Buy now pay later (BNPL) operators are becoming retail fairs where brands have raised their tents alongside the credit providers that enable purchases.

It’s not exactly an online marketplace that consumers have come to know through Amazon and others, but it does provide an alternative way to shop, one with an obvious attraction to young people who don’t have credit cards and also lower-income households who might not qualify for credit until they move up the salary ladder.

In other words, consumers are learning a new way to shop and pay for their purchases, one that offers the ability to shop and pay immediately online without having to qualify for credit traditionally.

Alex Fisher, Afterpay’s head of revenue, said it’s not about being a retailer. Fisher is also head of revenue for Cash App, whose parent company, Block, Inc. (formerly Square), purchased Afterpay in 2021 to offer its customers BNPL service and maintains Afterpay as a separate operation. Fisher said it’s about creating an online space where consumers can explore and discover new brands and immediately make purchases they can pay over Afterpay’s four-installment plan.

Still, like a retailer, Afterpay is launching its own promotions to draw consumers. For spring, the company touted deals and offers exclusively on the Afterpay app, and it provided those shopping in the app a chance of winning one of ten $500 cash prizes and earn an extra entry by creating a wish list with their favorite products and stores.

The particular target was younger consumers. Fisher explained in announcing the promotion that Afterpay designed the initiative with Gen Zers and Millennials in mind because those younger consumers who have discovered Afterpay see it as more of a payment option. They are most likely to view it as a shopping destination. Fisher pointed to market research indicating that 17% of consumers state that having no BNPL option is a deal breaker for them as they chose retailers to shop.

Alex Fisher, Head of Revenue, Afterpay

Younger generations want to use their own money and we empower our customers to do just that, enjoying their purchases right away while paying over time. Financial wellness and budgeting will continue to be the way young people want to pay for the things in their lives. And as BNPL goes mainstream, we anticipate that Millennials and Gen Zs will continue to use Afterpay for their lifestyle purchases especially as they get older.

– Alex Fisher, Head of Revenue, Afterpay

Although BNPL has won adoption across generations, Fisher said, the growth of Afterpay and other players in the sector has been driven by a generational shift in purchasing preferences. “Gen Z and Millennials are increasingly credit averse – wary of high-interest and revolving debt cycles – and favor debit cards,” she said.

“Younger generations want to use their own money, and we empower our customers to do just that, enjoying their purchases right away while paying over time,” Fisher continued. “Financial wellness and budgeting will continue to be the way young people want to pay for the things in their lives. And as BNPL goes mainstream, we anticipate that Millennials and Gen Zs will continue to use Afterpay for all their lifestyle purchases especially as they get older.”

“As they’ve adopted it, Afterpay shoppers see the money-management advantage in shopping through the platform,” Fisher said. “Our customers tell us they prefer to use Afterpay as a budgeting tool helping them pay for the things they want while saving on credit card fees. We also hear time and time again that shoppers are looking to use Afterpay at more retailers for more everyday spending categories. So we will continue to partner with merchants across verticals and segments who have a common desire and interest to give consumers an opportunity to engage in flexible, responsible spending. We will also continue to focus on building the best BNPL app and experience for all our consumers, which means launching new features and giving our users the best shopping experience on the Afterpay app.”

