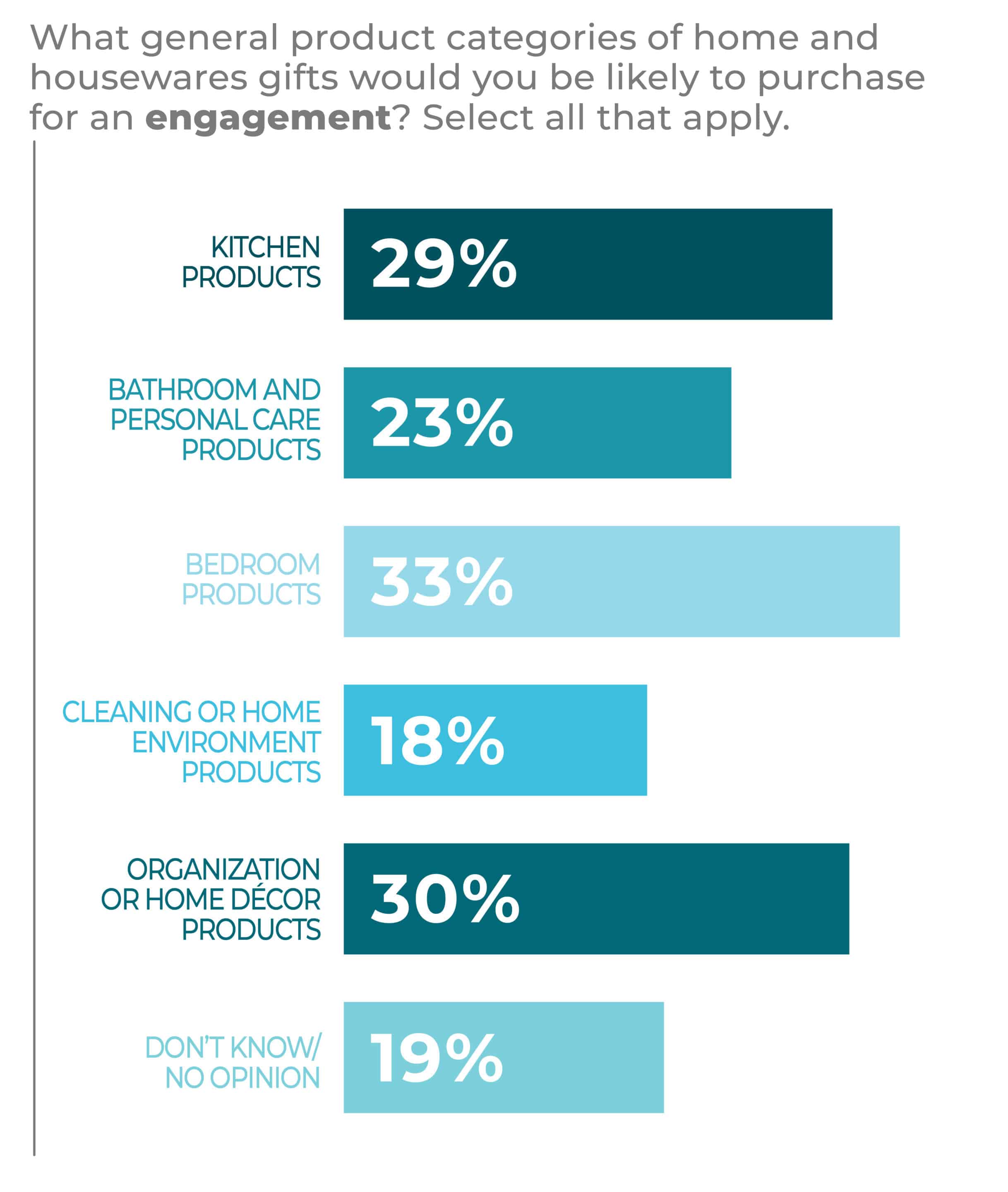

In terms of the housewares categories targeted, bedroom items led, with 33% of respondents ready to gift such products, followed by organization or home products at 30% and kitchen products at 29%. Year over year in the survey, kitchen products slipped a bit from 34% while organizing and home décor products also ticked down from 34% and bedroom products gained from 32%.

Men are more likely to favor bathroom and personal care, bedroom and cleaning and home environment gifts, while women tend toward kitchen products, organization and home décor. Younger consumers led in all categories, although 18-34-year-olds were tops in bathroom and personal care, organization or home décor and cleaning and home environment products. Meanwhile, 35-44-year-olds led in kitchen and bathroom products.

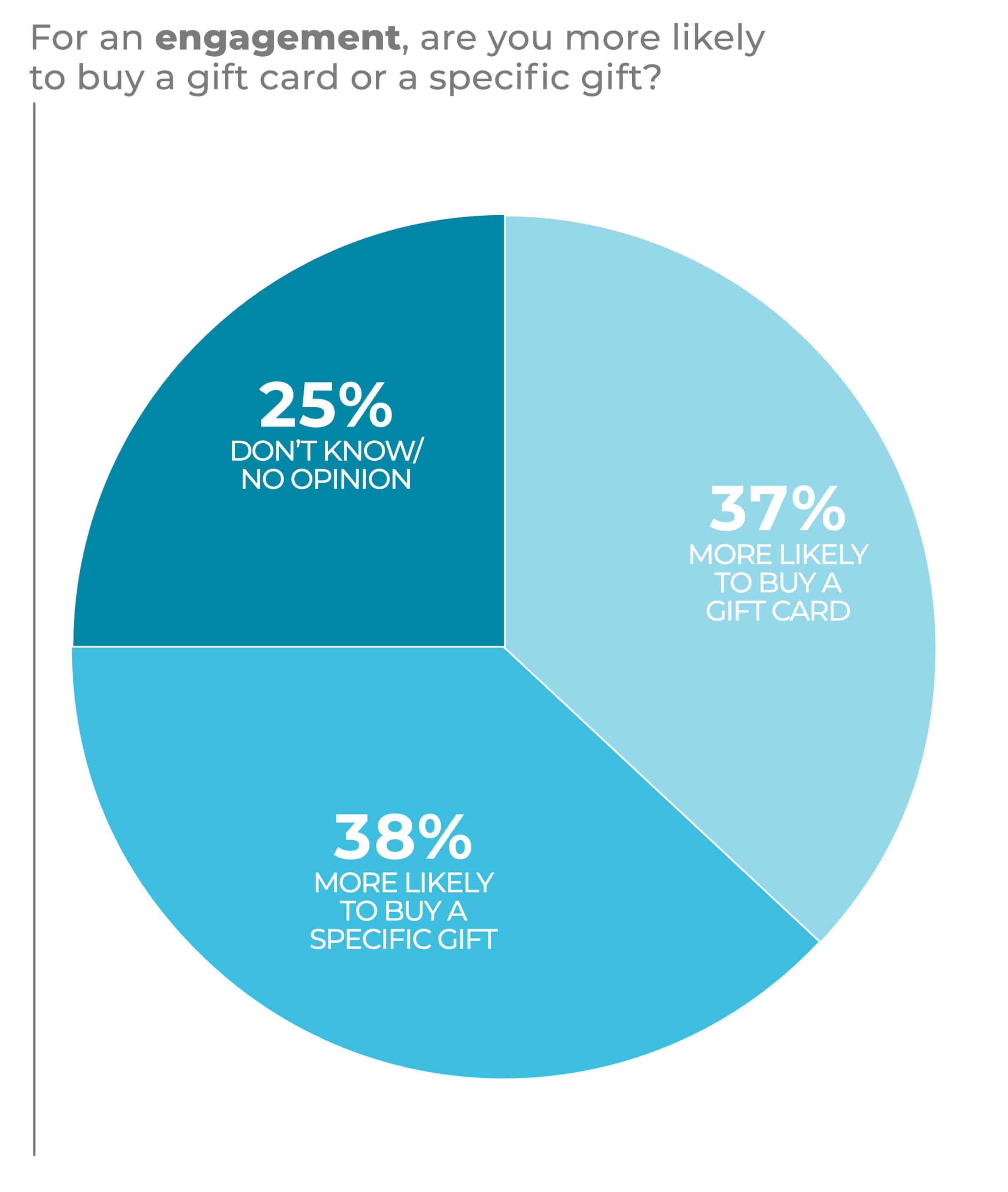

At the same time, 37% of survey respondents said they were more likely to buy a gift card for engagements, while 38% were more likely to purchase a specific gift, and 25% didn’t know.

Unlike weddings, engagements don’t seem to have a season. According to The Wedding Report, pretty much all months fall in the same range, except December, the only month reaching double digits at 15.5%.

Tom Mirabile, founder of Springboard Futures and IHA consumer trend forecaster, noted that consumers are looking for reasons to plan celebrations with even more interest as the COVID-19 pandemic wanes. The gender reveal party is an example of a celebration that has emerged to become a common occasion where loved ones assemble around a couple, even as these occasions are becoming more diverse in how they are celebrated. With less worry about illness but more general concerns about the economy and politics, family and friends want to get together and are looking for occasions to do so. “The consumer feels insecure,” he said. “We’re in a volatile world right now. It’s incumbent on family to bring in fun things.”

Housewares can fit in somewhere no matter the occasion. At times, cookware can be a great gift for someone who has become more interested in home cooking. But even when it isn’t the preferred choice, personal care or home décor items might be. Mirabile said creating occasions can be a critical boost to housewares sales, even everyday ones, as a significant proportion of the population may be looking for ways to perk up their lives at any time. The influence of social media and the desire of folks to post celebrations is another factor to take into consideration as a driver of social events and gift-giving.

“We can make these occasions more special,” Derochowski said.

Joe Derochowski, home industry advisor for The NPD Group, said housewares retailers and producers have an opportunity to collaborate with consumers on occasions, including those that might not have included a designated family and friends celebration in the past, as gift-givers look for items that elevate the experience. To do so, retailers and vendors should consider how the products they offer can and can be positioned to fit events such as engagements using the various means of influencing consumer thinking these days.

“We can make these occasions more special,” Derochowski said.

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands.

Bridal Showers

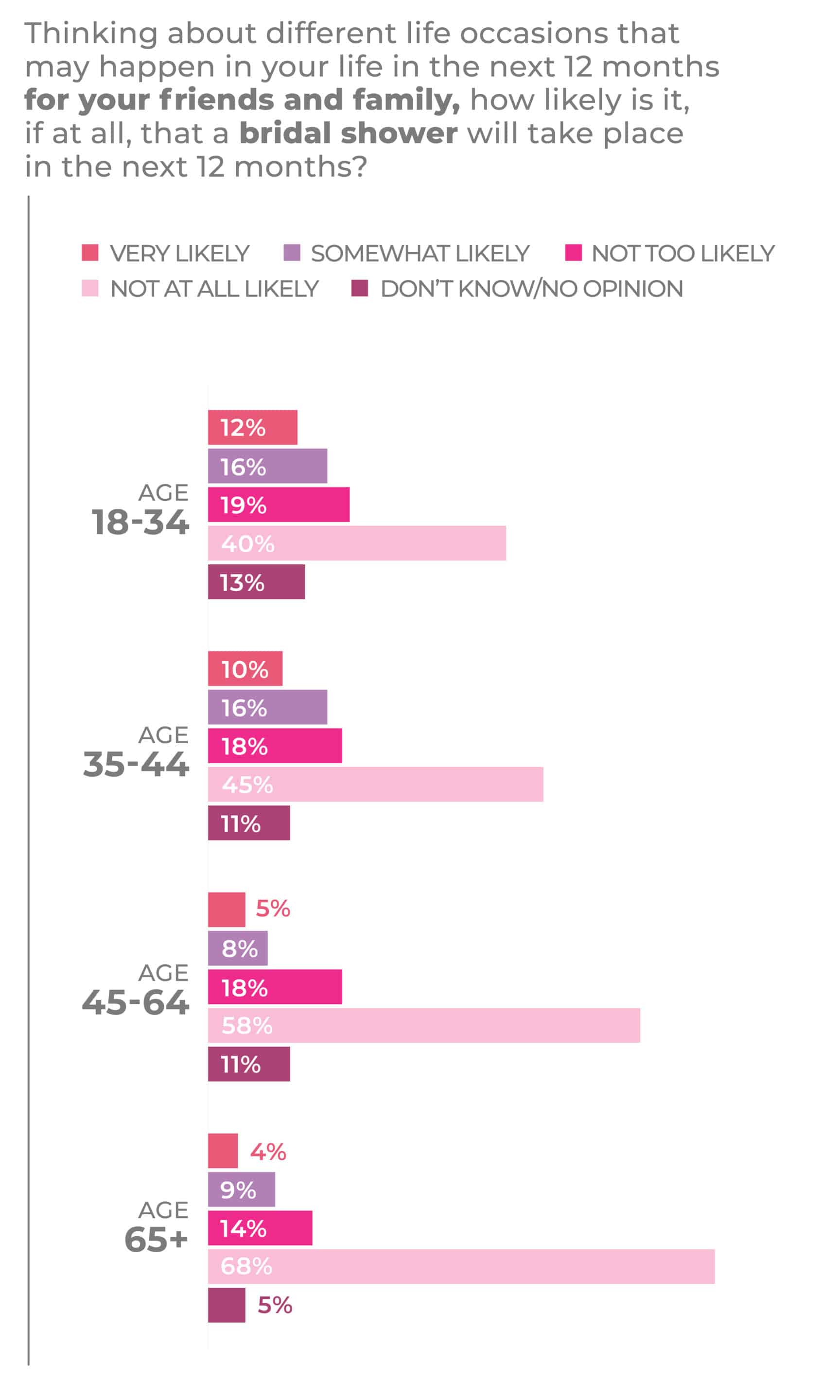

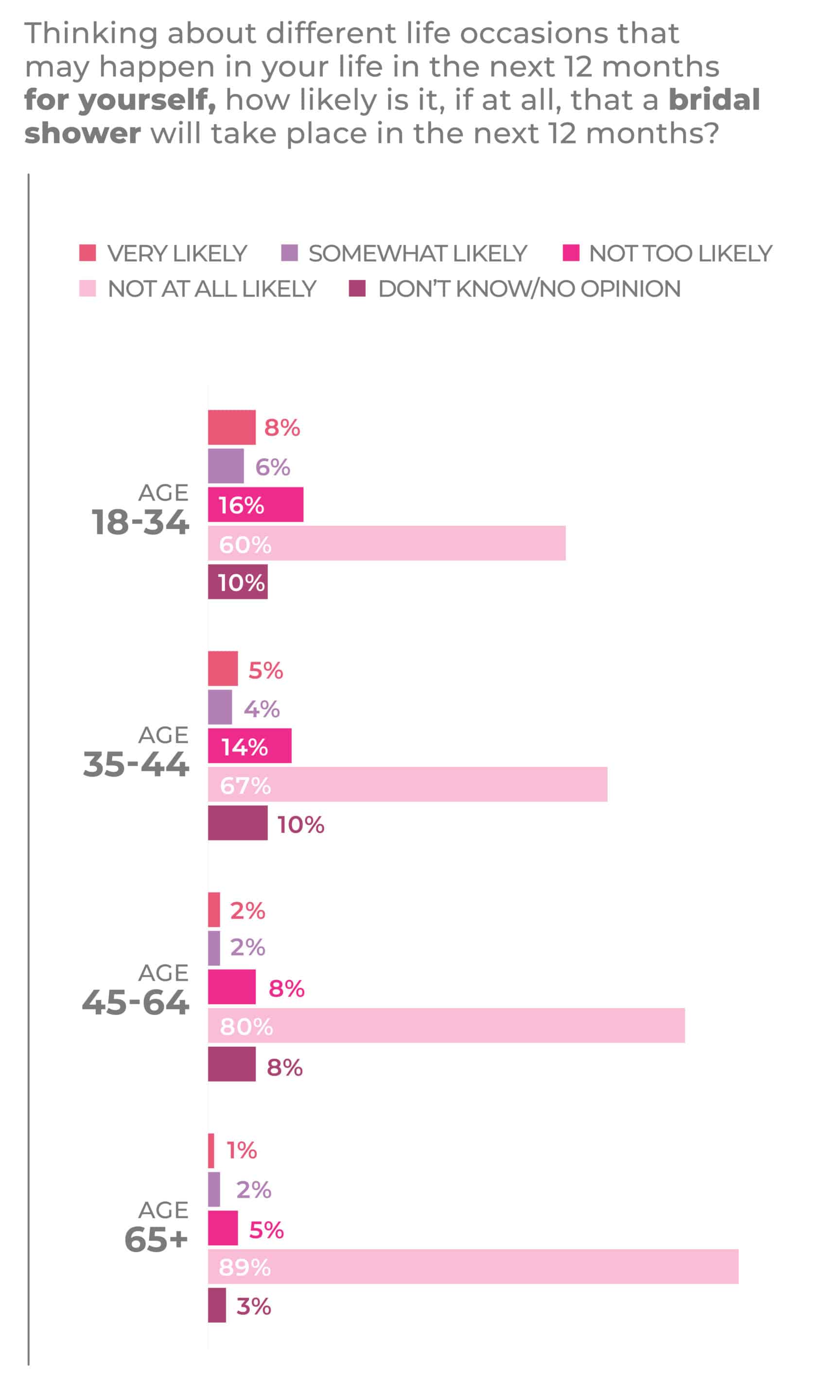

Almost 20% of the 2023 IHA Occasions Survey respondents expect to be taking some part in and around a bridal shower for family and friends, with 7% very likely and 14% somewhat likely, and 18–34-year-olds leading at 12% and 16%, respectively.

About 4% of respondents said they were very likely and 4% said they were somewhat likely to be involved with a bridal shower in their own lives. Men were ahead of women, as men registered 5% very likely and 5% somewhat likely compared to 3% and 2%, respectively, for women. Again, younger consumers lead as 8% of 18–34-year-olds said they were very likely to celebrate a bridal shower, and 6% said they were somewhat likely to do so, ahead of 35-44-year-olds at 5% and 4%, respectively.

Bridal shower expectations among family and friends come in at 62% for one such event, with 35% anticipating two to four and 4% anticipating five or more. For people just anticipating a single bridal shower occasion, respondents 65 and over lead at 74%, only a point higher than 45–64-year-olds. The 18-34 group was most likely to be involved with five or more bridal showers at 6%. Men were more likely to have one bridal shower on their calendars versus women at 63% versus 60%, respectively; and men were less likely to have two to four, at 31%, compared to 38% for women. Men were a bit more likely to have five or more such occasions, at 6% versus 2% of women.

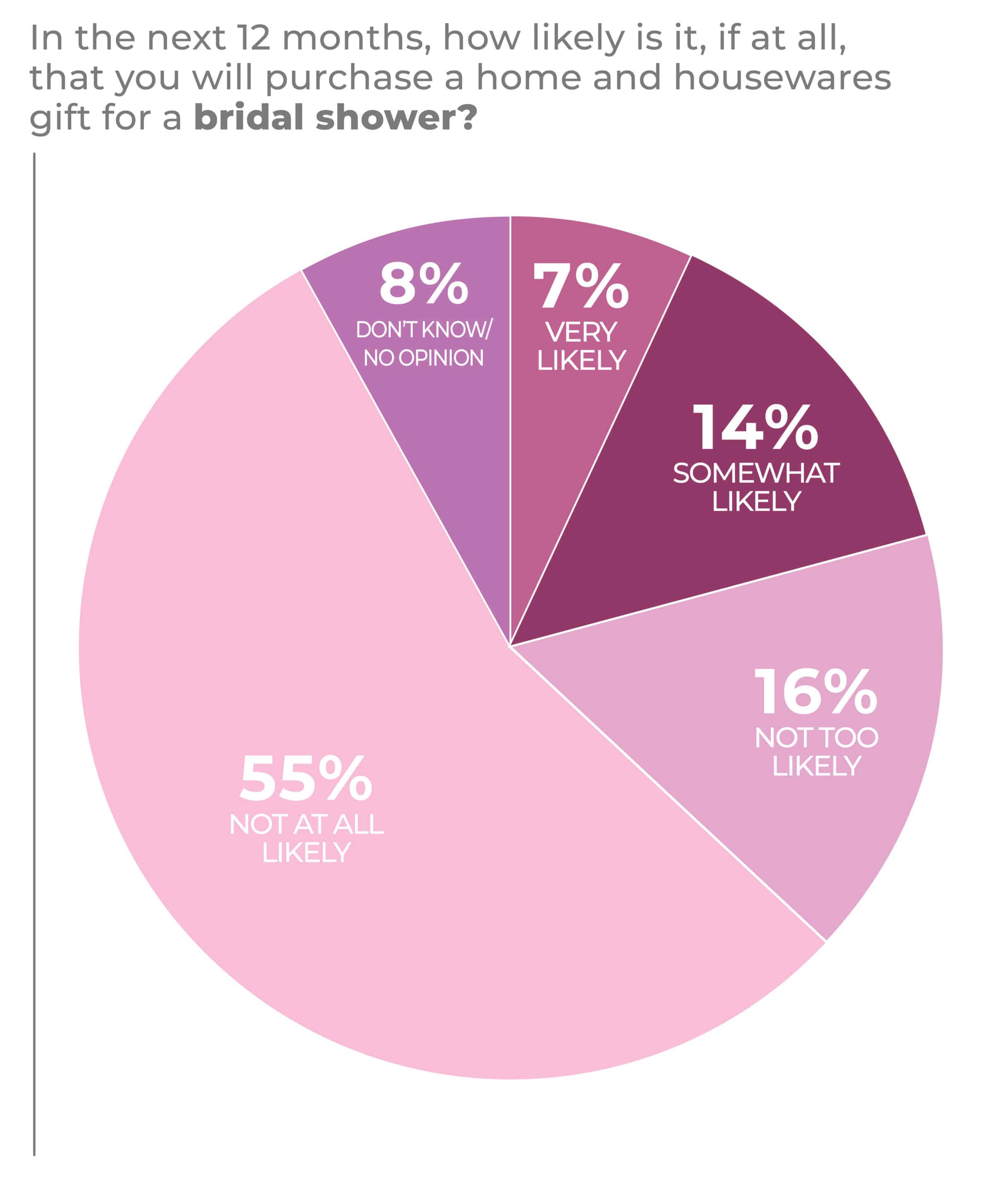

For bridal showers, 7% of respondents said they would very likely purchase a housewares gift and 14% were somewhat likely. Women and men tied on the very likely result, but men lagged on the somewhat likely response at 12% compared to 15% of women. In terms of age brackets, respondents 18-34 years old, at 11% very likely and 17% somewhat likely, led by 35–44-year-olds, at 9% and 18%, respectively, with older respondents trailing.

