Small-store strategies have proven popular with a number of major retailers.

Macy’s, for one, has been particularly adamant about the importance of limited size and limited assortment in full-priced stores, seeing the opportunity to draw new customers to locations where a full-line store is not the ideal solution.

In doing so, however, Macy’s has decided largely to drop a main, legacy department in its small stores… and that’s housewares.

In contrast, Kohl’s, which has developed a somewhat different small-store strategy, opening up a smaller format based on its standard design, is building housewares and home décor back into the mix under its new leadership after the departed CEO scaled back many household product segments.

Although Macy’s small stores can help customers link to housewares online and home-related items may show up in seasonal goods, as in the case of giftables, the company isn’t necessarily creating a conspicuous link on the sales floor. Asked why housewares operations were scaled back, a Macy’s spokesperson responded, “Macy’s new store formats are strategically placed for convenience. The new locations meet our customers where they are choosing to shop. These stores allow us to operate in a smaller footprint while still offering the best brands and services. Customers can enjoy all the benefits of the full-line Macy’s stores, including the At Your Service desk, which helps with bill payments, returns and exchanges and more, while also taking advantage of services like Buy Online Pickup In-store for items available on macys.com and curbside options.

“Macy’s small-format stores offer an immersive shopping experience, providing both convenience and discovery,” the spokesperson continued. “During the holiday season, shoppers can find holiday trim and giftables at a range of prices. While Macy’s small-format stores do not carry housewares, customers can shop online or buy-online-pickup-in-store for items available on Macy’s.com.”

Macy’s Small Store Interior

Macy’s has been explicit in extolling its small-store opportunity. In October, Macy’s posted an online tour of its most recently opened small store in Boston in the online newsroom at macy’s.com. The small store is Macy’s first in the Boston metropolitan area.

Adrien Mitchel, the company’s COO and CFO, conducted the online store tour. He made the point in the presentation that the company is repositioning its store fleet by adding “highly curated small-format stores. As one of our five growth vectors, our small-format stores play an important role in helping us deliver long-term sales growth beginning in 2024, We’re committed to delivering a seamless shopping experience for our customers alongside our full-line and off-price stores, and digital offerings.”

Mitchel characterized the small-format stores as providing a localized product assortment, private label goods, national brands and luxury product lines.

The store Mitchell visited, in the South Bay Center, a retail development that also features Best Buy, Ulta, T.J. Maxx, Nike, Target and Home Depot, among others, comes in at a bit more than 33,000 square feet. The store features shops under the banners of partner retailers such as Sunglass Hut and Finish Line. It also includes a Toys ‘R Us department, as Macy’s has featured the brand across its full-line store network for a couple of years now.

Beyond the in-store operation, Mitchell pointed out that Macy’s is using analytical models that incorporate factors including geography, market characteristics, location and customer demographics, co-tenants, footprints and a brand affinity to choose where to place small stores. The company also looks for placement where it can provide a differentiated shopping option within the surrounding retail, foodservice and entertainment environment.

Mitchell noted Macy’s plans call for adding 30 small stores across the United States through the fall of 2025. Macy’s is an operation in transition. And that’s apart from a proposed buyout at $21 a share by Arkhouse Management Co. and Brigade Capital Management, which was rejected this week by Macy’s board.

Changes at Macy’s include the evolution of company management, as CEO and chairman Jeff Gennette turns over the corporate reins to veteran Bloomingdale’s leader Tony Spring, in addition to the execution of the small-store strategy. As such, the final disposition of Macy’s small stores in its strategic advancement may be subject to change, but how it will fare lacking a substantial housewares element will be noteworthy. And it’s worth considering that two of its major competitors — Kohl’s and JC Penney — have recently discovered that less housewares does not translate into better business.

The overall store balance at Macy’s had already been subject to some change, with a decision to close stores a few years ago halted and revised part way through the process as the company discovered that the physical operations were effectively supporting the e-commerce sales it wished to build. As such, Macy’s is looking at small stores as an expansion vehicle and a building block for the omnichannel orientation it is working to establish.