Shopping Choices

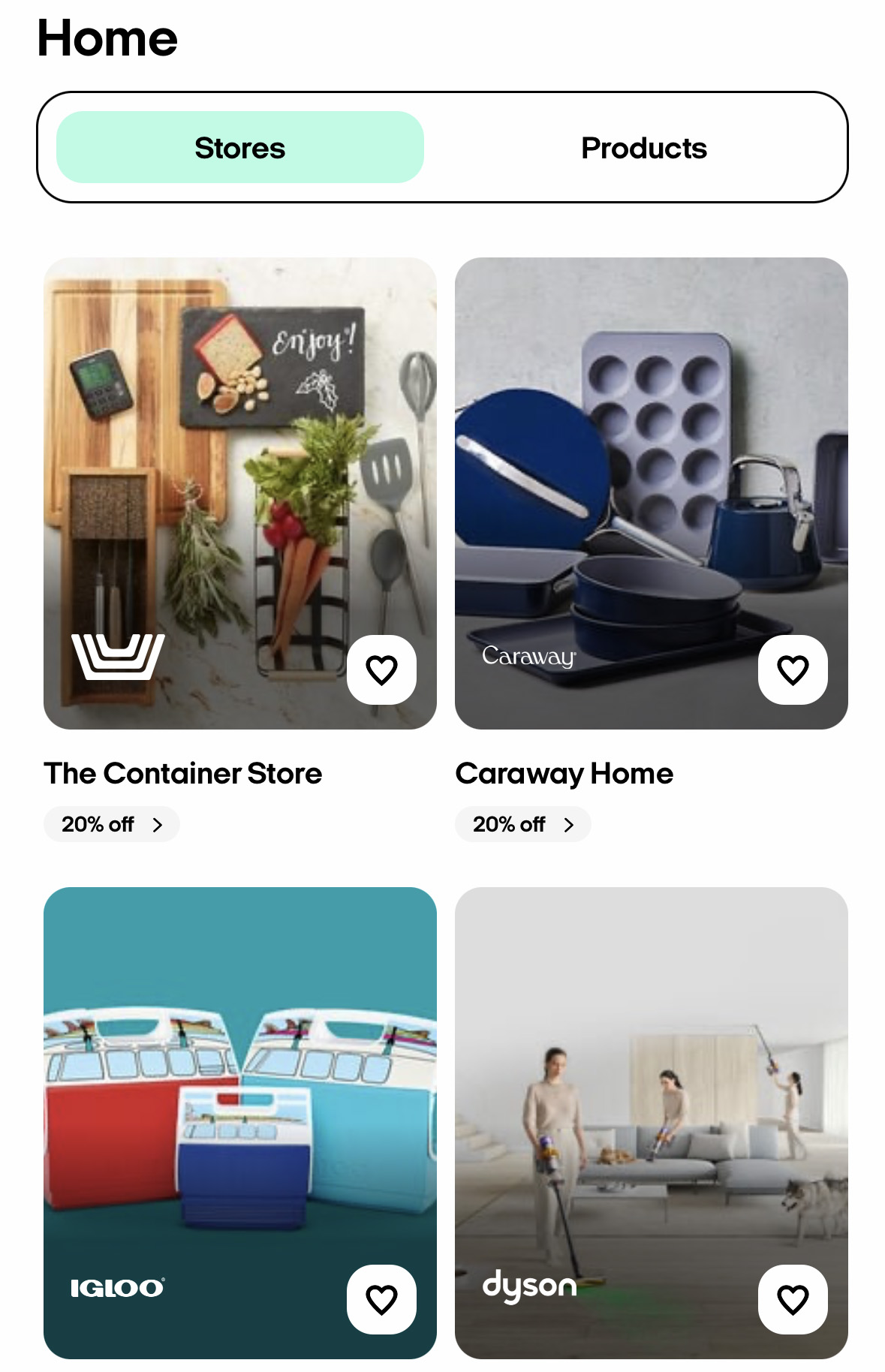

On the app, consumers can browse major producers such as Dyson and Nike or retailers such as Wayfair and Macy’s with the choice of purchasing through the app itself or from the brand websites.

At the same time, Afterpay continues to strike deals with major retailers that want to offer its payment option to their shoppers. A recent contract with Rite Aid expanded Afterpay’s pay-in-four installment purchasing to more than 2,000 Rite Aid locations. Rite Aid customers can shop the company’s e-commerce assortment via the Afterpay app where RiteAid offers access to both services and goods ranging from household and housewares items to health and beauty, baby care and grocery products. Consumers can also use Afterpay when shopping on riteaid.com.

Justin Mennen, RiteAid executive Vice President, chief digital and technology officer, said of the Afterpay deal: “Expanding our partnership with Afterpay allows more customers to obtain offerings that support their whole health needs while providing financial flexibility. We’re consistently leveraging technology to complement the busy lives of our customers and improve the health and wellness needs of our communities.”

Fisher told HomePage News Afterpay has developed a strategy offering price and payment advantages that are always available while providing retailers with a conduit that brings new customers.

“The Afterpay app is a top shopping destination for consumers to discover new brands, find deals and promotions, discover unique editorial content and learn how to budget their spend,” Fisher said. “The app is so widely used that we send over one million leads per day to merchant partners. Since our customer base is largely made up of Gen Z and Millennials, we hear from our expansive merchant base how critical it is to be seen on Afterpay’s app due to the value we’ve brought in helping them tap into a highly-engaged audience of next-generation shoppers.”

Afterpay user browses the app.

Although it offers a site with multiple stores and brands, Afterpay’s shopping format is more of a professional, brand-oriented, diverse online bazaar. At the same time, the Afterpay app serves as an outreach vehicle or even a virtual framework for online billboards, except the billboards click through to immediate shopping. Not only that, but the billboards can change to feature different goods over time, including promotions, guides and trend presentations. Afterpay’s editors, under the heading, “Get Inspired,” also provide content that links to products such as a feature on the best luggage for different types of travel. The site also provides different curations under designations such as Black Owned Businesses, Ethical and Sustainable, and Plus-Size which feature relevant brands.

“Afterpay serves as an advertising platform to our global merchant partners helping them increase their brand visibility and capture the millions of next-gen consumers who come to our app every day to shop,” Fisher said. “It has become a critical marketing opportunity for our merchant partners to see and be seen on Afterpay’s Shopping App. As a performance-based media platform, we deliver meaningful value to merchant partners through performance-backed advertising solutions and technology that enable conversion effectiveness, brand exposure and shopper engagement. It’s an always-on solution for merchants giving them the control they’re looking for and an opportunity for them to understand what connection they need to make with their audience.

The Home section within the Afterpay app.

The “Get Inspired” section within the Afterpay app.

Although it provides the BNPL service, Afterpay was established with a marketing mission in mind, which led to the development of the brand selling function on the app.

“Because Afterpay was built as a marketing partner for commerce, we’ve leveraged our marketing capability with retail brands to drive consumer awareness across the board,” Fisher said. “As a two-sided network, the Afterpay app has turned into a top shopping destination for consumers to discover new brands while merchants see the value we bring in helping them tap into a high-intent shopper.”

From The Beginning

Afterpay launched as an in-store service in the fall or 2020, giving shoppers access to contactless interaction at checkout and offering to let them pay for their purchases in the four installments. So, shoppers could make a contactless purchase and go, which some consumers felt was an advantage in the COVID-19 pandemic, Fisher said, and easy, contactless payment is appreciated, still, by many Afterpay customers.

“Launching Afterpay in-store has a very tangible impact on our retailers’ bottom line, and positively impacts key metrics like average order values, units per transaction and total sales volume,” Fisher said.

As it evolved as an operation, Afterpay fashioned the brand support element of its operation.

“The Afterpay platform is already one of the most powerful marketing engines for brands, generating an average of one million referrals per day globally from the Afterpay Shopping App,” Fisher said. “Merchant partners can now leverage our advertising solution as an added customer acquisition tool and drive conversion throughout the year and for all major shopping periods. Our current model is pay for performance, which means brands only pay if that ad drives conversion, a win-win for merchants.”

As such, the Afterpay app will continue to evolve as a shopping destination and means of connecting with consumers right at the point of purchase, which is little more than a click away.