At 15% very likely and 15% somewhat likely, consumers with an income of more than $100,000 were ahead of the other income demographics when it comes to bridal shower anticipation, with middle-earning households at 7% very likely and 18% somewhat likely; and households earning less than $50,000 at 6% and 11%, respectively. The higher the education level, the more likely respondents were to anticipate baby shower participation.

As for potential housewares purchases, Survey respondents selected kitchen products 37% of the time, bedroom products 37% of the time, bathroom or personal care products 34% of the time, organization or home products 28% of the time and cleaning or home environment products 15% of the time. Most of the categories line up in gender terms, with significant differences only in kitchen products, with men at 32% compared to women at 41%, and cleaning or home environment, with men at 19% and women at 13%. Year over year, kitchen products dropped seven points, while bedroom products gained two points; bathroom or personal care was flat; organization or home décor products gained a point; and cleaning or home environment lost two points.

Older consumers were most likely to purchase kitchen products for bridal showers, with those 45-64 and 65-plus both at 41% and interest in the category declining among younger consumers. Consumers with household incomes less than $50,000, at 41%, were significantly more likely to purchase bedroom products than more affluent consumers, while those with household incomes above $100,000 were significantly more likely to select kitchen products at 46%.

Respondents 18-34 were most likely to select bathroom or personal care products at 39%, cleaning or home environment at 25% and organization or home décor products at 37%. Otherwise, consumers 35-44 led in bedroom products.

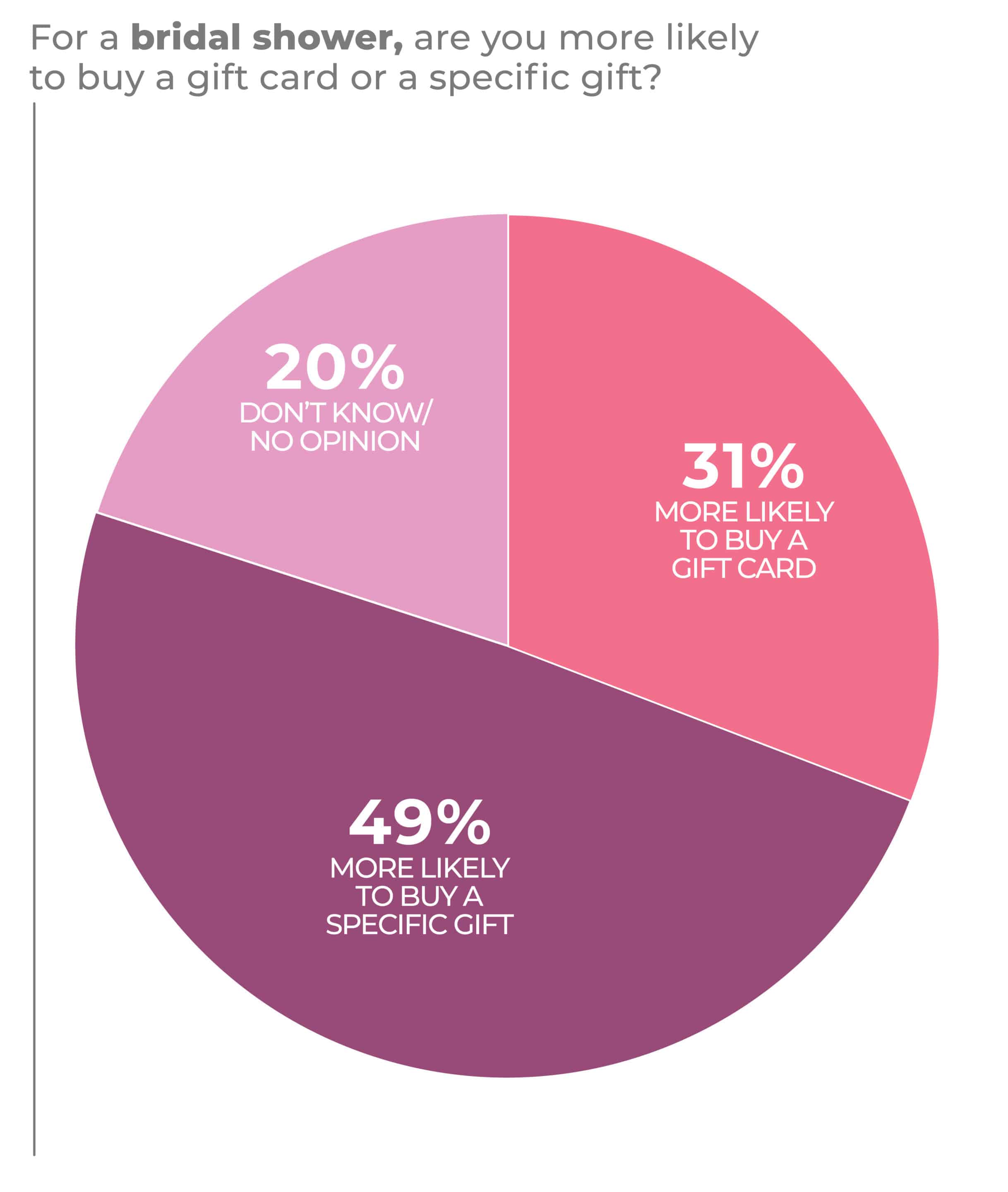

Some 31% of bridal shower-goers expressed a willingness to purchase a gift card; 49% were more likely to prefer a specific gift; and 20% weren’t sure. Men were a little more likely to give a gift card than women, but other key demographic factors including age, income and education, produce minor differences.

As COVID-19 poses less of a threat, a Priceline study is a reminder that destination bridal showers have become more popular and cost participants about $680 each, which may cut down on participants’ gift spending.

However, as with other celebrations, the place itself and the gifts involved aren’t necessarily the issues. Marsha Everton, principal, corporate director and advisor, The AIMsights Group, said how people approach occasions has changed. In the case of bridal showers, the event may mean more than the gifts, particularly to older and more educated people getting married, their families and their friends.

“There are so many choices and influences that allow each person to more clearly define their personal identity through what they own and use and gift to others. It’s an Instagram world. And TikTok, too!” Everton said.

“Even the nature of the occasion and the gifting portion of it are really different. At a bridal shower, 99% of the time those gifts are opened on-site in front of everybody, and there is ‘oohing’ and ‘ahhing’ over what was received. At the wedding, the presents are left on a table and opened by the couple after the fact. It doesn’t have the same kind of emotional resonance and sense of ‘this is from me to you.’ With the bridal shower, it is incredibly important that something about that item connects me and that person in some way.”

— Leana Salamah, VP Marketing, IHA

Leana Salamah, vice president, marketing, IHA, said the bridal shower occasion is about solidarity and familiarity as well as identity, making gifts a centerpiece of a critical personal event. The particulars have a dynamic that makes gifts even more immediately important than is the case with weddings.

“Even the nature of the occasion and the nature of the gathering and the gifting portion of it is really different,” Salamah said. “At a bridal shower, 99% of the time, those gifts are opened on-site in front of everybody, and there is ‘oohing’ and ‘ahhing’ over what was received. At the wedding, the presents are left on the table and opened by the couple after the fact. It doesn’t have the same kind of emotional resonance and sense of ‘this is from me to you.’ With the bridal shower, it is incredibly important that something about that item connects me and that person in some way.”

Given the emotional element, an opportunity for the bridal shower occasion may be, on one hand, a broader range of products considered, at least in terms of color and size, or, on the other, customization and personalization, any of which demonstrates an awareness of the bride’s tastes and personal preferences.

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands.

Weddings

The COVID-19 pandemic put a damper on wedding plans, but people are making up for it with significantly more marriage celebrations planned for the year ahead, all presenting opportunities to enhance the occasion.

After 2.1 million marriages in 2019, nuptials tailed off in the pandemic-impacted year of 2020 to 1.3 million, according to The Wedding Report, which conducts consumer research about the occasion. The projection from The Wedding Report for 2022 demonstrates a major rebound in marriages, up to 2.5 million plus, and more than 2.2 million in 2023.

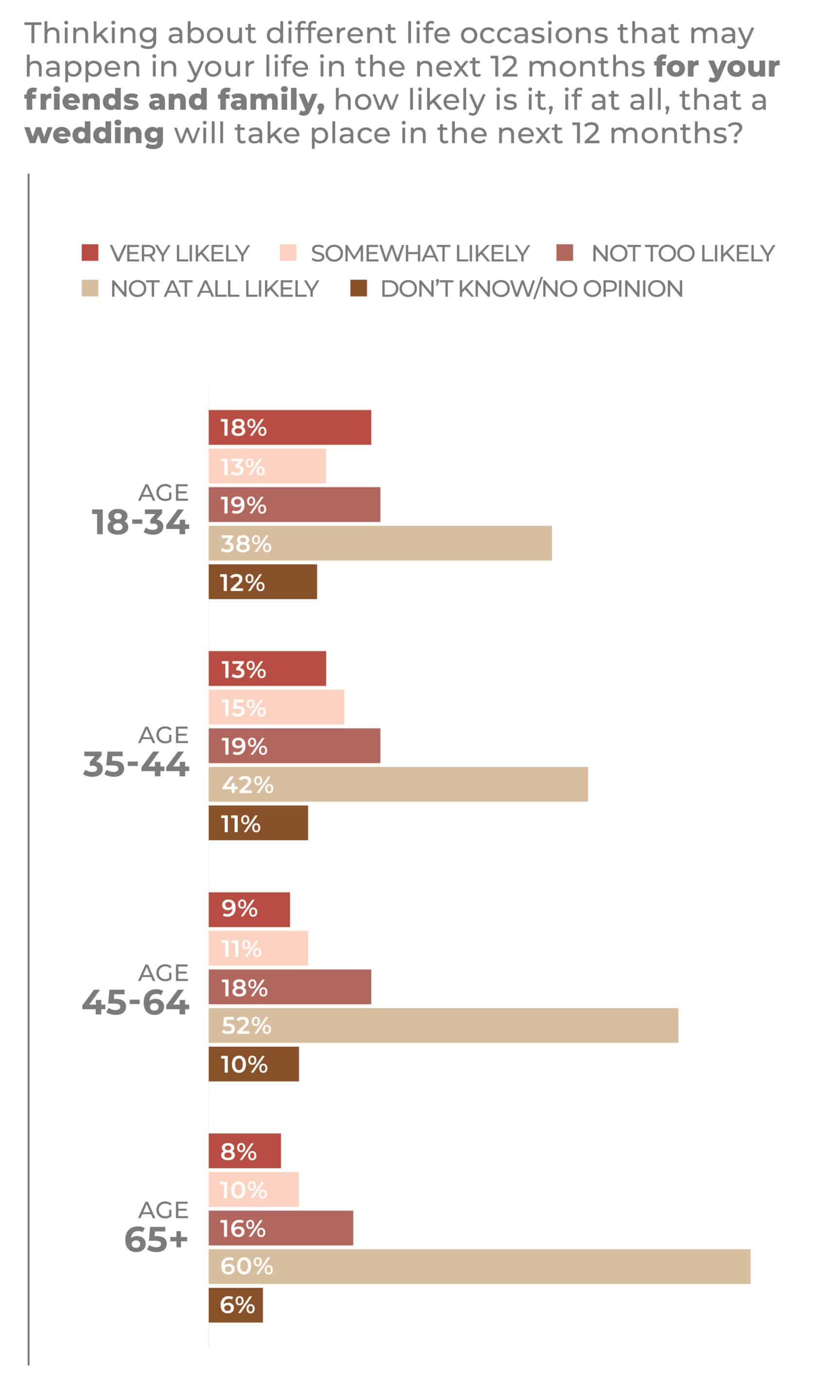

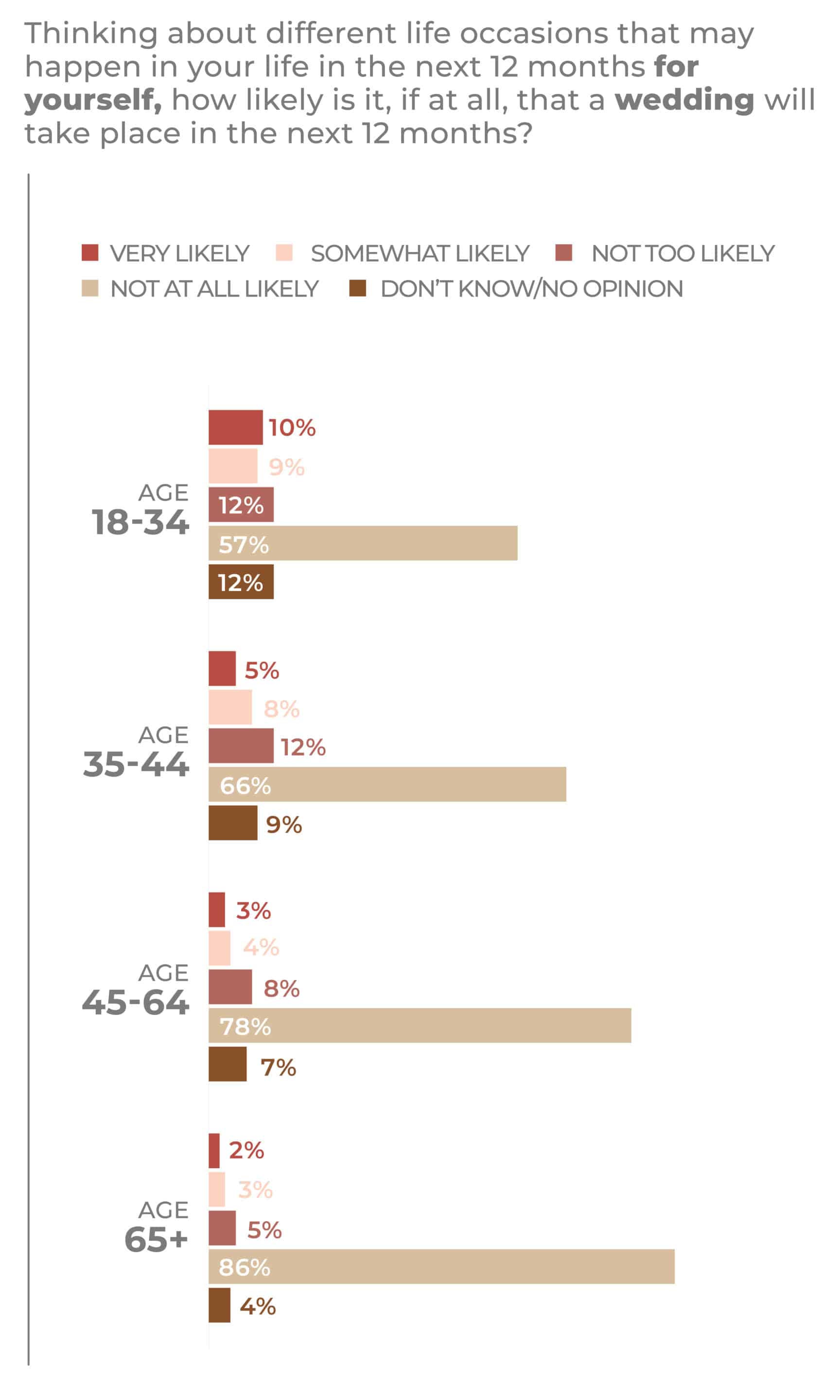

Almost a quarter of respondents in the 2023 IHA Occasions Survey said they were very or somewhat likely to have a wedding among family and friends in some capacity. Young adults from 18-34 were at the top when it came to the very likely response, six points above the 12% general reading for all ages. Of respondents commenting on what may happen in their own lives, 5% said they were very likely and 6% said they were somewhat likely to be involved in nuptials. Men were more likely to commit to the answer than women, with 6% of men very likely and 8% somewhat likely to get married in the upcoming months versus 4% and 4%, respectively, for women; while 18-34-year-olds led age brackets at 10% very likely and 9% somewhat likely to wed.

When it comes to family and friends, 62% of survey respondents said they expected to be involved with one wedding over the next 12 months, while 34% said two to four and 3% said five or more. On the demographic front, 18-34-year-olds were most likely to attend five-plus weddings, with 7% saying that’s what they believed would very likely be their fate, while tops for just a single wedding were respondents 65 and older at 81%. Men were more likely to attend a single wedding at 65% versus 59% for women, with women more likely to attend two to four such occasions at 37% compared to 31% for men; and the five-plus weddings line basically even.

“A challenge for housewares sellers in the wedding occasion is that more people are getting married older and more established couples may not need basic household items. Such couples are leaning toward ‘experiential, non-traditional’ gifts, even on wedding registries. In some cases, they’re looking for aspirational gifts as well, which registries often make easier to provide given they allow guests to chip in on expensive items the couple wants.”

— Mark Neckes, Former Chairman of Marketing, Johnson and Wales University

The most affluent consumers designated in the study, those earning $100,000 or more, were most likely to be involved in a friend and/or family wedding event, at 20% very likely and 12% somewhat likely. Households earning between $50,000 and $100,000 were fairly close behind at 11% and households making less than $50,000 trailed at 8%. When it comes to weddings in their own lives, the most affluent households were ahead at 9% very likely and 6% somewhat likely, followed closely by households earning $50,000 to $100,000 but with a drop-off at the under $50,000 designation to 5% and 3%, respectively. Respondents from households making more than $100,000 were considerably more likely to purchase a housewares gift for a wedding occasion at 20%, versus those making between $100,000 and $50,000 at 14%, and those making less than 50,000 at 8%.

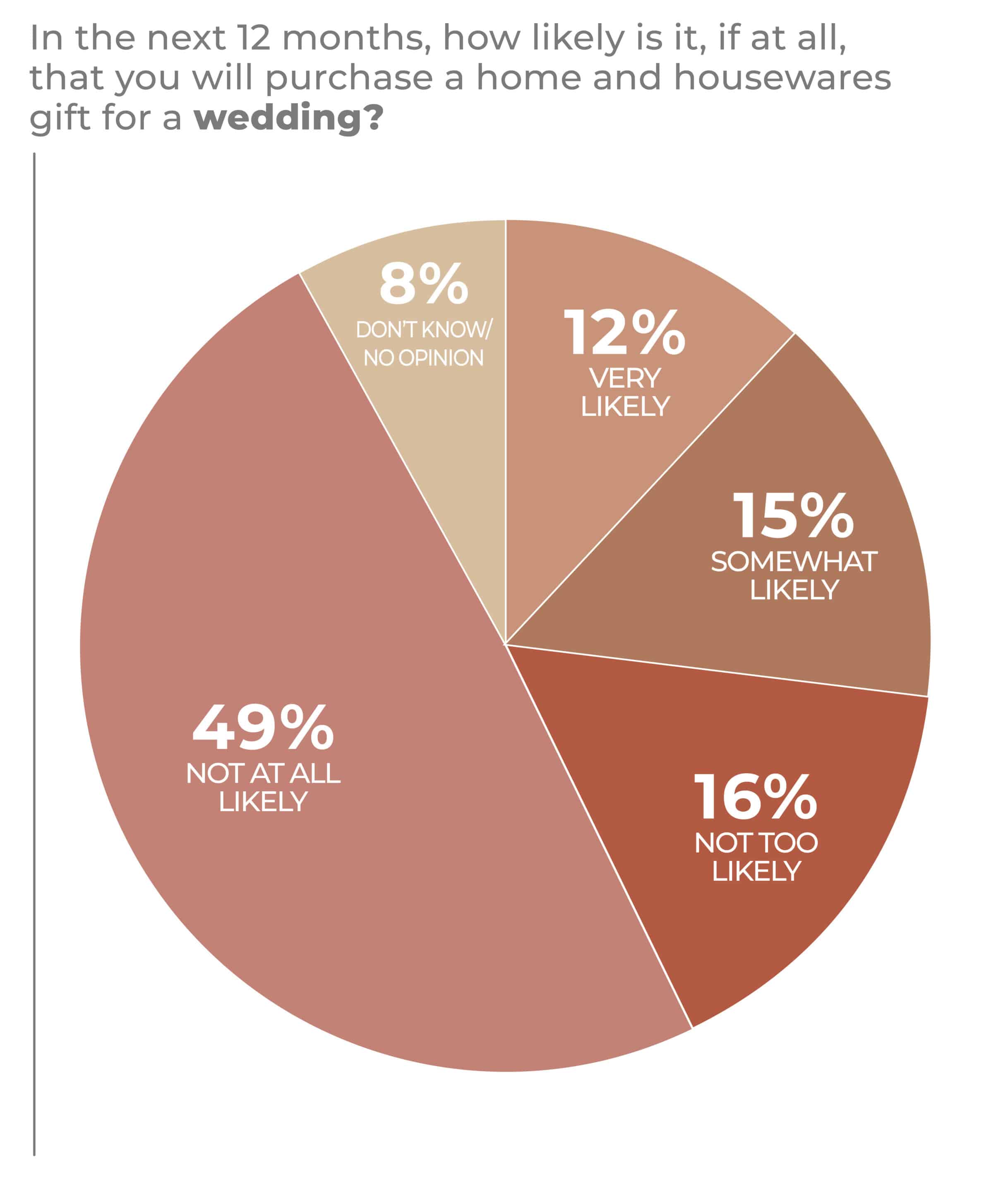

When considering a wedding gift, 12% of respondents said they were very likely and 15% said they were somewhat likely to choose a housewares gift, with men and women basically saying the same. Younger consumers 18-34 were most intent on choosing a housewares gift with 18% very likely and 18% somewhat likely to do so, while 35-44-year-olds came in at 12% and 21%, respectively.