Seattle Bloomie’s Location

Macy’s kicked off its small-store strategy in 2020 with what was then called Market by Macy’s. The initial eight small stores still carry that name, but the company decided to simply call the new format Macy’s. In the summer of 2021, the company initiated a small-store strategy at Bloomingdale’s. Macy’s opened the first Bloomie’s location, a 22,000-square-foot operation, in Fairfax, VA.

Bloomie’s offered customers luxury, contemporary goods, available stylists and a restaurant. The store operates in Fairfax’s Mosaic District, a hub for shopping, dining and entertainment near the town center. A Macy’s department store operates toward its western edge, offering consumers a Backstage off-price option.

Although its amenities are more elaborate than those at small store Macy’s, Bloomie’s, in terms of operation and location strategy, has a lifestyle approach to the customer that is reflected in the positioning of its sibling. Whereas Bloomie’s is set as a leisurely shopping destination, Macy’s small stores, as positioned in Boston, operate as an upmarket alternative to more mass market operators around them for consumers who might be a bit more fashion-driven and/or affluent.

Off-Price Start

The small-store strategy emerged after the introduction and expansion of Macy’s off-price operations under the Backstage brand, launched in 2015 and offered today as standalone and in-store operations functioning as part of full-priced format stores. Development of the Backstage format followed the development and expansion of Nordstrom Rack, a pioneer in the development of off-price variations on department stores with roots that go back to an outlet operation that morphed into an off-price concept with the launch of a standalone store in 1983. Nordstrom continues to open Rack locations as a critical part of its corporate strategy, with a recent rebranding of the concept suggesting that it remains central to the company’s go-forward strategy.

Macy’s advance of its Backstage off-price initiative departs from Nordstrom’s strategy in that much of the Backstage banner’s growth has been as a department store within a store. Although launched as freestanding stores, now, of approximately 300 Backstage operations extant, only nine are freestanding.

In an analysis for traffic tracker Placer.ai, Ezra Carmel noted department stores continually adjust their brick-and-mortar strategies as consumer preferences change.