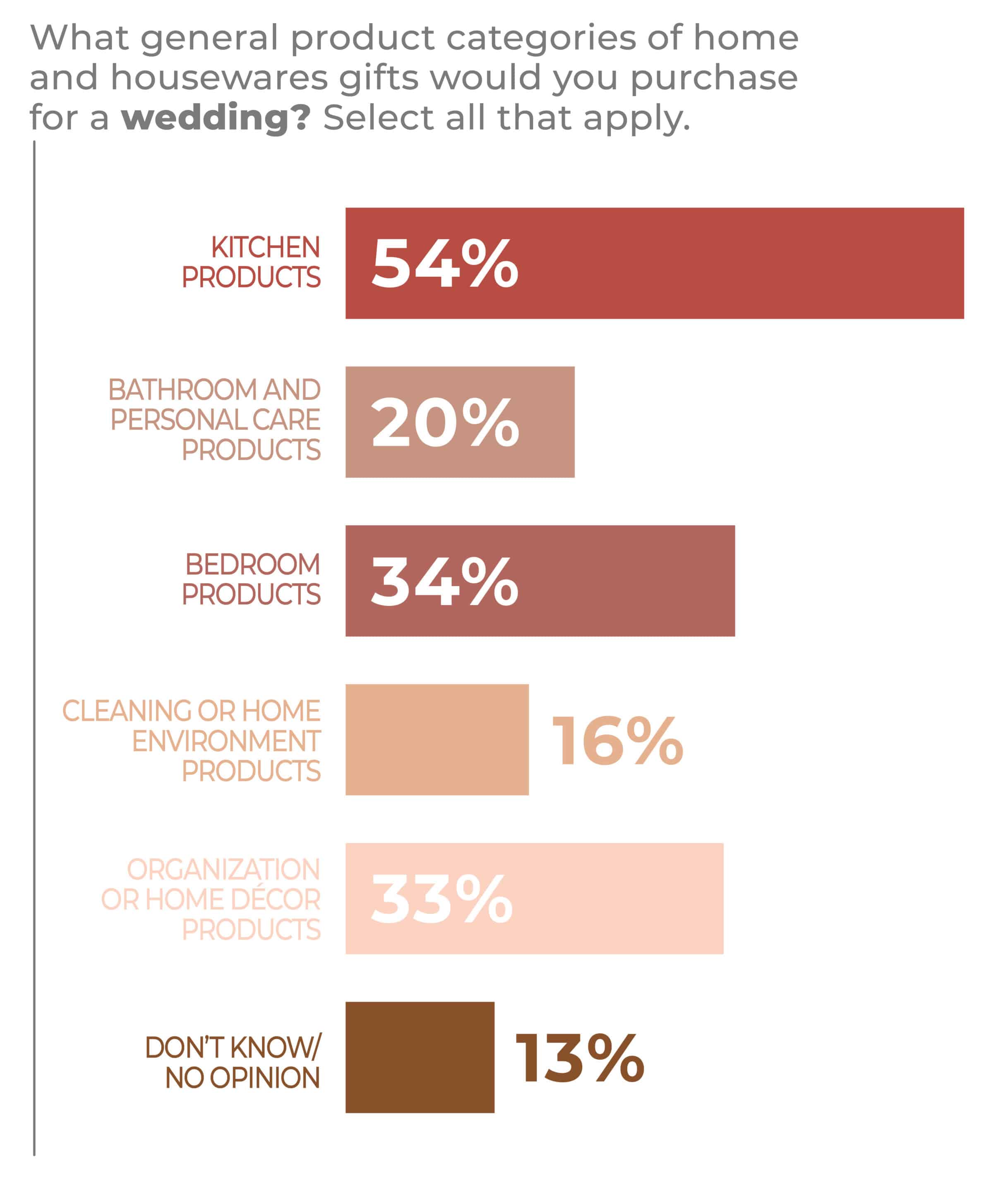

In terms of overall purchase intent for a family or friend wedding among adults year over year, the numbers were little changed except in the bathroom or personal care products segment, as that category slipped four points from the 2022 Survey results to 20% in 2023.

Otherwise, in the 2023 survey, 34% of respondents overall selected bedroom products, 16% selected cleaning or home environment products and 33% selected organization or home décor products.

When it comes to kitchen products, 54% found favor with the category. Women were more likely to purchase kitchen products among housewares categories as wedding gifts compared to men, at 59% versus 48% respectively; and organization or home décor products at 40% versus men at 26%. Men were more likely to purchase a bathroom or personal care product at 22% compared to 19% of women. Also, men, at 20%, were more likely to select cleaning or home environment products compared to women, at 12%, as well as bedroom products, at 39%, versus women, at 29%.

Households earning more than $100,000 stood out as considerably more likely, at 24%, to purchase cleaning or home environment products, while households making less than $50,000 and between $50,000 and 100,000 were much more likely to purchase organization and décor products, at 35% and 34%, respectively.

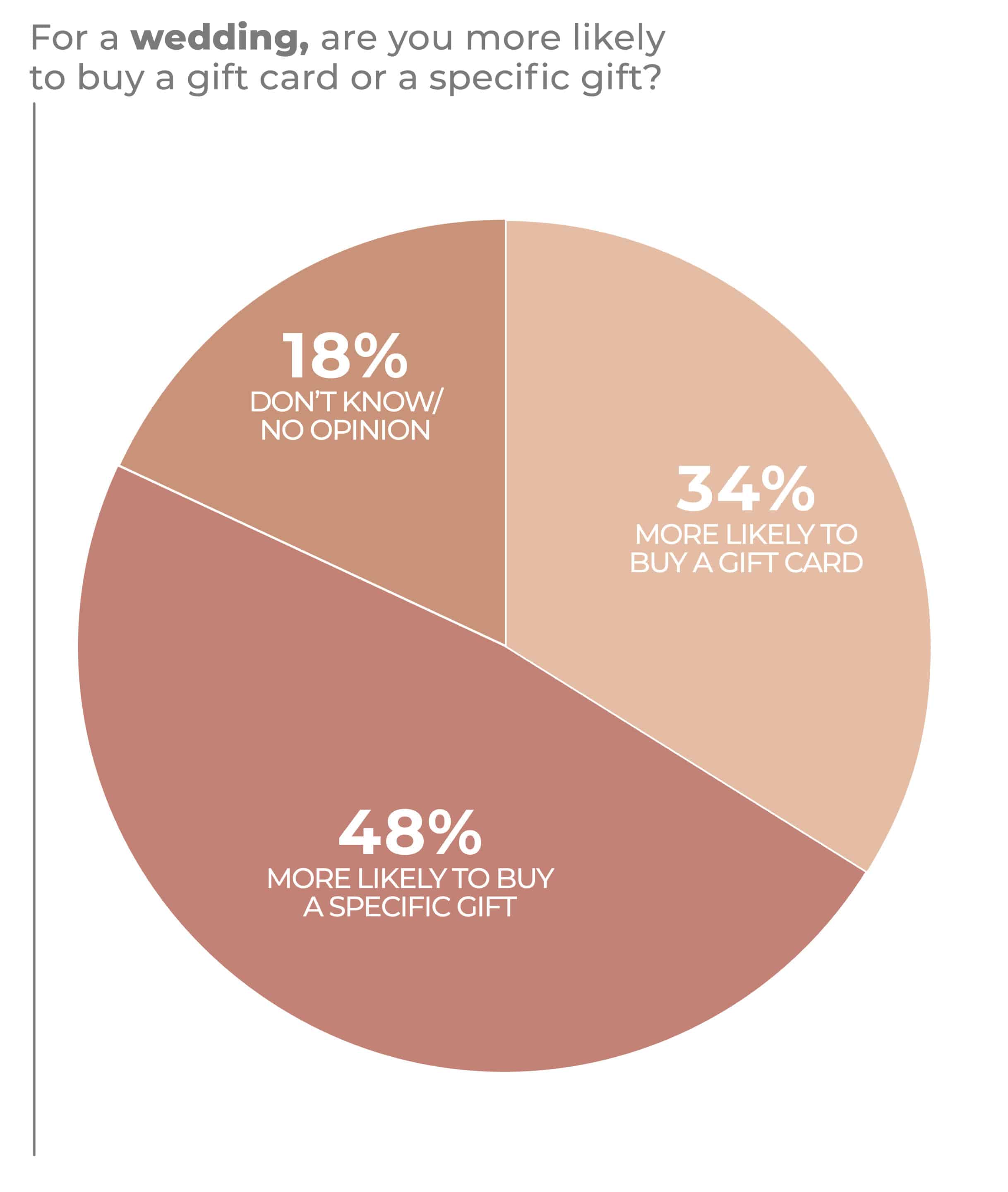

For the wedding occasion, 34% of respondents stated they would more likely consider giving a gift card, while 48% said they would more likely consider giving a specific gift. Some 19% were unsure, with women and older consumers more inclined to give a card.

According to The Wedding Report, about 56% of weddings in 2021 occurred from May to September. But, don’t count out October, the single most popular wedding month of the year, when 14.9% of nuptials occur. The average number of guests at a 2021 wedding was 124. Gifts for wedding attendants were at an average spend of $100, although that was a bit lower than the average in years past and the expected average in the next few projected years. The median spend was $39. The average spent on gifts from parents was $184 and the median was $82.

A challenge for housewares sellers in the wedding occasion is that more people are getting married older and more established couples may not need basic household items, said Mark Neckes, a consultant, past chairman of the marketing department of Johnson and Wales University, and a former department store buyer. Neckes said such couples are leaning toward “experiential, non-traditional” gifts, even on wedding registries. In some cases, they’re looking for aspirational gifts as well, which registries often make easier to provide given they allow guests to chip in on expensive items the couple wants.

Leana Salamah, vice president, marketing, at the International Housewares Association, pointed out that the recent peak in weddings that followed the 2020 downturn that occurred in the COVID-19 pandemic will take time to level out again. Moreover, the sequence of occasions that a couple’s decision to marry touches off will have a significant effect on the marketplace and for some time as well. The opportunity for the housewares sector is greater than even the one a wedding occasion might suggest.

Salamah added couples are getting creative in their weddings as they want the occasion to be an extension of their personalities and lifestyles and that can be an opportunity for housewares retailers and vendors that may not be in the traditional gift categories. For example: sous vide gadgets for foodie couples and personal care items for wellness-oriented couples. If the engaged couples have definite ideas about their lifestyles, the gifts they want and often register for might not fit the traditional “household staples” mold.

Marsha Everton, principal, corporate director and advisor, The AIMsights Group, said gift-givers today are responding to how the receivers define their identities. Gift-givers also want to express their own identities in the gift-giving occasion.

So, it might be advisable to look at home couples orchestrate wedding occasions to see where the non-traditional opportunities are. Keep in mind that the same non-traditional opportunities exist from engagement through baby shower, as many gift-givers in each case are likely to make selections and host events that demonstrate their bond and familiarity with the couple. “The opportunity is broader than one wrapped gift,” Salamah said.

Marsha Everton, principal, corporate director and advisor, The AIMsights Group, said gift-givers today are responding to how the receivers define their identities. Gift-givers also want to express their own identities in the gift-giving occasion.

In effect, a wedding no longer is just about setting a couple up in their new household. It is a bit more like outfitting a couple to live their lifestyles in an essential way.

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands.

Home Ownership

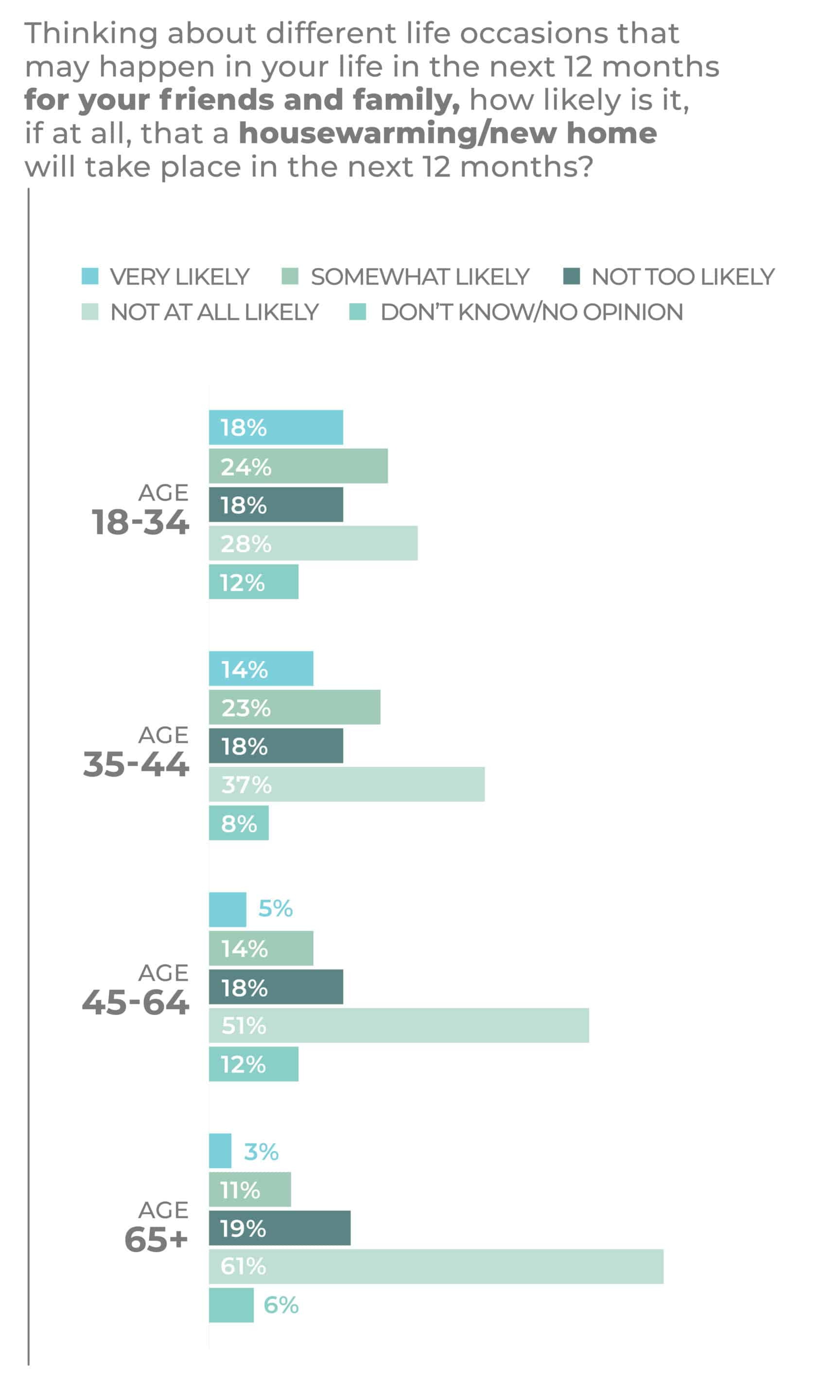

About 10% of consumer respondents to the 2023 IHA Occasions Survey expect someone to move into a new home among their families and friends, and 18% say it’s somewhat likely. The numbers are higher for 18–34-year-olds, at 18% very likely and 24% somewhat likely, as well as 35-44-year-olds, at 14% and 23%, respectively. Meanwhile, of 45-64-year-olds, 5% are very likely and 14% are somewhat likely to see new home ownership among friends and family, with people 65 or older at 3% and 11%, respectively.

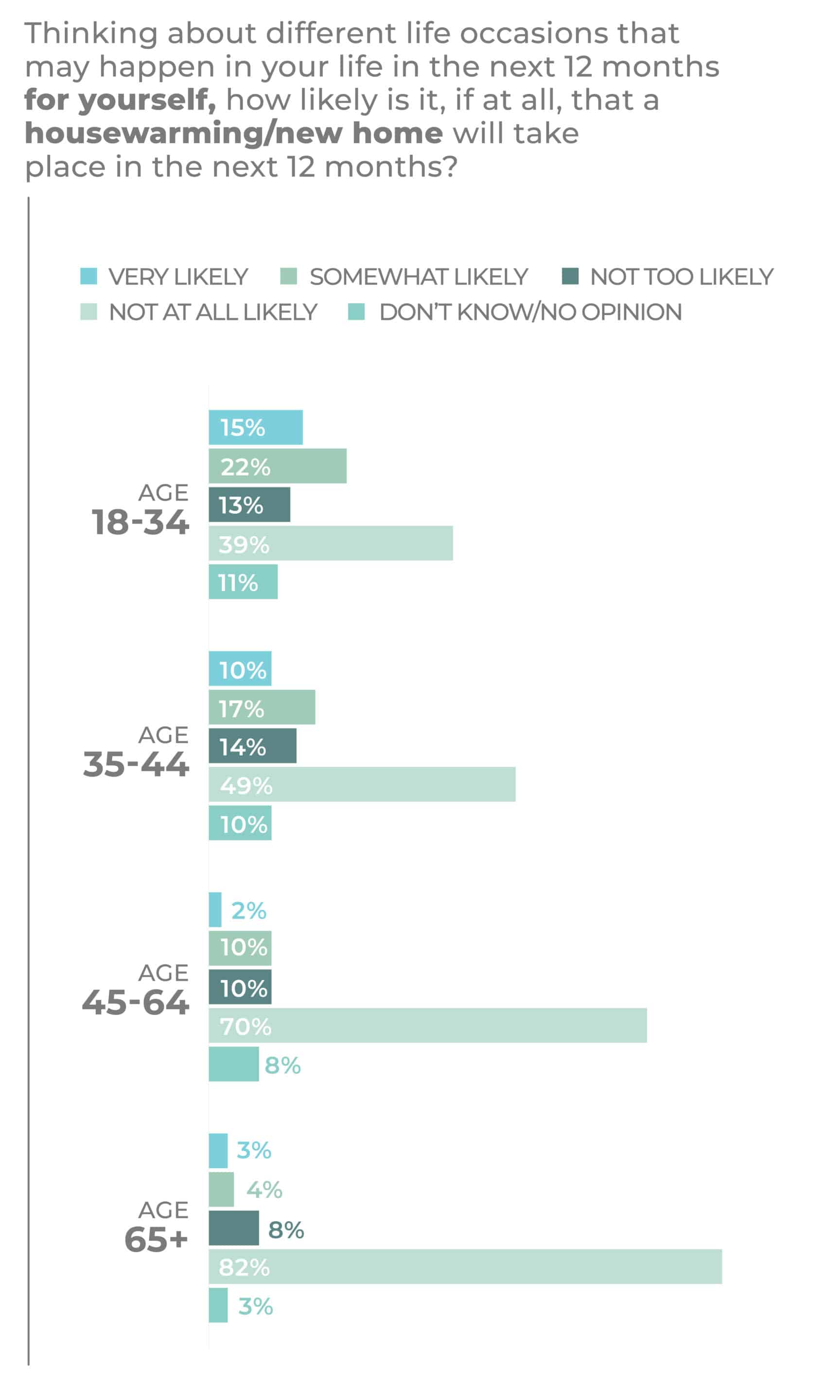

A new home, and social occasions surrounding a home purchase, were on the mind of 7% of respondents who said they were very likely and 13% who said they were somewhat likely to be involved with their own new home or housewarming event. Men came in more inclined to have such an occasion in mind, at 8% very likely and 15% somewhat likely, than women at 7% very likely and 12% somewhat likely. More than a third of 18–34-year-olds had such a consideration, leading other age echelons, with 15% saying they were very likely and 22% saying they were somewhat likely to be involved with new home ownership, with 35–44-year-olds next at 10% and 17%, respectively.

As for family and friends housewarming/new home events, 68% of respondents said they were expecting to participate in one new household-related occasion, while 28% said they expected to be involved in two to four and 4% said they expected to attend 5 or more. Men were 67% for one, 26% for two to four and 7% for five or more; while women were 69%, 30% and 1%, respectively. Respondents 65 or older were most likely to have only one new home occasion, at 77%, two points higher than 45–64-year-olds.

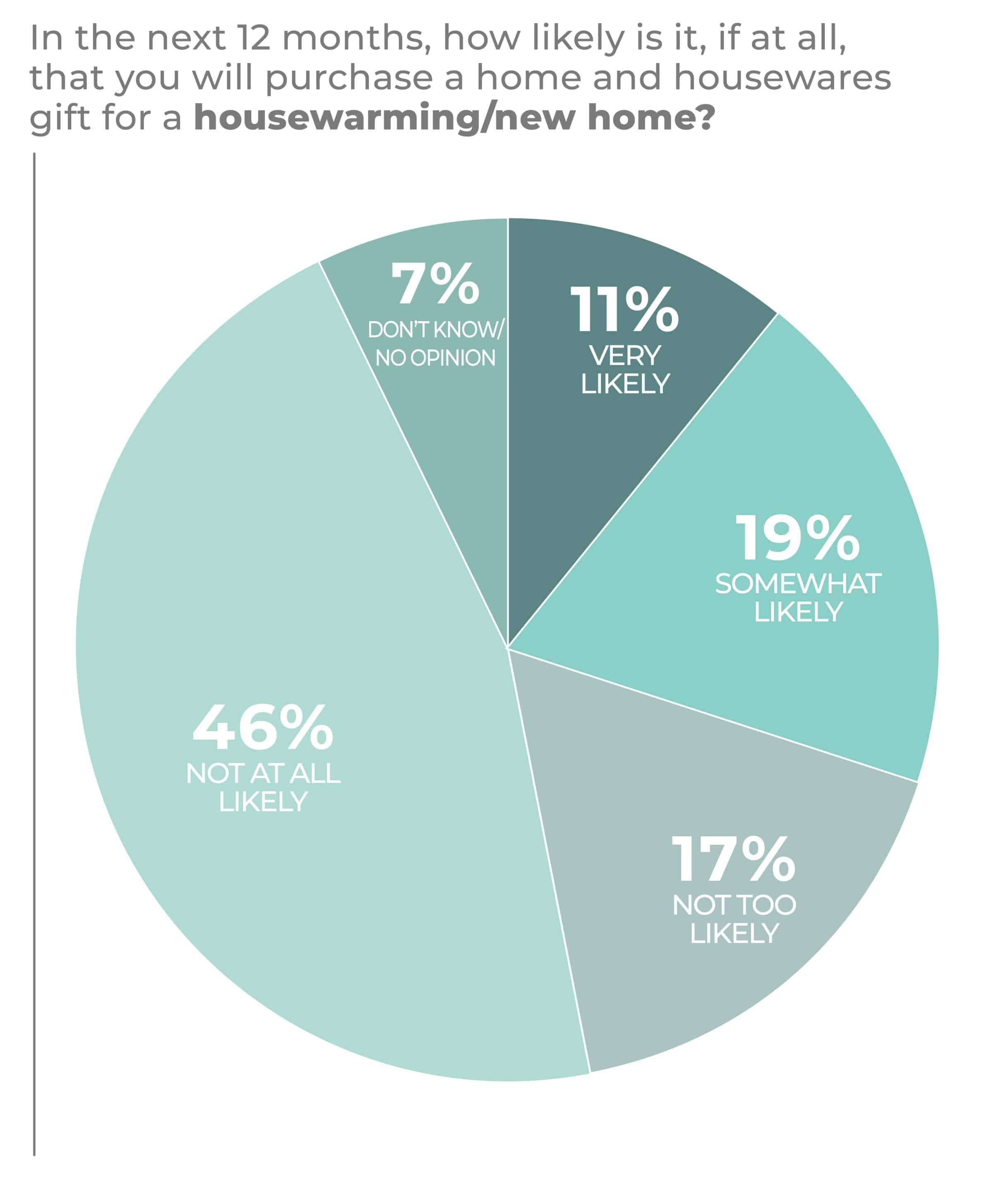

Regarding the housewarming occasion, 11% of survey respondents said they were very likely and 19% said they were somewhat likely to purchase a housewares gift. Men and women were closely aligned in their choice to purchase housewares. The younger age brackets, 18-34, at 20% very likely and 23% somewhat likely, and 35-44, at 12% very likely and 25% somewhat likely led respondents; while the 45-64, at 6% and 16%, and 65-plus, at 4% and 13%, age brackets trailed.

Education doesn’t change the housewares purchase likelihood much, but respondents from households with incomes of more than $100,000 were, at 15% very likely and 21% somewhat likely to purchase housewares gifts, ahead of middle earners, at 12% and 24%, respectively, and those bringing in less than $50,000, at 9% and 16%, respectively.

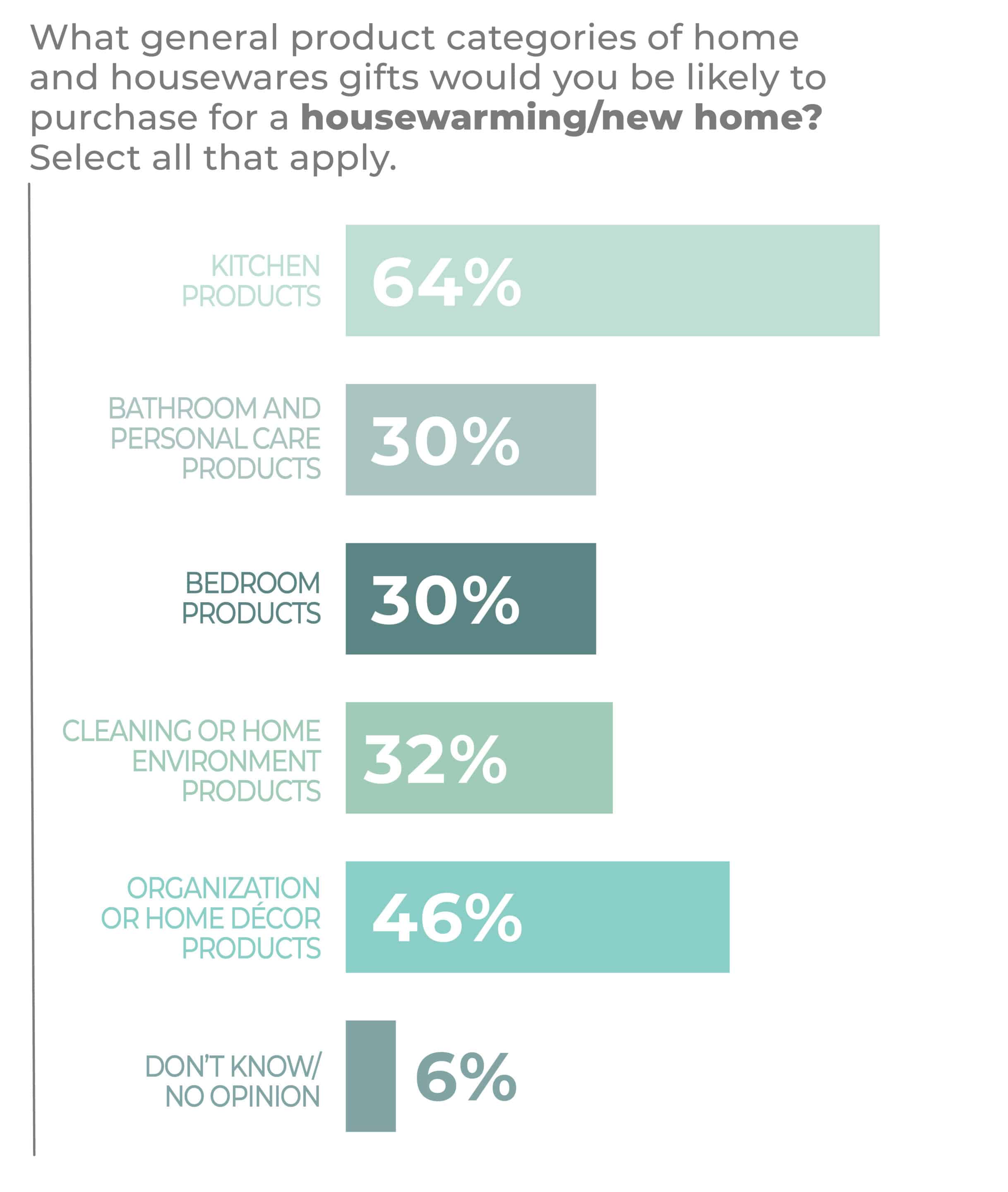

Kitchenware, at 64%, and organization or home décor products, at 46%, were by far the most popular new home gifting categories, followed by cleaning or home environment, at 32%, and bathroom or personal care and bedroom products, tied at 30%. As compared with last year’s 2022 IHA Occasions Survey, kitchenware gained eight points; organization or home décor was basically flat; cleaning or home environment gained three points; bathroom or personal care added two points; and bedroom lost two points.

Kitchenware gets strong support from the youngest two age brackets, 18-34, at 68% and 35-44, at 66%. The youngest bracket was tops in each product category, which fell away in descending order in each case except one, organization and home décor, where the descent stopped at 65+, which came in second to 18-34, at 50%.

Respondents who had less than a college education, at 66%, were several points more likely to select kitchenware than were those more schooled, and they were also more likely to choose bedroom products, at 32%. Bachelor’s degree holders were especially fond of cleaning and home décor products, at 41%. As for income, consumers from households earning less than $50,000 a year were well ahead on bedroom, at 32%, and a bit ahead on cleaning or home environment products at 35%. Middle-income respondents were ahead on organization or home décor products, at 52%.

Kitchenware gets strong support from the youngest two age brackets, 18-34, at 68%, and 35-44, at 66%. The youngest bracket was tops in each product category, which fell away in descending order in each case except one, organization or home décor, where the descent stopped at 65 plus, which came in second to 18-34, at 50%.

As for gender, relative harmony reigned except for bedroom products, favored by 36% of men versus 25% of women, and organization or home décor, favored by 52% of women but just 39% of men.

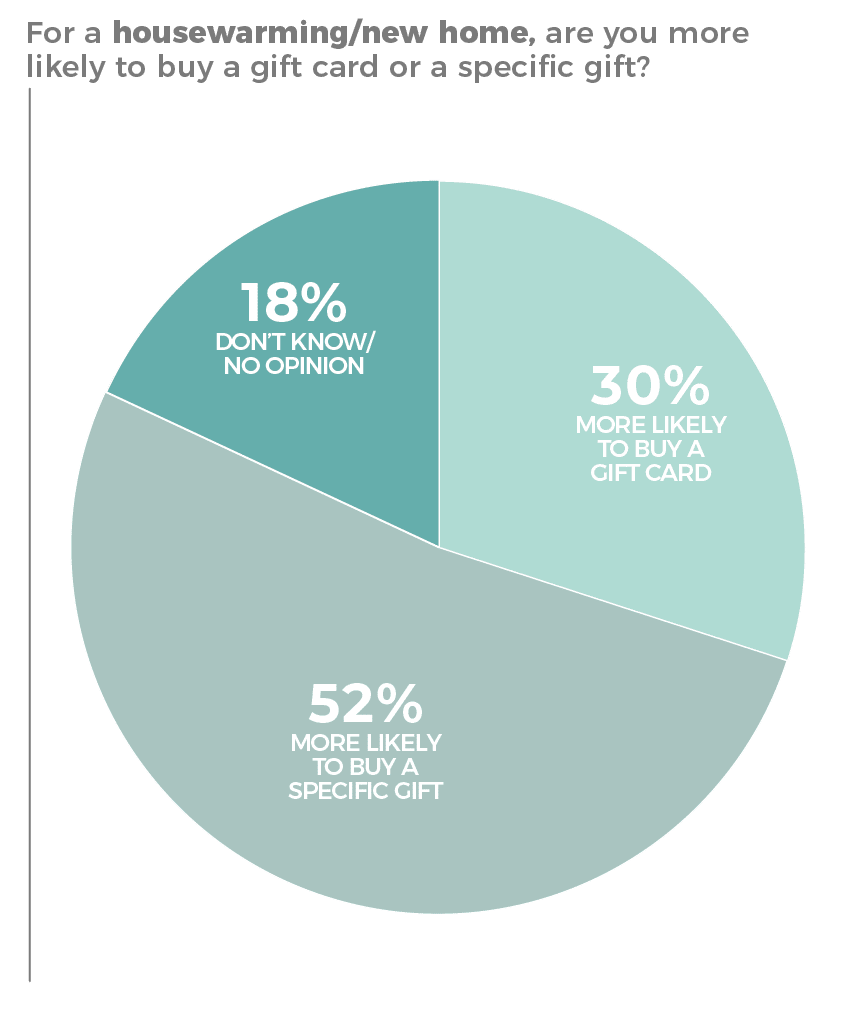

When thinking about gifts, 30% of consumers were more likely to purchase a gift card, 52% were more likely to buy a specific gift and 19% weren’t sure.

The immediate future of the housewarming/new home occasion may be pressured by rising mortgage rates as the United States Federal Reserve boosts prime lending rates to fight inflation. According to the U.S. Census Bureau, building permits for privately owned housing were at 1.5 million in August, down 10% from July and 14.4% from August 2021. Housing starts, although up from July, were down year over year. Yet during both the Great Recession and the COVID-19 pandemic, consumers invested in and upgraded their homes to make them more comfortable. As such, while the new home gifting occasion may tighten, housewares sales related to home improvement might not.

“The pandemic has had a fascinating impact, driving greater interest in products that will be used in the home,” said Marsha Everton, principal, corporate director and advisor, The AIMsights Group. “The ‘entertain and self-entertain at home’ trend has continued, especially for new parents, even after the lifting of COVID-related restrictions.”

The idea of home-centric lifestyles is important, said Leana Salamah, vice president, marketing, IHA, particularly given the change in lifestyle entering a first or new home entails, even if it means finding a way to confirm a preference for a downsized household. Beyond that, retailers and the suppliers who work with them should continue to consider and explore the possibilities that evolving lifestyles provide.

Although downsizing gets its due, products that are smaller but work as well or better than what had been in the larger domicile are a real opportunity, Salamah said. She added other opportunities are also getting more recognition, including aging in place. This can include aging in place with friends, as when people with too much space when kids move out invite friends and family to move in with them.

“Different living arrangements mean a single housewares item might not suit everyone even in the same application. Depending on the makeup of that household, you could have multiple similar, but different, products.”

— Leana Salamah, VP Marketing, IHA

Then there is moving to a new home, which continue despite the tough mortgage rates that home buyers face today, because of equity that can make the move relatively economical. Multi-generational and blended families are another consideration, and the unique needs that arise in those circumstances may drive purchasing in unexpected ways.

“Different living arrangements mean a single housewares item might not suit everyone even in the same application. Depending on the makeup of that household, you could have multiple different appliances,” Salamah said.

Single households are growing rapidly too. “In this case, you have to think about products a little bit differently,” Salamah said. “How do you market something for singles versus something for a family? If it’s waffle makers, do you need a waffle maker that makes four waffles or do you need one that just makes one at a time? A housewarming doesn’t necessarily translate into a whole family of people.”

Mark Neckes, a consultant, past chairman of the marketing department of Johnson and Wales University, and a former department store buyer, made the point that singles particularly need the support of family and friends because of rising apartment rents in coveted cities and neighborhoods. Many who seek independence may find their freedom comes with a lack of discretionary income, and so may need help buying most everything they need, so, in effect, you have the leaving for college occasion all over again.

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands.

Pet Ownership

Pets have become family to many Americans, and they are lavished as such, which means lots of celebrations and gifting.

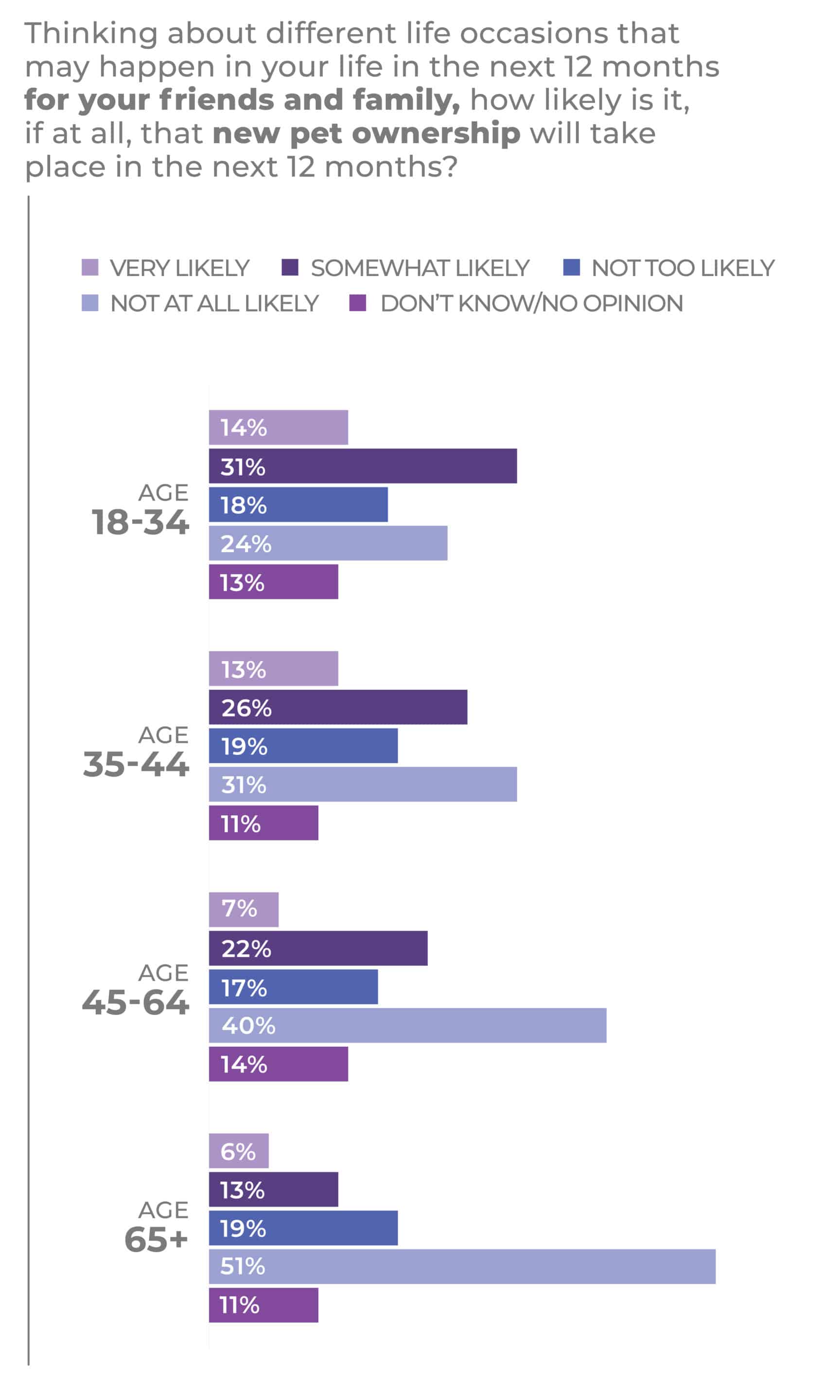

In the 2023 IHA Occasions Survey, about a third of respondents considered they would be celebrating someone’s pet acquisition, with 10% saying it was very likely and 23% saying it was somewhat likely. Younger consumers were particularly critter-centric with 14% and 31% of 18–34-year-olds and 13% and 26% of 35-44-year-olds responding that they were very likely or somewhat likely, respectively, to be celebrating someone’s new pet.

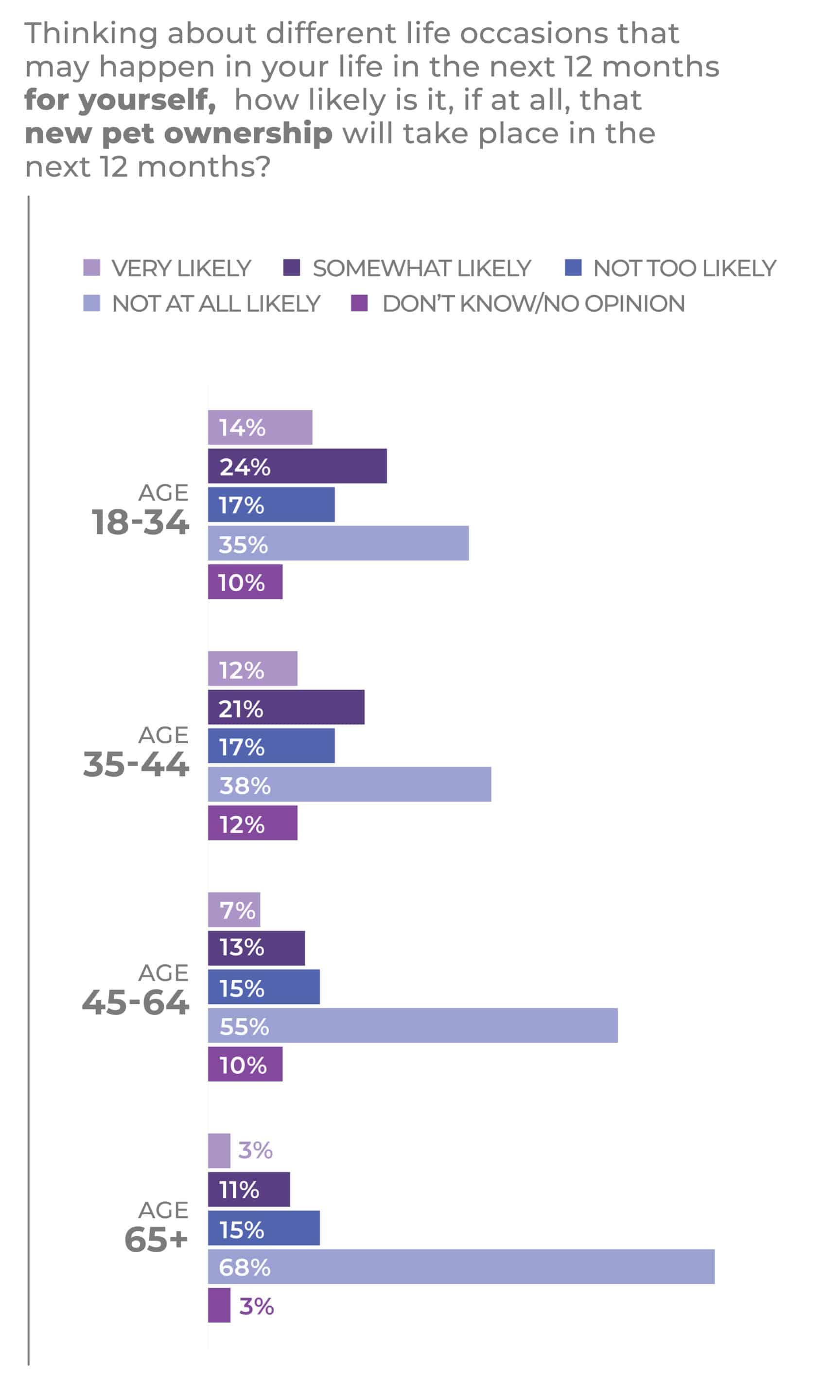

Some 9% of respondents said they were very likely to wind up with a pet, and 17% said they were somewhat likely to do so. In this case, 18–34-year-olds came in tops at 14% very likely and 24% somewhat likely to get a new pet, with 35-44-year-olds just behind at 12% very likely and 21% somewhat likely. Men are just a bit ahead of women at 9% very likely and 19% somewhat likely versus 8% and 16%, respectively.