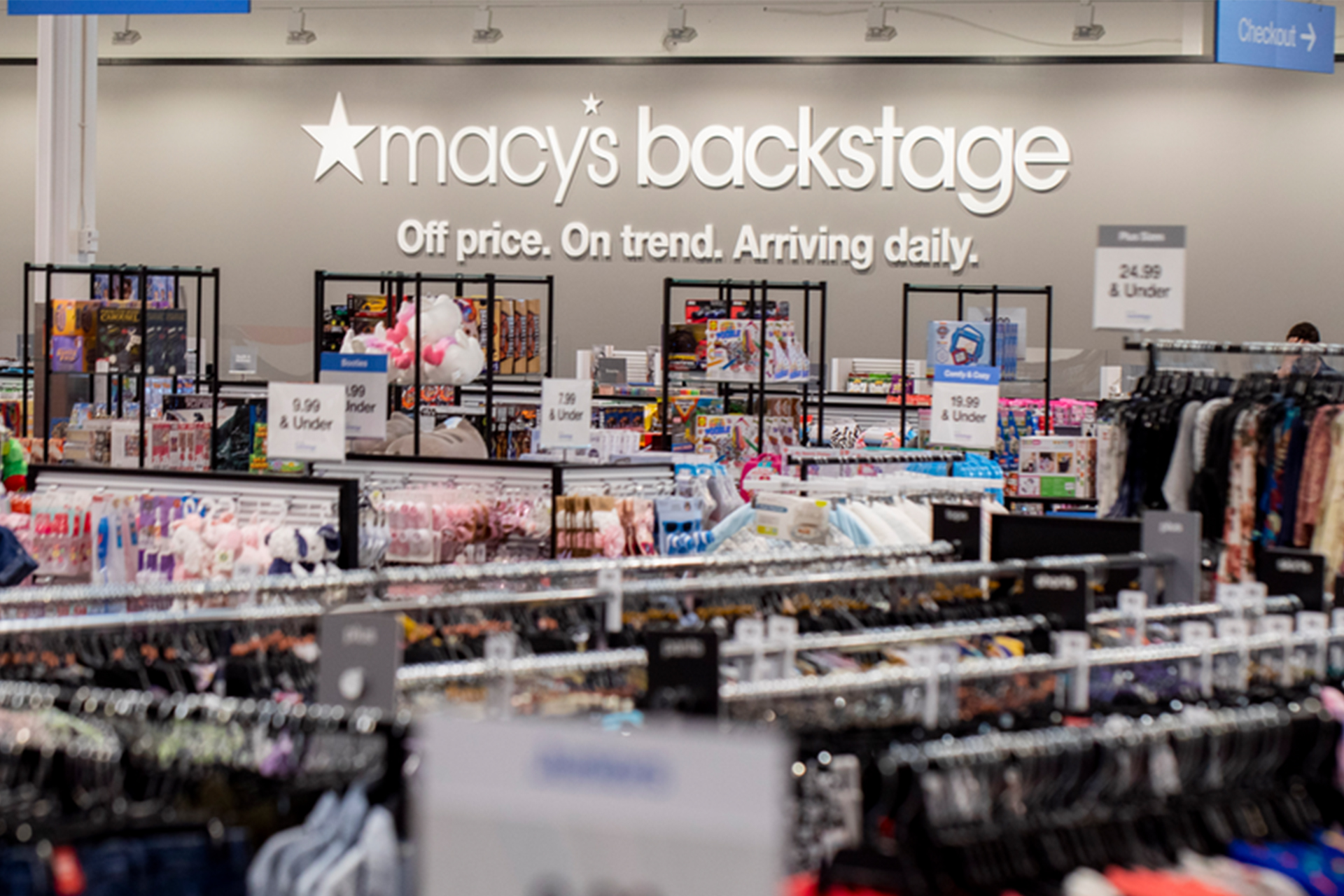

Macy’s Backstage

In considering Backstage as part of Macy’s evolving store fleet and the rapid expansion of the off-price banner, Placer.ai considered the larger and specific traffic metrics. From January 2021, Macy’s as an enterprise experienced overall positive visit growth. However, Macy’s locations with a Backstage operation led to the gains, which, Carmel noted, provides evidence that Macy’s can find success in the off-price market.

Currently, Bloomingdale’s isn’t counting on an off-price format for growth, even if it has some outlet units. So Carmel looked at Bloomie’s and discovered that, in comparing visit metrics for the first store in Fairfax, VA, shoppers there tend to stay longer, at a 39-minute median, than visitors to Bloomingdale’s, at a 36-minute median. The difference may be in the mix of product and services. In addition to items curated product assortment of apparel and other non-edibles, the food and drink element that Bloomie’s offers attracts consumers looking to turn shopping into a social activity, especially in the evening, Carmel determined.

The Marketplace

Despite the efforts that have gone into it, Macy’s isn’t relying on small stores alone to propel its omnichannel ambitions. Later in 2021, Macy’s announced that it was launching an online marketplace operation to further its omnichannel strategy, giving shoppers new options and access to additional merchandise. The marketplace offers consumers more ways to shop under the Macy’s banner, not to mention a broader range of merchandise provided by its third-party platform partners.

As such, Macy’s is building an array of concepts that allow it to address customers of most means but also across a variety of shopping occasions. At the same time, though, none of those concepts has a really substantial housewares presence except for the full-line department stores and website, not even Backstage. Macy’s is counting on its omnichannel operations to maintain its housewares business beyond the full-line department store presence.

Scott Benedict of consultancy McMillanDoolittle said the Macy’s small-store concept has possibilities but may be self-limiting.