During the next year, 64% of consumers anticipate celebrating a single new pet ownership occasion, with 31% expecting two to four such occasions and 6% anticipating five or more. Survey respondents 65 or older expected the most single pet-related events at 75%, and those 18-34 were most in anticipation of five or more events at 9%.

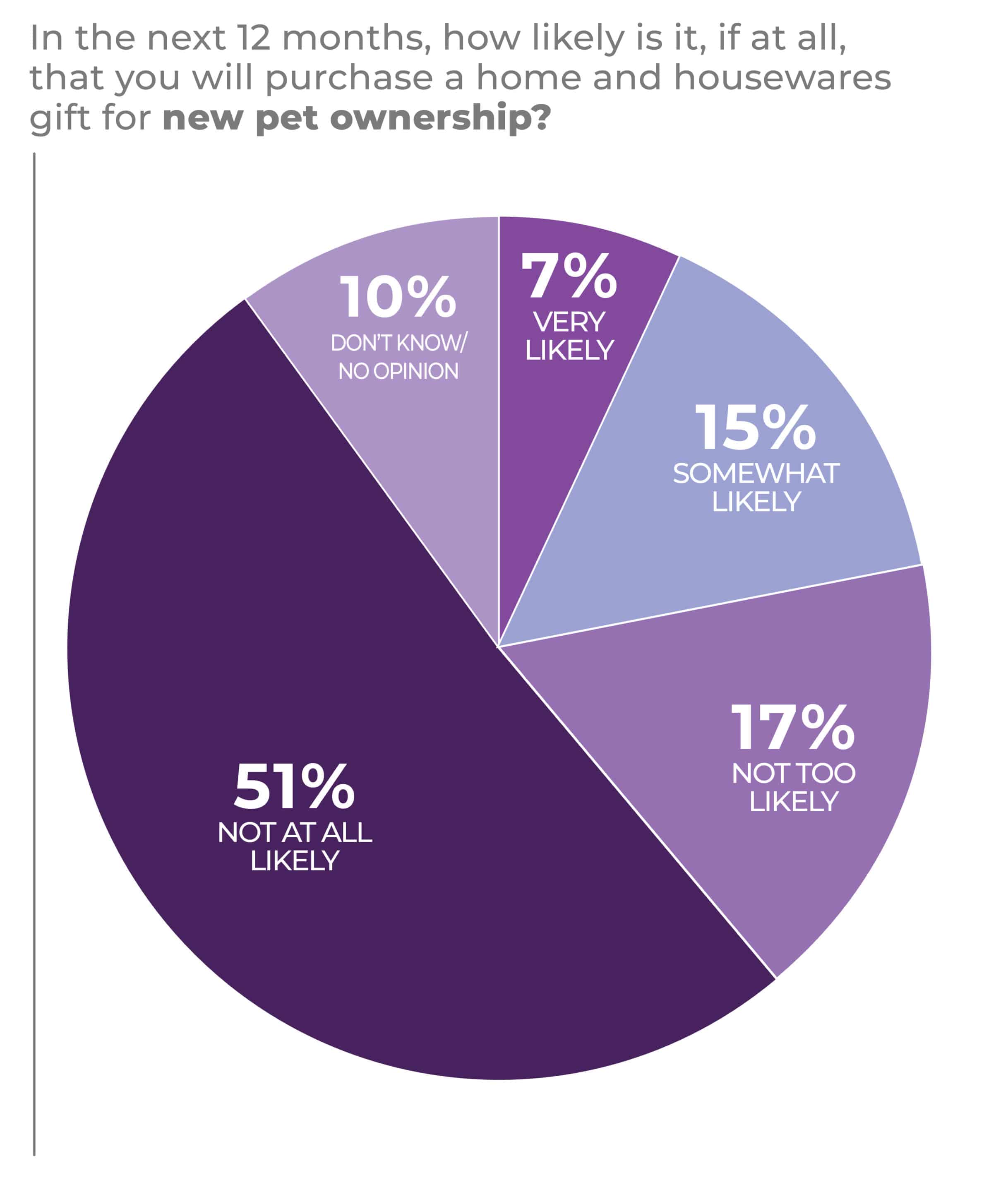

Consideration of a housewares gift for the new pet ownership occasion occurred to 7% of survey respondents as very likely and 15% as somewhat likely. The two younger groups are most likely to plan to purchase a housewares gift for a new pet occasion, at 12% very likely and 19% somewhat likely for 18-34-year-olds and 9% and 17%, respectively, for 35-44-year-olds.

As to schooling, consumers with post-graduate educations, at 7% very likely and 20% somewhat likely, are ahead of bachelor’s degree holders at 6% very likely and 14% somewhat likely, in consideration of a housewares gift purchase for a pet and in a similar ballpark with those who didn’t attend college at 8% and 14%, respectively.

Single households are growing rapidly too. “In this case, you have to think about products a little bit differently,” Leana Salamah, vice president, marketing, IHA, said. “How do you market something for singles versus something for a family? If it’s waffle makers, do you need a waffle maker that makes four waffles or do you need one that just makes one at a time? A housewarming doesn’t necessarily translate into a whole family of people.”

Mark Neckes, a consultant, past chairman of the marketing department of Johnson and Wales University, and a former department store buyer, made the point that singles particularly need the support of family and friends because of rising apartment rents in coveted cities and neighborhoods. Many who seek independence may find their freedom comes with a lack of discretionary income, and so may need help buying most everything they need, so, in effect, you have the leaving for college occasion all over again.

The more affluent consumers were most inclined to purchase a housewares gift for pet-related occasions, at 11% very likely and 18% somewhat likely. But even the lowest-income group of households earning less than $50,000 were only a few points behind at 7% very and 14% somewhat likely.

As for the likelihood of purchasing housewares products for pet occasions, the genders were about the same with men slightly ahead.

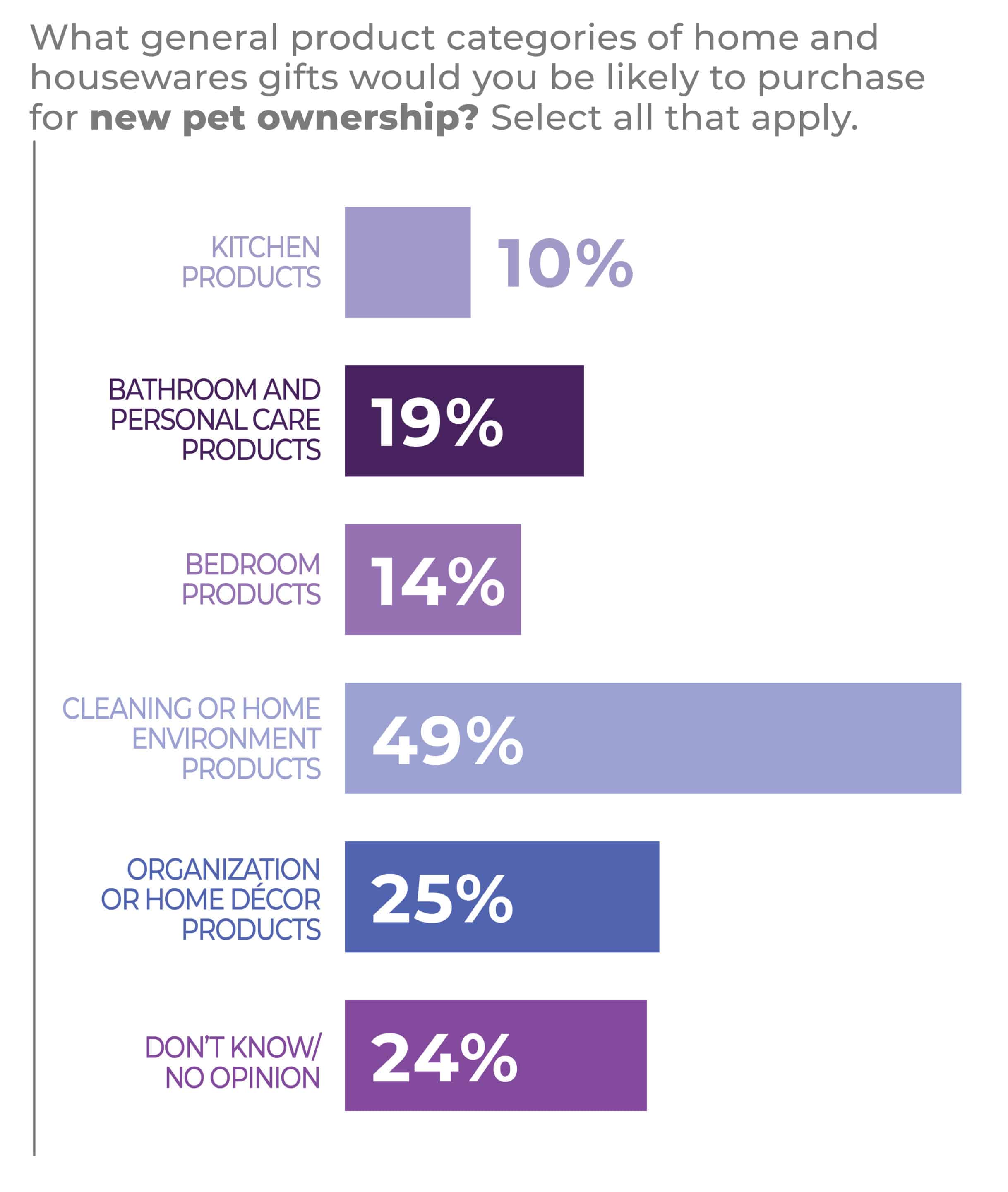

Among income brackets, middle-income households earning between $50,000 and $100,000 were most likely, at 58%, to purchase cleaning and home environment items for a new pet occasion. Higher earners were the most likely to select organization or home décor products, at 32%; bedroom products, at 22%; bathroom or personal care products, at 21%; and kitchen products at 13%.

It seems as if potential gift-givers have a real and realistic sense of what’s needed when it comes to bringing home a new pet, as 49% said they would likely consider a cleaning or home environment product, followed by 25% looking at organization or home décor products and 19% bathroom or personal care. All pets need their spaces, a place for their toys and care and grooming attention. The responses were consistent with those consumers offered a year ago, although respondents were somewhat less likely to choose kitchen and bathroom products and a bit more likely to choose cleaning products.

Among income brackets, middle-income households earning between $50,000 and $100,000 were most likely, at 58%, to purchase cleaning and home environment items for a new pet occasion. Higher earners were the most likely to select organization or home décor products, at 32%; bedroom products, at 22%; bathroom or personal care products, at 21%; and kitchen products at 13%.

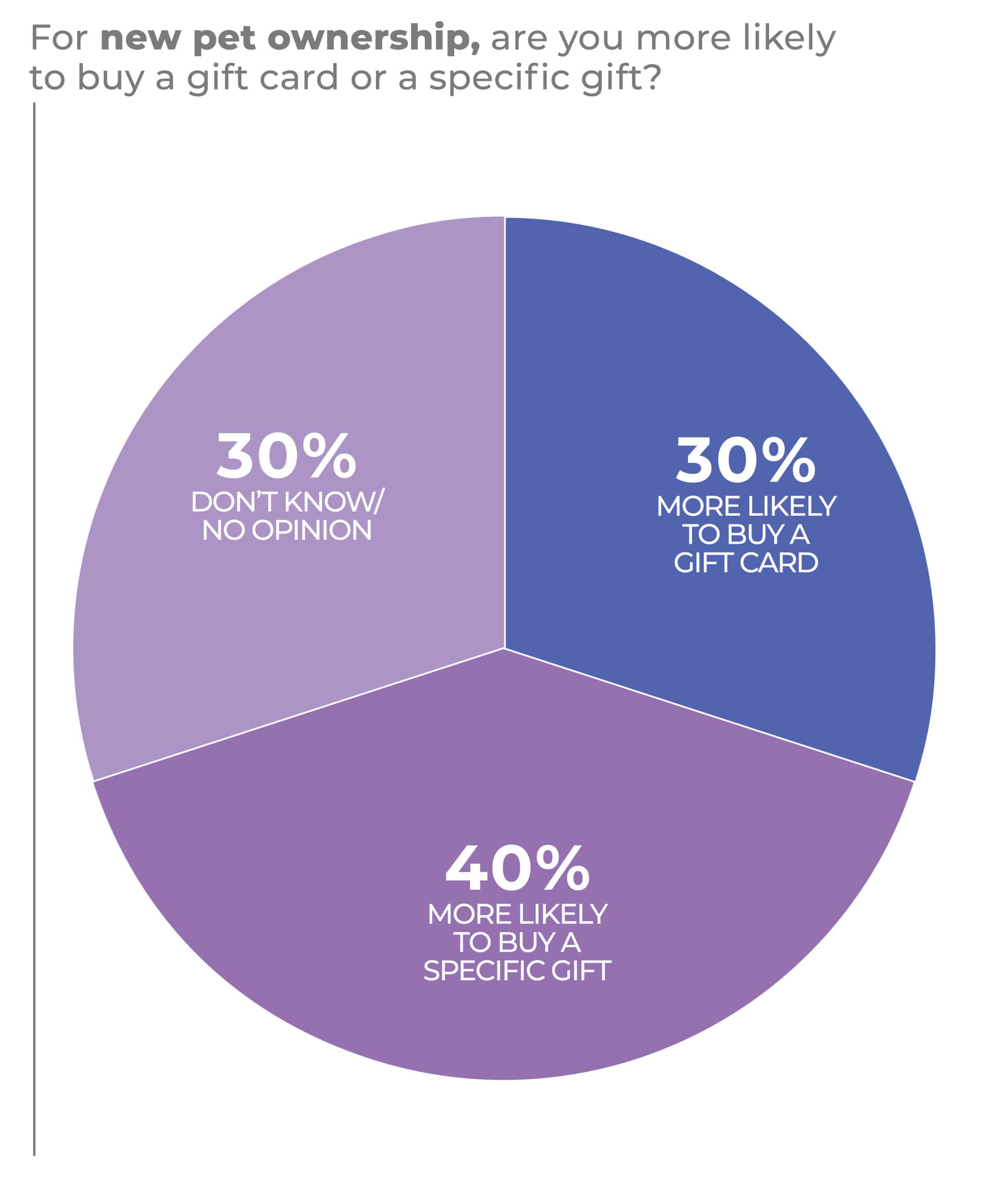

Some 30% of survey respondents said they were more likely to give a gift card, and 40% said a specific gift with 30% undecided.

Mark Neckes, a consultant, past chairman of the marketing department of Johnson and Wales University, and a former department store buyer, said, “Pets in the pandemic were saviors of a lot of people, who spend what it takes to keep them happy.”

The sense that pets are family members has grown among pet owners in the United States, and now a lot of people think of themselves not only as pet parents but as pet grandparents, aunts and uncles. As such, Neckes said, retailers and their suppliers may think about targeting the extended family with more upscale gift products just as they do with newborns.

Marsha Everton, principal, corporate director and advisor, The AIMsights Group, also points to the status of pets as family members, adding that changing circumstances may continue to drive gift sales focused on pets.

“Gift/treat giving is a year-round occasion,” she said, “now magnified by the guilt of leaving (pets) at home as we return to the non-home office.”

An underappreciated aspect of pet ownership may be the change of lifestyle it entails, said Salamah. Pet ownership ties people closer to the home as pet care is required. As such, it might serve to repurpose and modify housewares products—including cleaning and organizing products—for those moments when home and lifestyle are conforming around a new pet.

“It’s about including that pet in your home,” Salamah said. “They get to be a part of whatever activities the family or the pet owner are doing. How do you facilitate their inclusion?”

A spokesperson for the American Pet Products Association (APPA) pointed to the organization’s 2021-2022 survey to showcase the growth of pet ownership, which advanced from an estimated 67% of U.S. households to an estimated 70%. Millennials were the top generational group, at 32%, with Boomers at 27% and Gen X at 24% following.

“It’s about including that pet in your home. They get to be part of whatever activities the family or the pet owner are doing. How do you facilitate their inclusion?”

— Leana Salamah, VP Marketing, IHA

According to APPA, the percentage of pet owners purchasing gifts for their animal friends has increased across all pet types, as between 50% and 80% of pet owners purchased pet gifts.

Bird owners have the highest percentage of owners who have bought their pet a gift, at 80%, followed by dog owners, at 79%, and small animal owners, at 77%. The most common occasion when dog and cat owners buy pet gifts is Christmas, at 45% and 35%, respectively.

However, owners of all other pet types report the most common occasion for pet gift giving is anytime/no special occasion. Although pet owners who purchase gifts report buying between 3.6 and 5.3 gifts, on average, there is a very wide range of totals spent per gift, APPA pointed out. In the survey, horse and saltwater fish owners spend the most per gift at $92 and $83, respectively, while bird owners who buy gifts said they spent $56 and freshwater fish owners spent $44 on average. Dog, cat, small animal and reptile owners all spent between $25 and $30 per gift. Dog owners spent the least, on average, per gift but had the highest average number of gifts purchased annually.

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands.

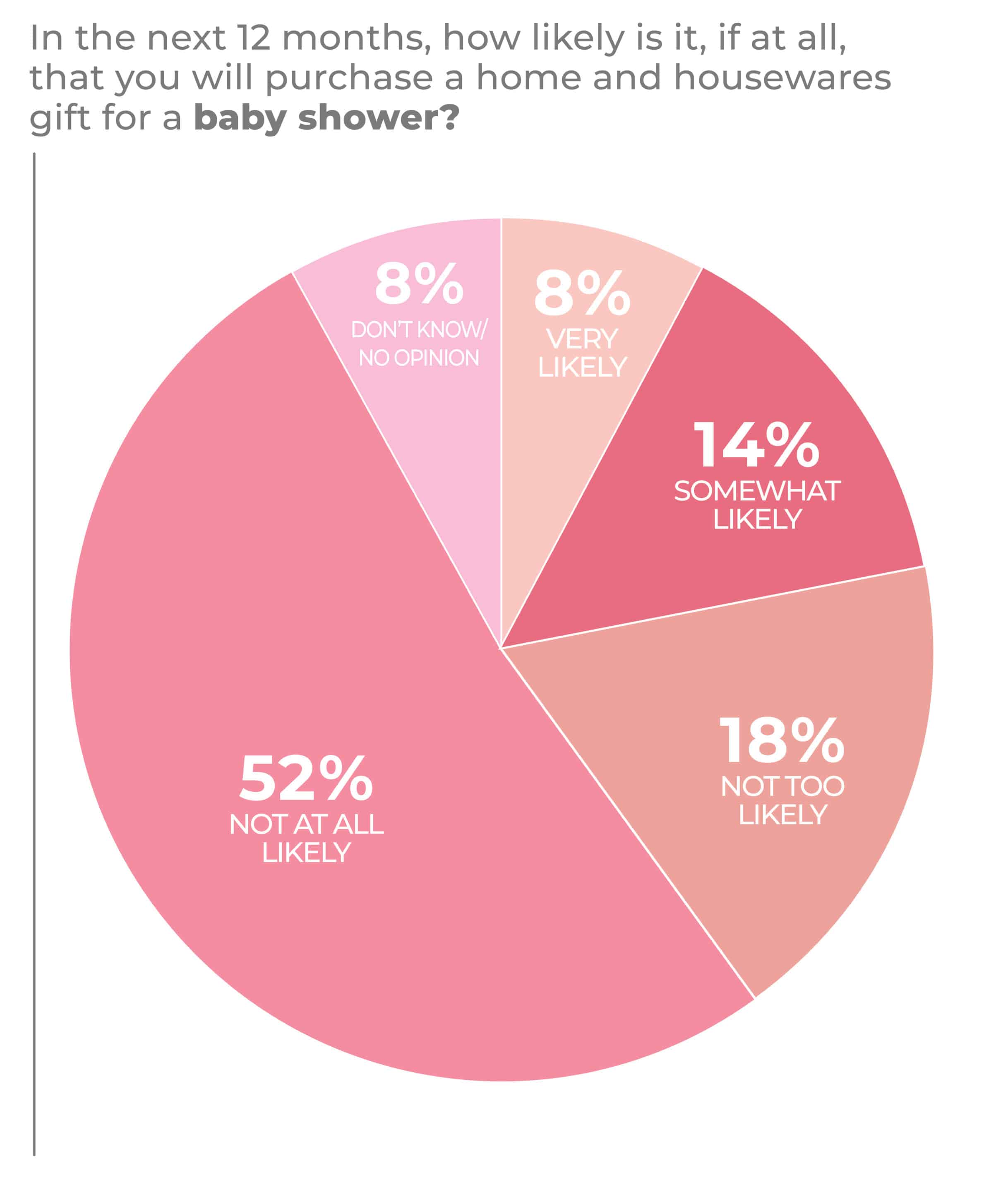

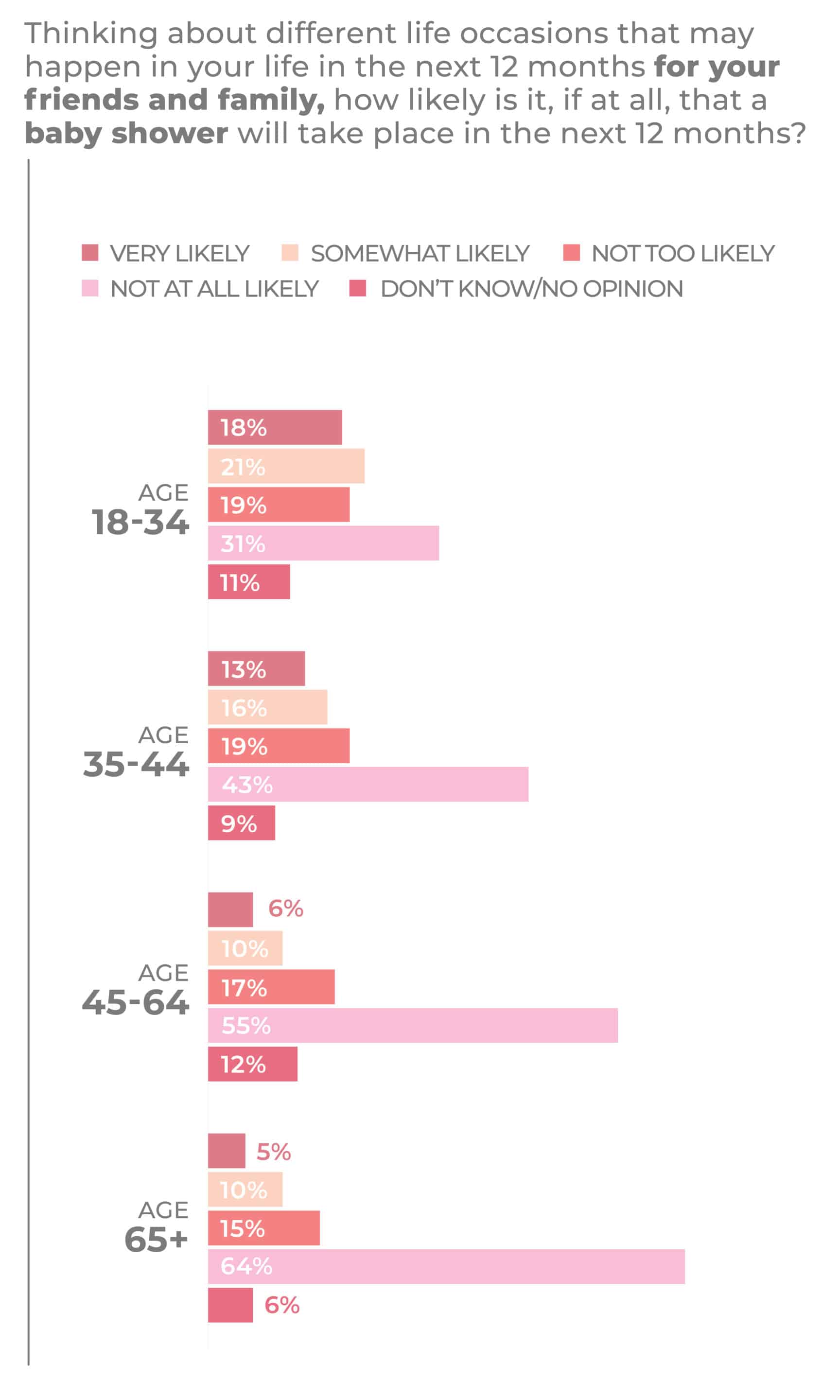

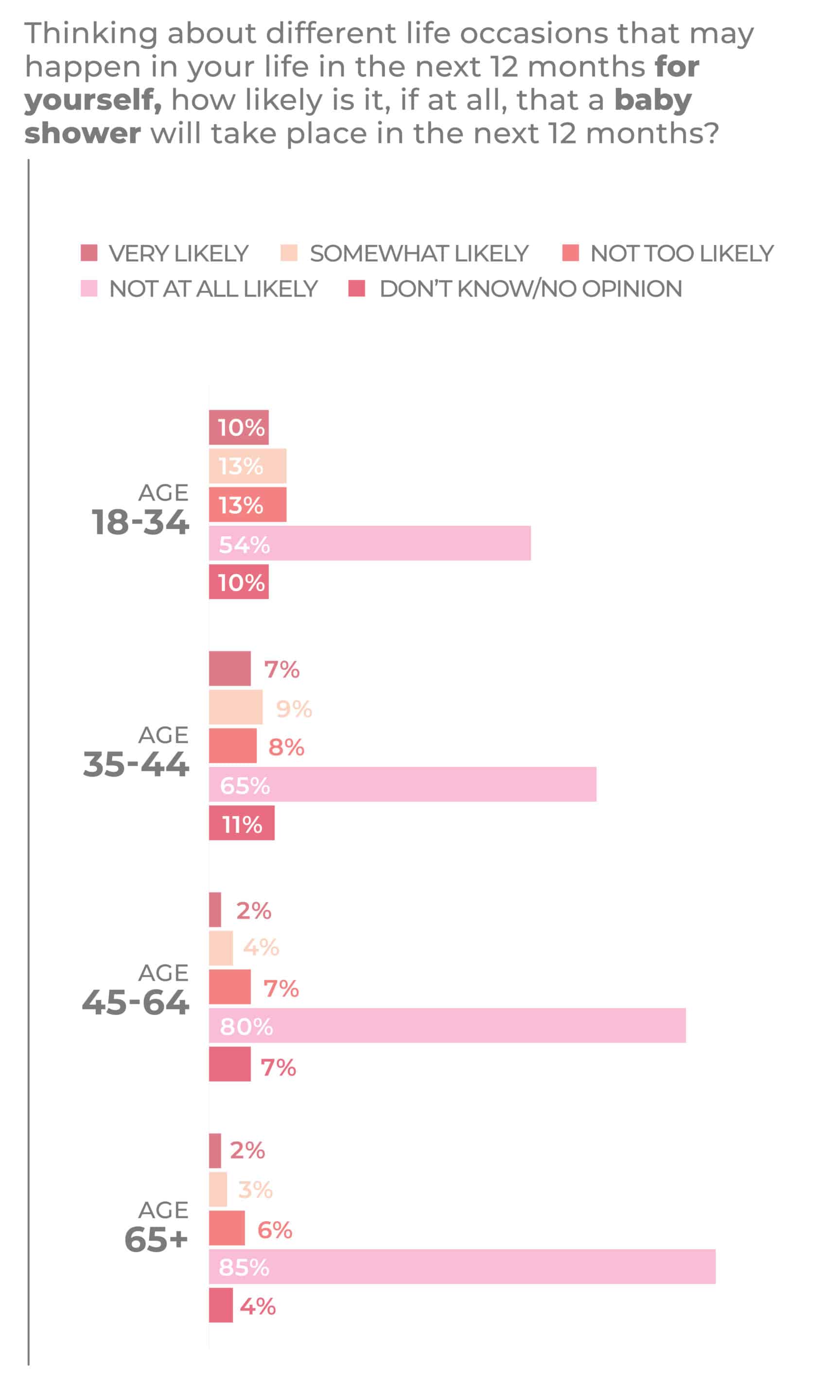

Overall, 11% of 2023 IHA Occasions Survey respondents are very likely and 14% are somewhat likely to have such a family and friends baby shower event on their calendars. Then, 18–34-year-olds dominate expectations, as 18% said they were very likely and 21% said they were somewhat likely to participate in some form for family and friends. Genders line up pretty closely, with women a bit more inclined to say very likely.

Baby showers are on the horizon for 5% of respondents who said they were very likely to have such an event upcoming in their own lives and 7% who said they are somewhat likely to be involved. Men lead women at 6% very likely and 9% somewhat likely, respectively, versus 5% very likely and 6% somewhat likely be baby shower participants. Among the age brackets studied, 18–34-year-olds had the highest response at 10% very likely and 13% somewhat likely to be expecting a baby shower with a gradual fall-off starting with 35-44-year-olds, at 7% and 9%, respectively.

Survey respondents anticipating a single baby shower occasion in the year ahead among family and friends were 62% of the total, with 34% expecting to attend two to four and 4% expecting to attend five or more. Men came in at 64% anticipating one such event, 31% anticipating 2 to 4 and 5% anticipating five or more; while women came in at 61%, 36% and 4%, respectively. Among those most likely to have only one such event to attend, people 65 or older, at 75%, were three points higher than those 45-64. Then, 18–34-year-olds are most likely to be involved with five or more family or friend baby showers, at 5%, one point higher than 35-44-year-olds and 45-64-year-olds.

When it comes to purchasing a housewares gift for baby showers, 8% of respondents said they were very likely and 14% were somewhat likely to do so. Men and women were about even, but 18–34-year-olds, at 13% very likely and 22% somewhat likely, topped 35-44-year-olds, at 11% and 14%, respectively.

Likelihood went up with income from 7% very likely among households earning less than $50,000 a year to 13% very likely among those making $100,000 or more a year.

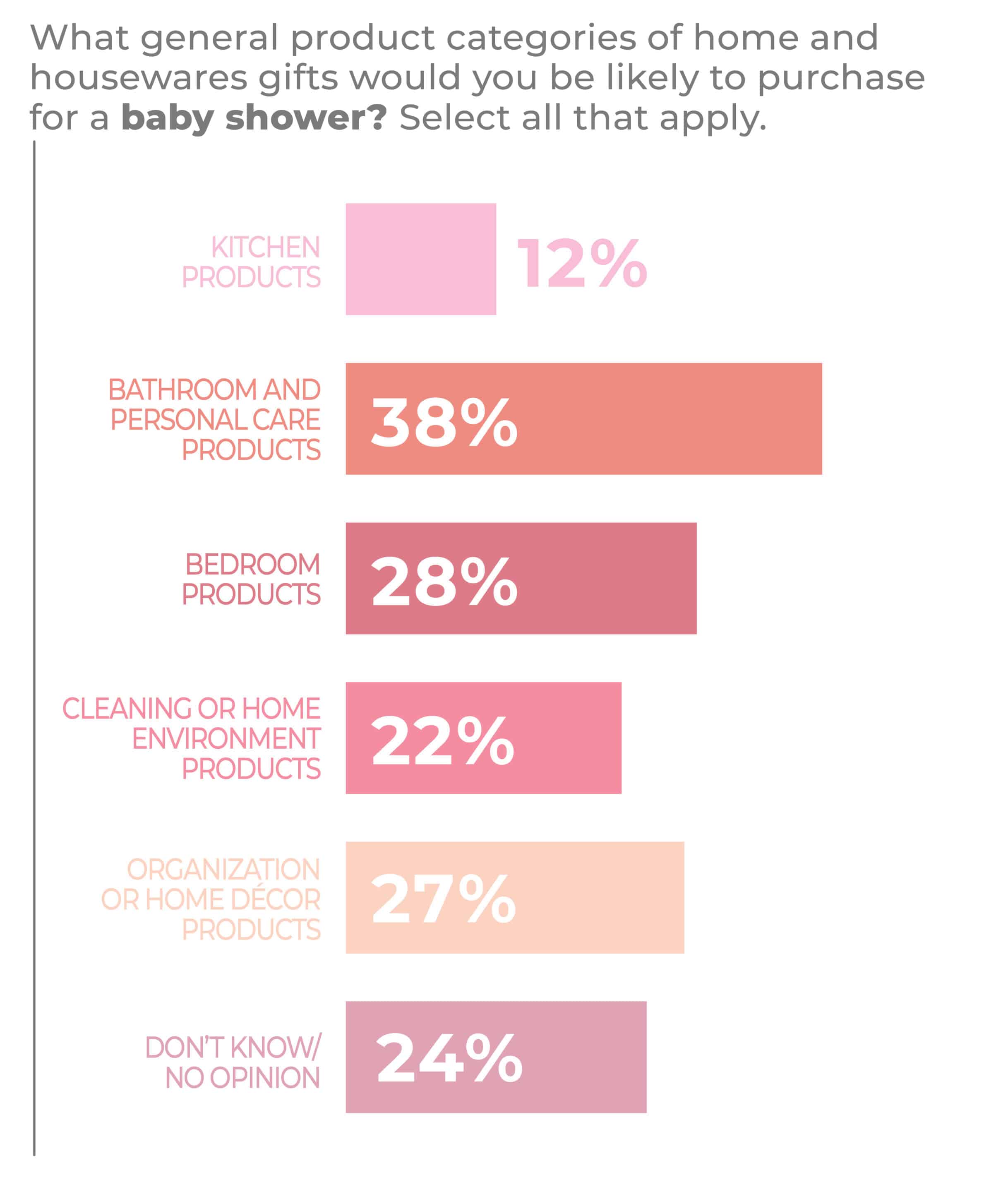

The top housewares gift category selected for baby showers was bathroom or personal care products, at 38%, followed by bedroom products, at 28%, organizational and home storage products, at 27%, organization or home décor, at 27%, cleaning or home environment products, at 22%, and kitchen products, at 12%. Compared to last year’s Survey, bathroom or personal care slipped four points, bedroom slid three points and cleaning or home environment tumbled seven points while organization or home décor was flat and kitchen products fell three points.

Likelihood went up with income from 7% very likely among households earning less than $50,000 a year to 13% very likely among those making $100,000 or more a year.

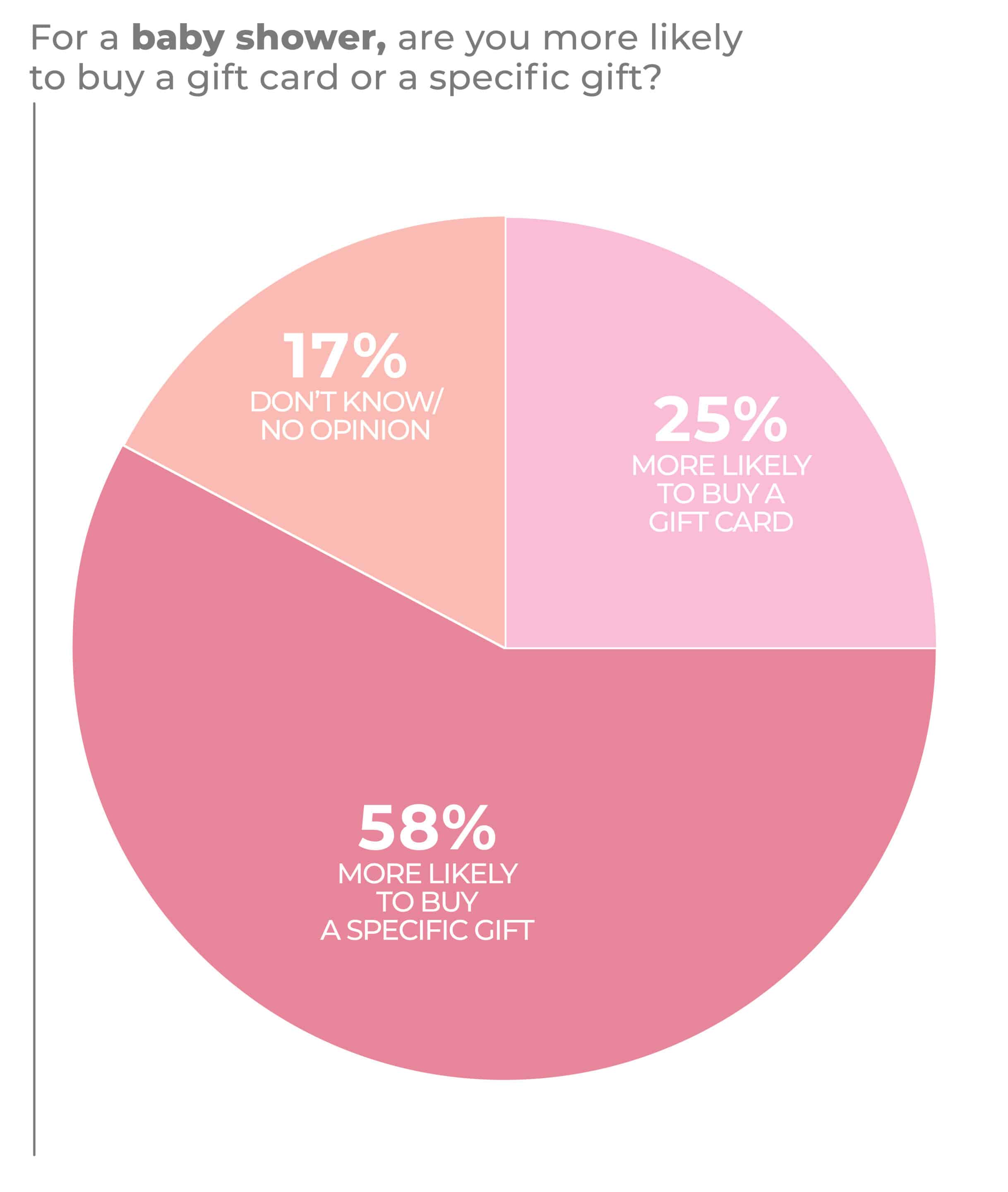

By age bracket, 18–34-year-olds were most likely to favor bathroom or personal care products, at 44%, and cleaning or home environment products, at 29%; while 35-44-year-olds were most likely to favor kitchen products, at 19%, bedroom products, at 35%, and organization or home décor products, at 34%.

Men, at 18%, were three times more likely than women to select a kitchen product for a baby shower, and they lead on bedroom products, 34% to 23%, and cleaning or home environment products, 26% to 17%. In the other substantial difference, women lead men, at 34% to 20%, in organization or home décor products.

Gift cards are the more likely choice for 25% of respondents, compared to 58% who are more likely to give a specific gift and 17% who weren’t sure about a choice. Men favored gift cards more often, at 31%, versus women, at 19%.

Mark Neckes, a consultant, past chairman of the marketing department of Johnson and Wales University, and a former department store buyer, said fewer baby showers today focus on basics, with older parents particularly favoring something more enduring. “They’re looking for the best quality merchandise,” Neckes said. They want products that will perform well and last, he added.

Moreover, gifts need to fit within set and specific parameters. “The personal fit of the gift is more important than the sophistication of the gift,” said Marsha Everton, principal, corporate director and advisor, The AIMsights Group. “Or perhaps a sophisticated gift is the one that is ‘just right’ for the individual.”

She also noted Baby Boomers, who lead wealth metrics, may not be given their due by businesses selling products for babies and kids. “Remember that a tidal wave of them have become gift-giving grandparents,” she said.

“The personal fit of the gift is more important than the sophistication of the gift. Or perhaps a sophisticated gift is the one that is ‘just right’ for the individual. Baby Boomers, who lead wealth metrics, may not be given their due by businesses selling products for babies and kids. Remember that a tidal wave of them have become gift-giving grandparents.”

— Marsha Everton, Principal, Corporate Director and Advisor, The AIMsights Group

At the same time, and even if they may not need the basics, occasions are often based on need and reinforcing personal bonds, which is an issue in the tumultuous times people have been navigating.

“It’s not just gifting,” said Joe Derochowski, home industry advisor for The NPD Group. “It’s part gifting, along with ‘somebody has a need, I have to do something.’”

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands.

Off to College

With nearly everyone leaving for college in need of living essentials and on a tight budget, gifting can be significant to the experience.

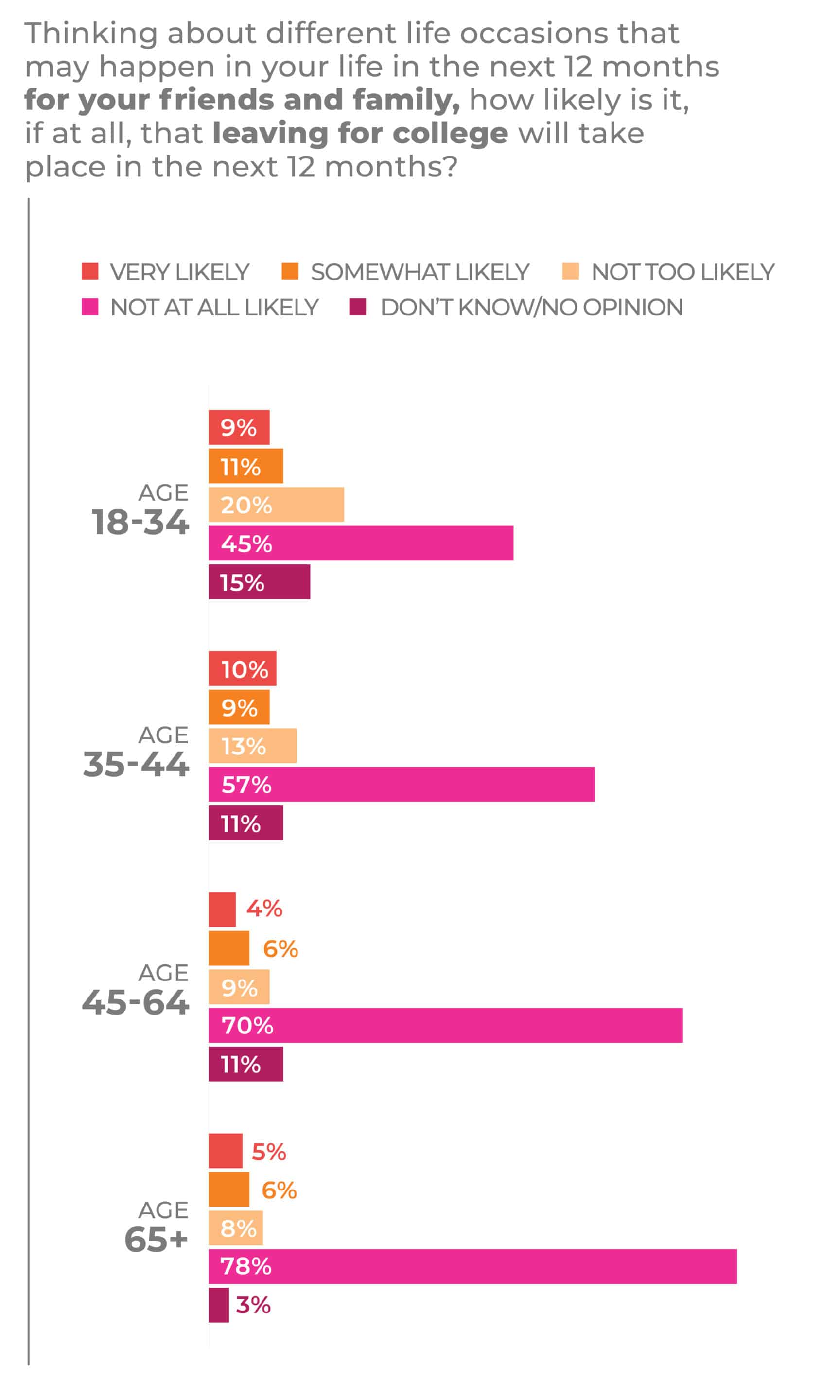

Family and friends leaving for college was a very likely future event for 7% of the 2023 IHA Occasions Survey respondents and somewhat likely for 8% more. Men were slightly higher at 8% very likely and 9% somewhat likely to have a college-bound person in their social circles than were women at 6% very likely and 6% somewhat likely. In a not-too-surprising development, 9% and 11% of 18–34-year-old respondents were very likely or somewhat likely, respectively, to face an upcoming leaving-for-college occasion. However, 35–44-year-olds were very close, with 10% very likely and 9% somewhat likely to face a college-bound situation. It might be hard to tease out just why the difference is so narrow, but, as it turns out, one factor may be how many 35–44-year-olds are involved in decisions about returning to college themselves. It turns out the cohort has a relatively high interest in academia, which means the whole age bracket may be exchanging leaving for college occasions.