“The concept of taking a venerable brand like theirs and placing smaller footprints in non-mall locations makes a lot of sense,” Benedict said. Giving Macy’s a chance to present the brand “to new shoppers, gain insights on where such a format is/is not successful and step away from mall settings that may not be attracting the younger affluent shoppers they are seeking. With that said, the decision to leave categories out altogether versus utilizing a smaller category footprint is interesting.”

Benedict said that retailers associated with categories such as housewares risk disappointing customers who enter the store and can’t find them.

“The concept of taking a venerable brand like theirs and placing smaller footprints in non-mall locations makes a lot of sense. [Giving Macy’s a chance to present the brand] to new shoppers, gain insights on where such a format is/is not successful and step away from mall settings that may not be attracting the younger affluent shoppers they are seeking. With that said, the decision to leave categories out altogether versus utilizing a smaller category footprint is interesting.”

– Scott Benedict, Affiliate Partner, McMillanDoolittle

“Even a small footprint location should have a presence in all major categories with reference to expanded assortments online and the ability to leverage store pickup and delivery from store options for items not readily available in that specific store’s assortment,” Benedict said.

By leaving out a major department store category, Macy’s not only risks disappointing consumers, including full-line regulars, because they’ve visited the store and realized what they intended to shop isn’t available. Beyond the immediate letdown, disappointed shoppers may feel as if the small-store concept doesn’t fulfill their needs, and it doesn’t take much to make consumers strike a store off their list of favored retailers. Then, given the immediate availability of other retailers, as in the case of the Boston small store, shoppers may turn to Macy’s competitors as they address their housewares needs, costing sales and reinforcing loyalty to rivals such as Target and Ulta.

Benedict identified another potential difficulty in integrating the expanded brick-and-mortar operations with the digital elements.

“I believe both Macy’s and Kohl’s continue to treat online and legacy store retail as separate channels instead of integrated elements to serve their customer,” he said. “I view this as a missed opportunity to adapt to the modern retail consumer who does not see channels, per se, but rather different paths to purchase with a brand. A broad online assortment – called ‘digital-first’ assortments – places every item and category within reach of a shopper and can then be complemented with compelling new store formats that fit a local community with the top items and categories. Tying in digital services like delivery or store pickup creates an integrated approach to serving a customer. Moving to smaller stores is half-right in my view, but an integrated digital-first strategy is still missing from both brands.”

Housewares Reboot

The irony is that department store retailers such as Kohl’s and JCPenney have reversed policies from previous regimes that deemphasized housewares. Kohl’s has its own small-store strategy. In Kohl’s case, the small-store concept is a growth vehicle. In the company’s third-quarter conference call, Kohl’s CEO Tom Kingsbury, who immediately on his ascension to the leadership began to build back home-related products that had been pruned during Michelle Gass’ time as chief executive, noted the company intends to capitalize on opportunities to open new smaller-format Kohl’s stores.

As confirmed by a Kohl’s spokesperson, the company intends to offer a full range of departments in its smaller stores. Indeed, it is even adding Sephora shops in smaller stores, with 50 of the 900 Kohl’s locations that include the beauty operation in the reduced-size locations. He added that Kohl’s sees Sephora, gifting, impulse and home décor, and longer-term, new stores as the company’s most significant drivers of future growth, representing largely white space opportunities for Kohl’s.

Kohl’s Home Department

Although small stores aren’t a factor in JCPenney’s plans for the future, the Macy’s rival recently launched a billion-dollar investment initiative to further its development with omnichannel operations, giving a particular emphasis as the company seeks to regain the position it once had in home goods. Katie Mullen, JCPenney’s chief customer officer, recently told HomePage News that, in enhancing home goods assortments in-store and online, the company wants to regain its once-held position as a top digital purveyor of household products.

In a way, the moves by Kohl’s and JCPenney make the position Macy’s has taken with small stores curious, especially since major competitors have identified home goods as a substantial opportunity. Mullen made the point that JCPenney sees a store assortment of home products, such as small appliances, as important because many consumers want to see and assess their items of interest in person, then pick them up and take them home. That can’t happen in Macy’s small stores.