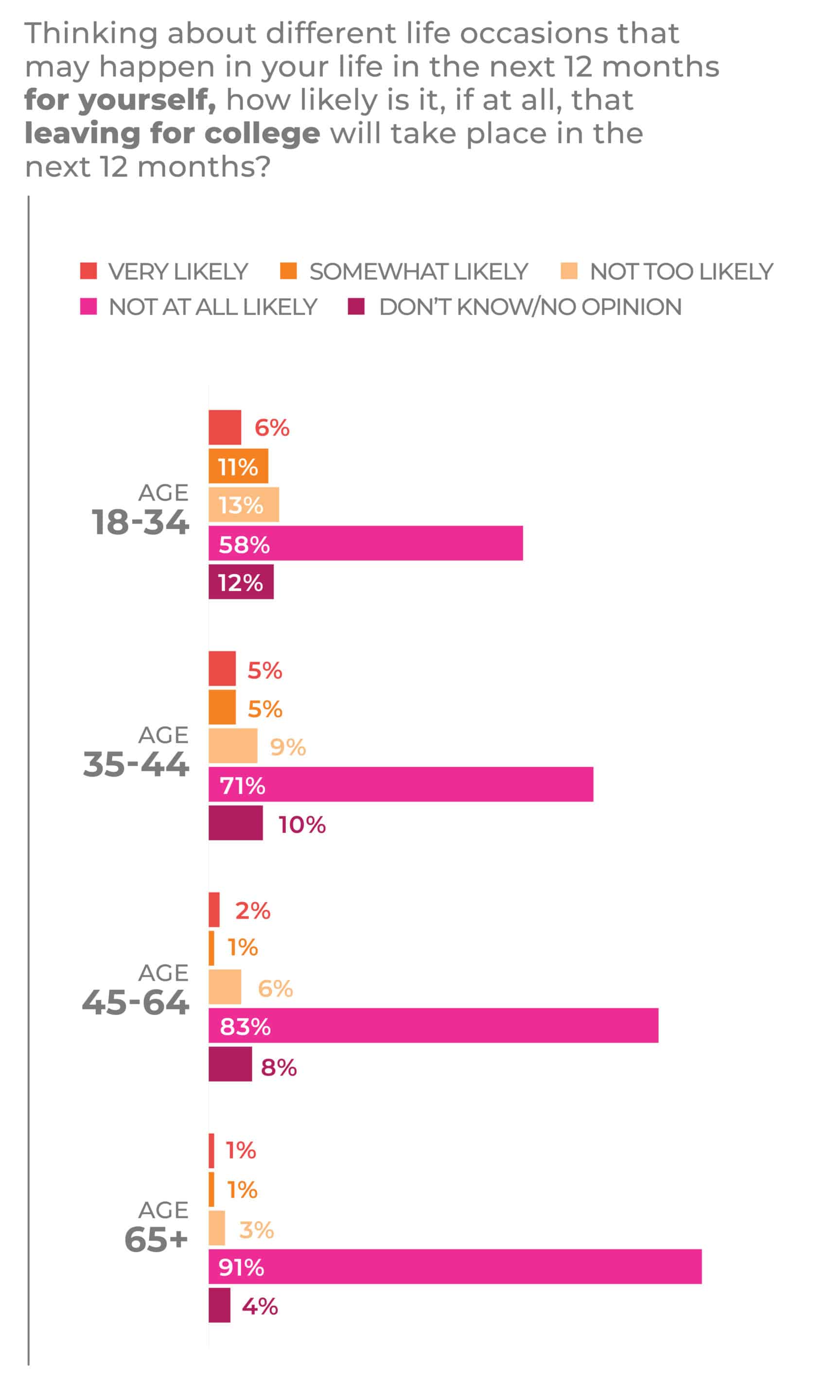

Consumers 18-34 were thinking about forthcoming leaving-for-college occasions involving themselves, at 6% very likely and 11% somewhat likely, but a fair proportion of respondents 35-44, at 5% and 5%, respectively, had such a destination in mind with at least some finishing degree programs or in pursuit of advanced degrees to further their careers. Men were more likely to see themselves involved in the leaving-for-college life occasion than were women. Men were 5% very likely and 7% somewhat likely to be so involved versus 2% and 3% of women, respectively.

For the occasion, 5% of respondents said they would very likely purchase a housewares gift, while 9% said they were somewhat likely to do so. There was very little gender difference with women slightly behind men in enthusiasm for housewares gifts— men at 6% very likely and 10% somewhat likely, versus women at 5% and 8%, respectively. Consumers in the 18-34 age bracket were almost in a dead heat with those in the 35-44 age bracket— 7% very likely and 15% somewhat likely for 18-34-year-olds versus 7% very likely and 13% somewhat likely for 35-44-year-olds, with the older two brackets considerably lower. Respondents with more education and higher incomes anticipated more college send-offs, as might be expected, with those who have post-graduate schooling, at 8%, very likely and 12% somewhat likely, and households earning more than $100,000 at 11% and 10%, respectively.

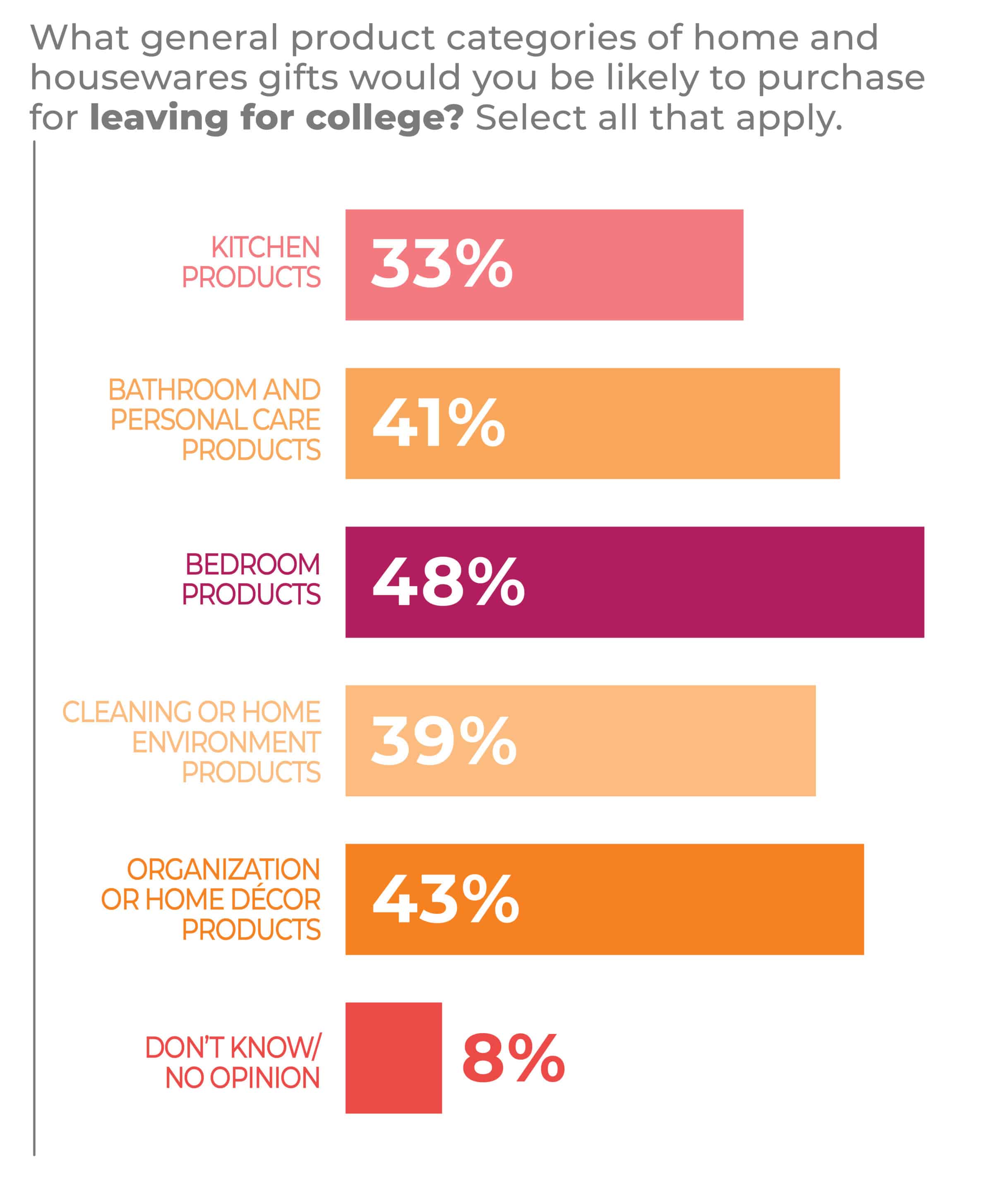

A third of respondents overall anticipated purchasing kitchen products for the leaving-for-college occasion, while 41% were thinking about bathroom or personal care products, 48% bedroom products, 39% cleaning or home décor products and 43% organization or home décor products. The answers line up pretty closely when compared to last year’s 2022 IHA Occasions Study, although kitchen picked up five points and cleaning or personal care products picked up six points, while bedroom product products, organization or décor, and bathroom or personal care came in basically flat.

The genders were closely aligned as to anticipating the purchase of leaving-for-college gifts, with women ahead a bit in each category except for organization or home décor, for which they were ahead 51% compared to 36% for men. Survey respondents 18-34 lead every category in purchase intent except for organization or home décor products, for which they were tied with 35–44-year-olds at 49%. Otherwise, 35–44-year-olds came in second, except for in the bathroom or personal care product segment. In that category, 18–34-year-olds led the way at 50% and the 45-64 bracket was next at 39%.

Some 36% of respondents with less than a college education were most likely to purchase kitchen products for a leaving for college occasion, several points above those with a bachelor’s degree or postgraduate education. However, the difference in terms of household income was small, with those earning less than $50,000 annually leading at 34%. Higher- and lower-income respondents were several points more likely to consider bathroom or personal care products than middle-income households, with incomes between $50,000 and $100,000 at 36%. Middle-income consumers, at 42%, were less likely to consider purchasing in the bedroom category versus lower-income consumers, at 49%, and higher-income respondents, at 55%. And middle-income consumers, at 35%, were seven points lower than less and more affluent consumers in the cleaning or home environment segment.

With bedroom products, bachelor’s degree holders were several points higher, at 58%, to consider buying in the segment than respondents with less, at 46% or more, at 42% education. As to cleaning or home environment products, respondents with postgraduate education, at 33%, are several points lower in the tendency to purchase in the category versus those groups with less education. When it comes to organization or home décor products, postgraduate respondents at 32% again trail those with less education, this time by 14 points in both cases. Little difference emerged among different income groups in their consideration to buy cleaning or home environment products, although those earning between $50,000 and $100,000, at 35%, were least likely to make a leaving-for-college purchase in the category.

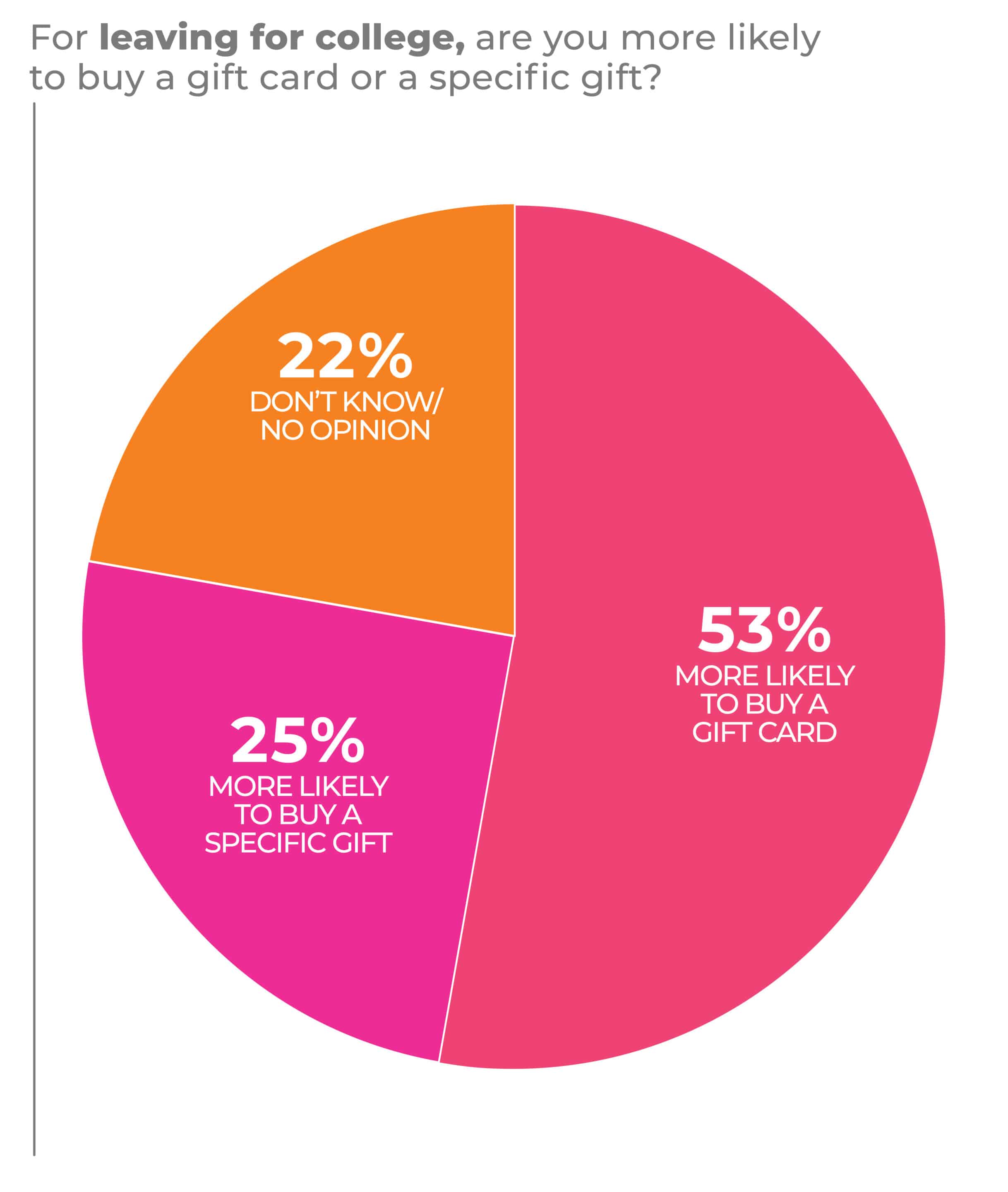

Some 53% of consumers in the survey were more likely to give a gift card compared to 25% more likely to buy a specific gift and 22% who were undecided.

Post-secondary college enrollment in the fall of 2020 was 19.4 million students, down from the peak of 21.6 million students in the fall of 2010, according to the National Center for Education Statistics. Although the number was affected by the COVID-19 pandemic, college enrollment has been eroding since the 2010 peak. That being said, the National Retail Federation forecast record back-to-school and back-to-college season spending this year, with the average family spend on a student headed to campus at $1,200.32, up $141 from the same time period last year.

However, the pandemic and inflation have affected how consumers shopped this year, with consumers cutting back on other spending, focusing their purchasing on where they think the best deals are, looking for bargains and even starting earlier to get a jump on rising prices.

“We are seeing real shifts in the way people are shopping and spending on back-to-class items since before the pandemic. As a result, retailers are also shifting by bringing in inventory earlier and extending back-to-class offerings,” said Phil Rist, executive vice president, Prosper Insights, which conducted the back-to-the-classroom research for the NRF.

Mark Neckes, a consultant, past chairman of the marketing department of Johnson and Wales University, and a former department store buyer, said leaving for school, given the costs of education and housing, is one of those occasions when the basics still count at gifting time.

“Back to college is small carpets, single bed linens, hot plates, refrigerators and microwaves, and gift cards,” he said.

In the 2023 IHA Occasions Survey, a fact that stood out is that leaving for college purchasing isn’t confined to summer months, Leana Salamah, vice president, marketing, at the International Housewares Association, pointed out. Like some other occasions–engagements and celebrations around new pets–the event might not be a singular moment in time, but it might occur over time as various friends and relatives have the opportunity to visit. Salamah said the leaving-for-school occasion has a certain preliminary sequence of events that might be cause for at least some celebration going back to the high school graduation.

“There are leadups and lead-outs of these occasions,” she said. “Sometimes we recognize them, as in the engagement/bridal shower/wedding sequence of occasions, but something similar can be true of other events.”

“More recent additions to the list of what college students need are products that enhance their sense of well-being. They have grown up in a topsy-turvy time and now are college students, with their demographic cohort dominating academia for quite a while. The number one product benefit for Gen Z is enhanced mental wellness.”

— Tom Mirabile, Founder, Springboard Futures

Tom Mirabile, founder of Springboard Futures and International Housewares Association consumer trend forecaster, said more recent additions to the list of what college students need are products that enhance their sense of well-being. They have grown up in a topsy-turvy time and now are college students, with their demographic cohort dominating academia for quite a while.

“The number one product benefit for Gen Z is enhanced mental wellness,” Mirabile said.

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands.

Retirement

Many Baby Boomers are retiring, even if a significant proportion is working later in life than might once have been the case. People who have begun or are preparing for retirement are entering a new phase of life, with the occasion marked by not only immediate celebrations but also household changes including those involved in downsizing and aging in place.

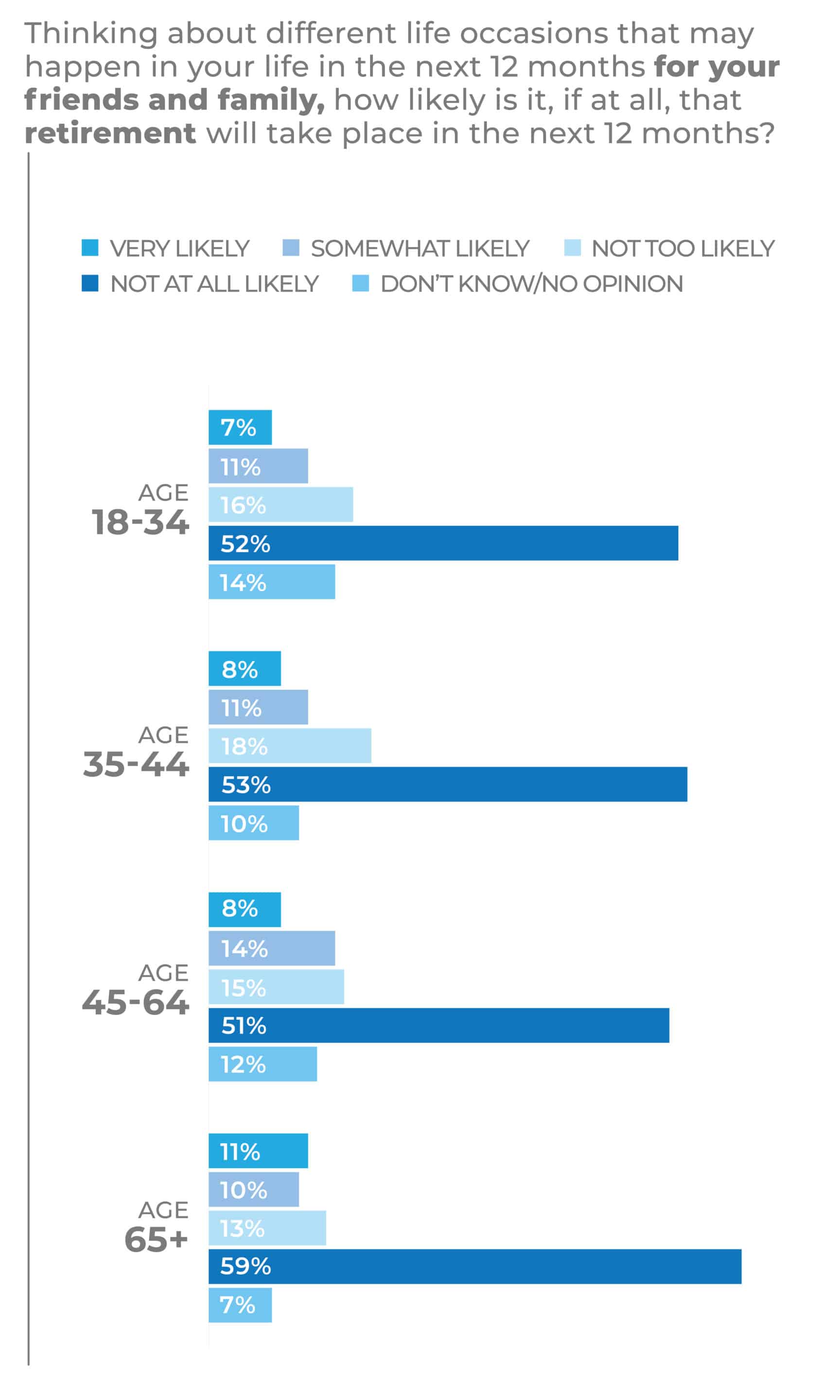

When it comes to retirement occasions, 8% of 2023 IHA Occasions Survey respondents said they very likely would be celebrating a retirement among friends and family, with 12% saying they were somewhat likely. For 45–64-year-olds, a group including Boomers and Gen Xers, the proportion goes up to 8% very likely to 14% somewhat likely. And for people 65 and older the numbers are 11% very likely and 10% somewhat likely.

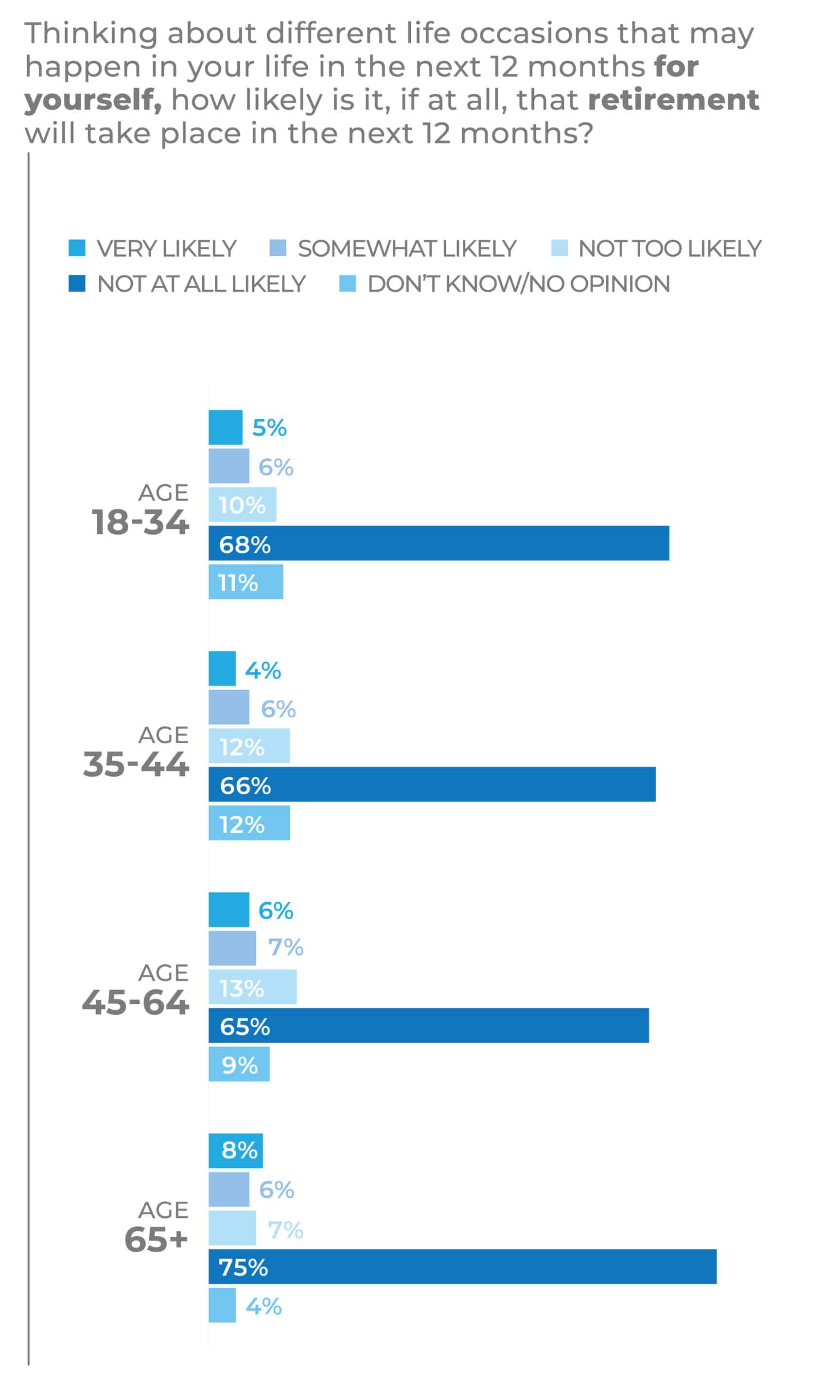

As the time nears, 6% of respondents said they were very likely and 6% said they were somewhat likely to be personally involved in retirement. Those 65 and older came in at 8% very likely and 6% somewhat likely, just a bit ahead of 45–64-year-olds at 6% and 7%, respectively. Men’s and women’s responses came in nearly the same with men slightly ahead on the somewhat likely line.

Single retirement-related events appear on the 12-month horizon of 65% of survey respondents, while two to four such occasions loom for 29% and five or more for 6%. Women, at 66%, are more likely than men, at 63%, to have one such event in their immediate futures, while 28% of women have two to four versus 30% of men. In comparison, men, at 7%, are only one point ahead of women for five or more. The oldest age bracket, 65-plus, at 69%, is most likely to have one retirement-related meet-up on the calendar, while 35–44-year-olds are most likely to have five or more retirement occasions upcoming, at 9%.

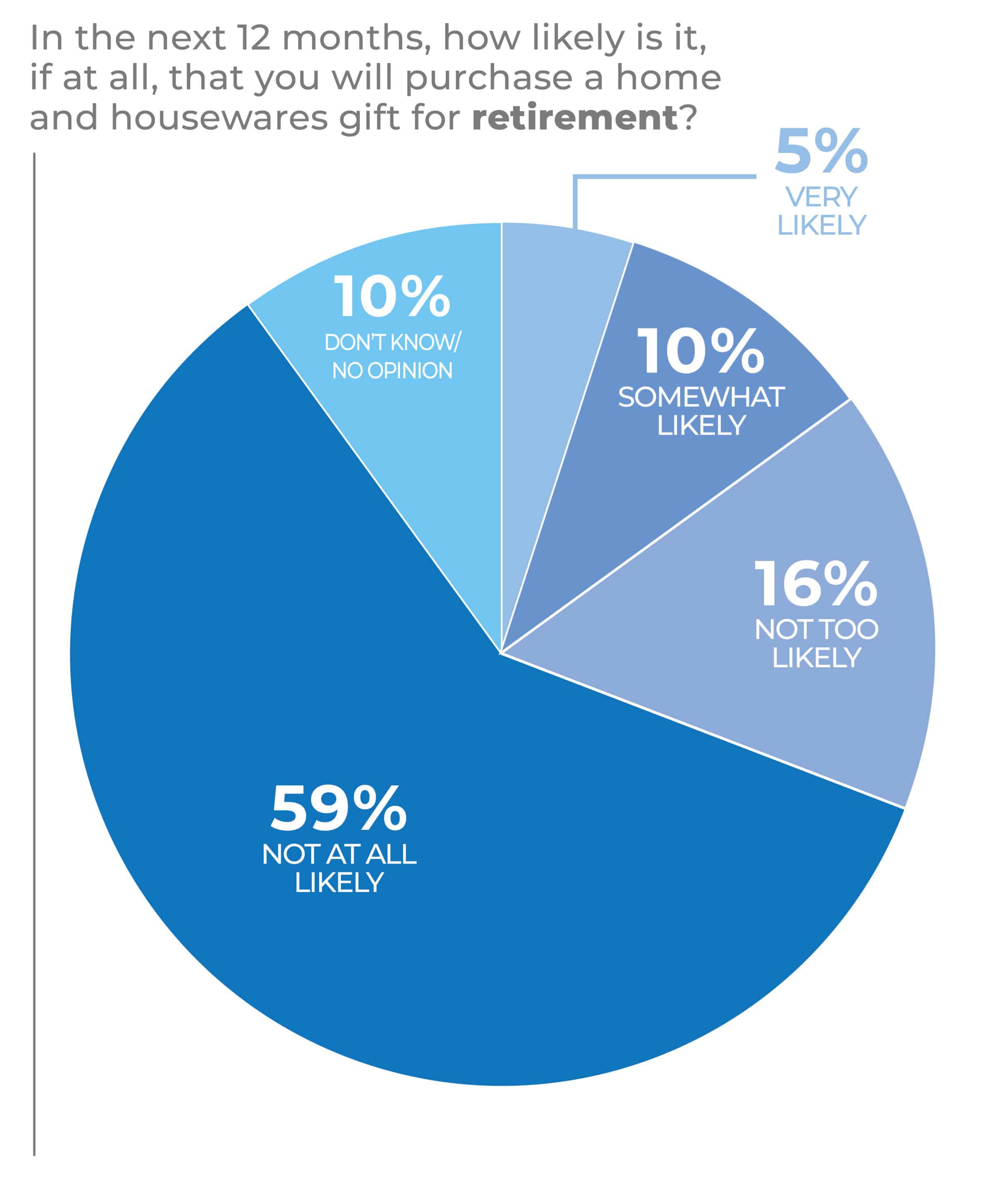

When thinking of what they want to purchase for a retirement get-together, 5% of consumers would very likely and 10% somewhat likely choose a housewares product, according to the survey. Men and women are just about the same when it comes to a housewares purchase, with men just slightly ahead in the very likely and somewhat likely choices. Shoppers 18-34 years of age and 35-44 years of age were equally intent on purchasing a housewares gift for a retirement occasion, both at 6% very likely and 12% somewhat likely.

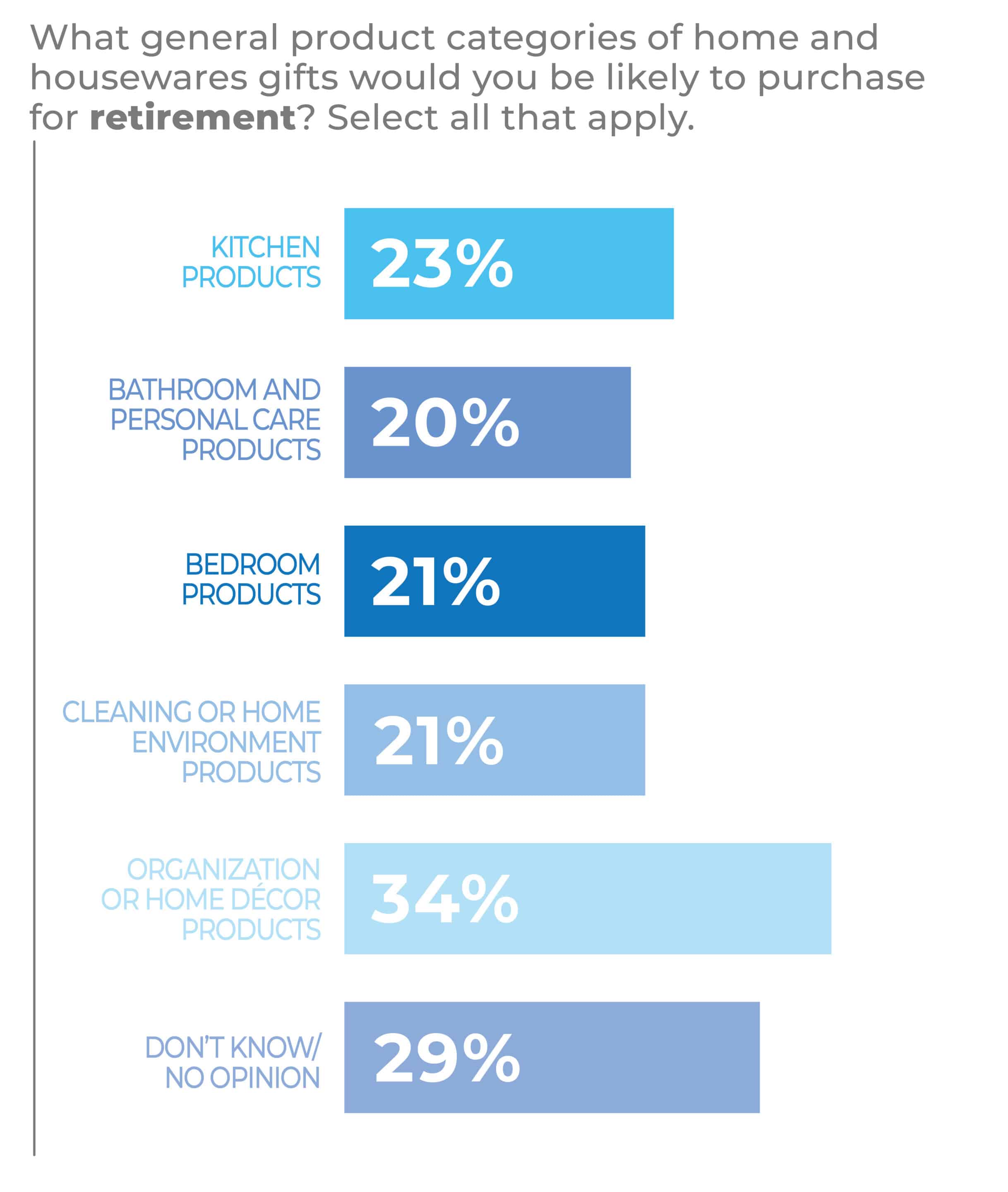

As for what consumers might be inclined to buy, 23% selected kitchen products, while 20% chose bathroom or personal care products, 21% chose bedroom products, another 21% picked cleaning or home environment products and 34% selected organization or home décor products. The dispersion at least suggests that purchasing is tied to next-phase lifestyles as gift-givers help retirees settle into new habits and, at least in some cases, new homes.

Although most categories demonstrated only slight change from last year’s 2022 IHA Occasions Survey, the numbers did show some larger variation with bathroom products slipping four points and kitchen products up three points.

In the 2023 survey, men, at 28%, were 11 points more inclined to purchase kitchen products for a retirement occasion than women.

In other points of notable difference, men were 14 points more likely to purchase bedroom items, at 27%, and, at 26%, 10 points more inclined to purchase cleaning or home environment products than women. On the flip side, women, at 39%, were 10 points more inclined to purchase organization and home décor items than men.

In terms of age, kitchen products had the greatest intent-to-purchase among younger consumers aged 18-34, at 30%, followed by 45–64-year-olds at 24%. Bathroom or personal care products led the purchase intent of those 18-34, at 28%, followed by 35-44-year-olds at 16%. The youngest age bracket again showed the most inclination toward bedroom products at 32%, followed by the 35-44 bracket, at 25%. They led the cleaning or home environment products category at 38%, followed by the 35-44 bracket at 28%. Preference for organization or home décor products followed the pattern of younger consumers favoring housewares gifts as it got consideration from 35% of 18-34-year-olds followed by both 35-44-year-olds and 45-64-year-olds at 34%, with 65 and older consumers not far behind at 29%. In fact, more respondents to the 2023 IHA Occasions Survey aged 65 or older picked organization or home décor over any other category.

Education didn’t make a significant difference in kitchen products as a primary selection, nor did income, with all variation across different designated groups minor. Consumers who were in the lower brackets in education at 16%, and income at 17%, were a few points shy of the other two in each group as regards bathroom and personal care products.

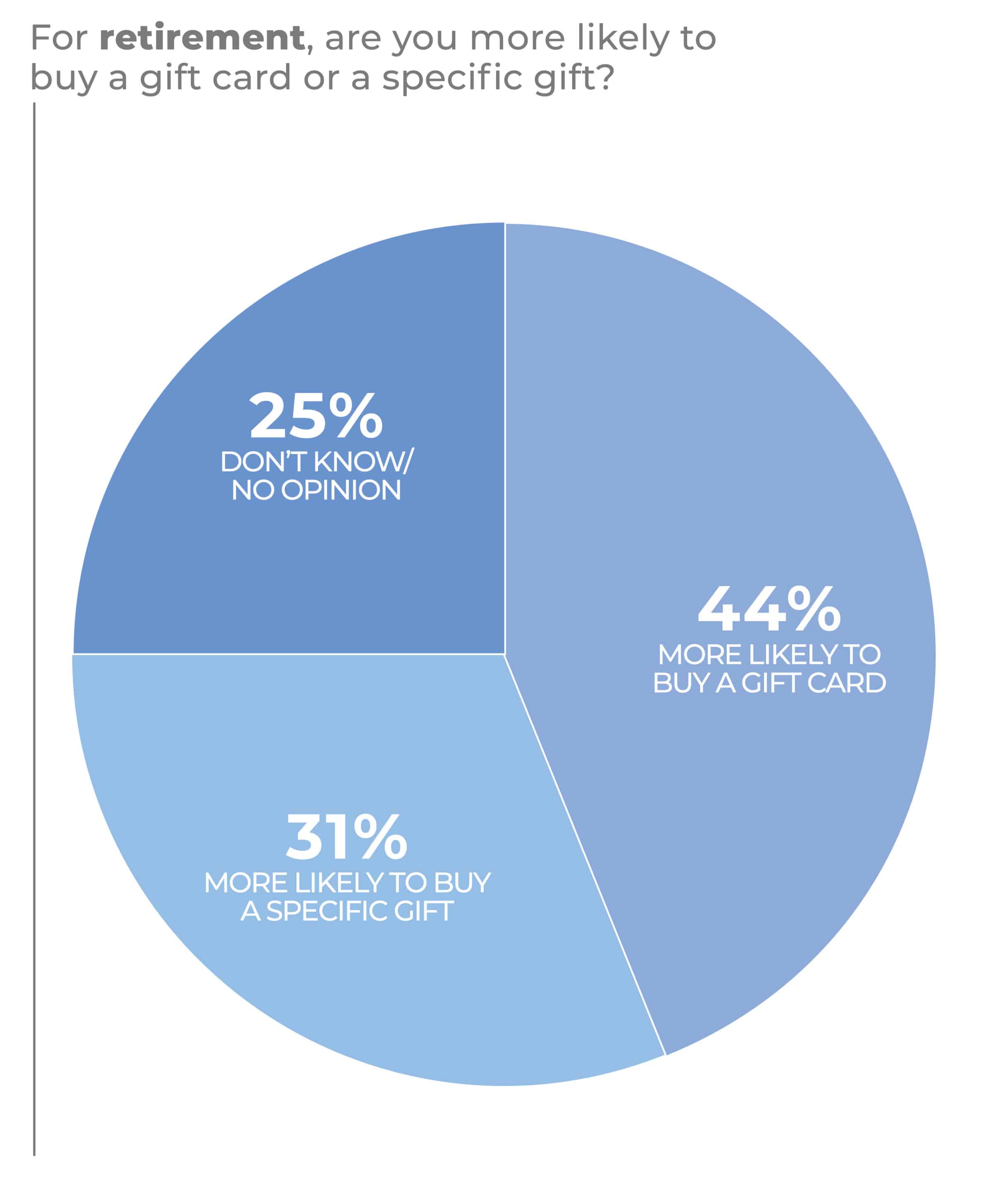

Some 44% of 2023 IHA Occasions Survey respondents were more likely to buy gift cards for the retirement occasion, while 31% were more inclined to get a specific present and 25% weren’t sure about which they favored.

According to the Administration for Community Living, an operating division of the United States Department of Health and Human Services, the U.S. population age 65 and older numbered 54.1 million in 2019, the most recent year when data was available, so people 65 or older represented 16% of the population.

The number of older Americans has increased by 14.4 million, or 36%, since 2009, a period of time with a population increase of 3% for the under-65 population. In 2019, 51% of people 65 and older lived in nine states: California, 5.8 million; Florida, 4.5 million; Texas, 3.7 million; New York, 3.3 million; Pennsylvania, 2.4 million; Ohio, 2 million; Illinois, 2 million; Michigan, 1.8 million; and North Carolina, 1.8 million. The median income of older persons in 2019 was $27,398 with men at $36,921 compared to $21,815 for women. From 2018-2019, the real median income, after adjusting for inflation, of all households headed by older people increased by 6.5% with the median income hitting $70,254. In 2019, Americans reaching age 65 had an average life expectancy of an added 19.6 years, 20.8 years for women and 18.2 years for men.

Marsha Everton, principal, corporate director and advisor, The AIMsights Group, says it’s a mistake to overlook Baby Boomers when it comes to pursuing occasions gift purchasers.

“Boomers still dominate all wealth and spending metrics and are still grossly underappreciated by most marketers. Big time opportunity for smart marketers,” she said.

A way to look at retirees, says Mark Neckes, a consultant, past chairman of the marketing department of Johnson and Wales University, and a former department store buyer, who actually lives in a retirement community, is to consider that they have time on their hands and better health than previous generations enjoyed. As such, they are a bit like consumers generally in the pandemic as they have time on their hands to pursue hobbies and interests, such as cooking. So Neckes says gift promotion should include merchandise that suits retirement pursuits, whether gardening, personal care, cooking, grilling or others, which frequently occur around the home. Also, consider that many seniors are dealing with diminishing physical strength and mobility while coping with aches and pains, which means products that function better and are easier to handle should enjoy preference.

“Don’t overlook expensive cookware and really good knives,” Neckes said.

“There is a huge transition between being in the workforce and becoming retired. It’s an event, and you might gift for that or buy something special for yourself specifically because of it. But beyond that, it’s about that massive change in lifestyle – what are you going to do now with the newfound time on your hands and how does the housewares industry support that?”

— Leana Salamah, VP, marketing, IHA

In the case of retirement, said Leana Salamah, vice president, marketing, at the International Housewares Association, the consumer really is entering a brand-new life, with new possibilities and choices to make. So, in addition to the actual occasion opportunity, retailers and vendors both should be looking beyond.

“That’s a huge transition out of being in the workforce to being retired,” Salamah said. “It’s an event, and you might gift for that or buy something special for yourself specifically because of it. But it’s really about that massive change in lifestyle, and what are you going to do now with the time on your and how does the housewares industry support that?”

The 2023 IHA Occasions Report is sponsored exclusively by Newell Brands.

Engagements

Engagements Bridal Showers

Bridal Showers Weddings

Weddings Home Ownership

Home Ownership Pet Ownership

Pet Ownership Baby Showers

Baby Showers College Bound

College Bound Retirement

Retirement